Highlights

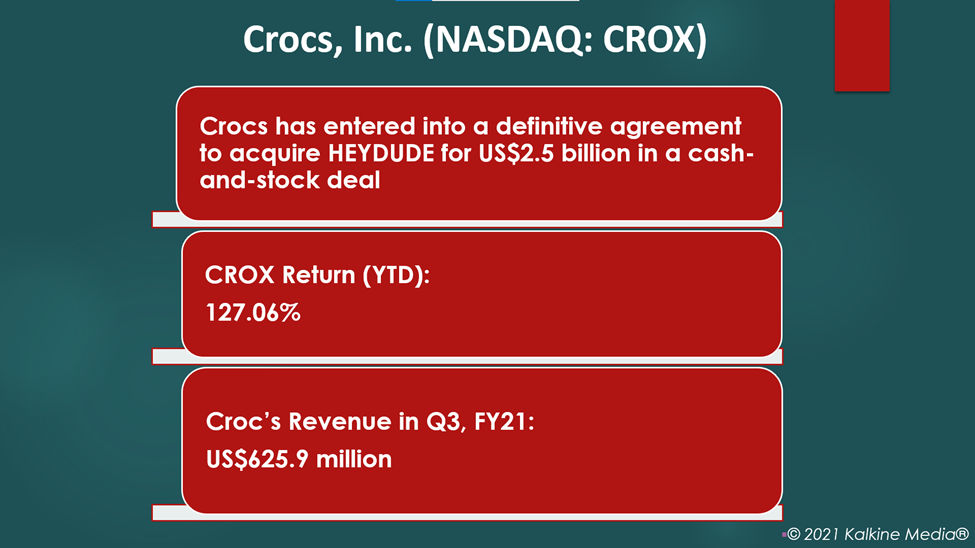

- Crocs, Inc. (CROX) has entered into a definitive agreement to acquire Heydude about US$2.5 billion.

- Crocs will pay US$2.05 billion in cash and US$450 million in CROX shares to Heydude founder and CEO Alessandro Rosano, according to the company.

- The CROX stock surged over 127% YTD.

Shares of footwear company Crocs, Inc. (NASDAQ:CROX) tumbled over 15% in intraday trading on Thursday after it announced to purchase its peer brand Heydude for US$2.5 billion.

On Thursday, the Broomfield, Colorado-based company said that it has entered into a definitive agreement to purchase the privately-owned footwear brand for US$2.5 billion in a cash-and-stock deal. The CROX stock fell after the announcement.

The move suggests that rubber clogs maker Crocs is eager to take advantage of the pandemic-fuelled demand for casual shoes. The trend shows the consumers may have ditched the dress shoes for more comfortable footwear, driving up the sales of companies like Crocs.

The Colorado-based company sells Crocs brand of foam clogs.

Also Read: Why is Pasithea Therapeutics (KTTA) stock rising today?

Also Read: Why did Allakos (ALLK) stock crash today?

What is in the deal?

Crocs will pay US$2.05 billion in cash and US$450 million in CROX shares to Heydude founder and CEO Alessandro Rosano, according to the company.

To fund the cash portion, it will take a term loan and borrow US$50 million under its senior revolving credit facility.

The transaction is likely to close in Q1 next year. It will boost Crocs’ revenue and margins. Upon completion of the deal, Heydude will operate as a standalone division, it added.

Also Read: Gardiner Healthcare IPO: How to buy the stock?

Crocs, Inc. (CROX) stock performance and financials

The CROX stock was priced at US$118.73 at 10:36 am ET on Dec 23, down 15.06% from its previous close. Its market cap is US$6.97 billion, its P/E ratio is 10.29, and the forward P/E one year is 18.42. Crocs’ EPS is US$11.51.

Also Read: Top stocks under US$1,000 to explore in 2022

The CROX stock saw the highest price of US$183.88 and the lowest price of US$58.97 in the last 52 weeks. Its trading volume was 1,171,336 on Dec 22.

The company's revenue surged 73% YoY to US$625.9 million in Q3, FY21. Its net income came in at US$153.48 million, compared to US$61.88 million in Q3, FY20.

Also Read: Justworks IPO: Why investors exuded confidence in HR tech startup?

Bottomline

The company stock saw significant gains in the recent quarters. It rose 127.06% YTD. In contrast, the S&P 500 Consumer Discretionary Sector jumped 21.64% YTD.