Highlights

- Nikola Corporation (NASDAQ:NKLA) delivered its first electric truck on Dec 17, 2021.

- Nikola manufactures fuel-cell electric vehicles and offers energy infrastructure solutions.

- The company launched its IPO in January 2021. Its stock declined around 27% since IPO.

Shares of Nikola Corporation (NASDAQ:NKLA) jumped over 18% to US$11.18 on Thursday morning after it announced receiving an order for 10 electric trucks a day before.

The Phoenix, Arizona-based EV-maker announced late Wednesday that it bagged an order for 10 Nikola Tre BEV trucks from liquid cargo trucking company Heniff Transportation Systems, LLC. The requests were placed at the Nikola vehicle dealership Thompson Truck Centers.

Thompson will provide maintenance and energy infrastructure support to Heniff Transportation. The trucks are expected to be delivered in the first two quarters of 2022. As per the agreement, Heniff will purchase 90 more trucks from Nikola after its first delivery.

Also Read: These 5 US stocks returned between 500% and 5,000% in 2021

Also Read: Yearender: Top 5 shipping and logistics stocks of 2021

Nikola Financials

The company earned no revenue in the first nine months of 2021. The net loss attributable to the common shareholders was US$267.6 million for the quarter ended Sept 30, 2021, compared to US$79.7 million in the same period a year ago. The loss per share diluted was US$(0.68) versus a loss per share diluted of US$(0.31) in the September quarter of 2020.

Its cash and cash equivalents were US$587 million as of Sept 30, 2021, compared to US$907.5 million as of Sept 30, 2020.

Also Read: Global real-estate management firm GLP eyes US IPO

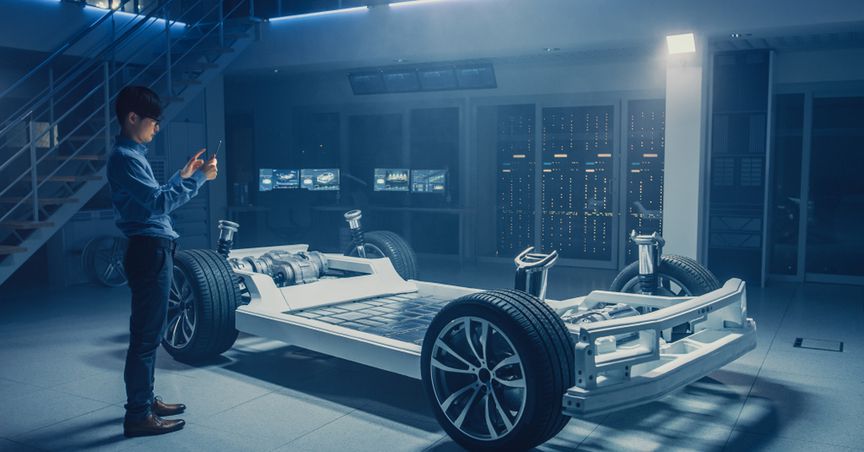

Nikola manufactures fuel-cell electric vehicles (FCEV), heavy-duty commercial battery-electric vehicles (BEV), and energy infrastructure solutions. The company develops, designs, and manufactures innovative clean technology transportation and next-generation fueling solutions such as battery and hydrogen-electric vehicles, components and energy storage systems, EV drive trains, hydrogen fueling infrastructure, and maintenance.

Also Read: Is Philly delivery startup Gopuff gearing up for IPO?

The company brought its IPO in January 2021. Its current market capitalization is US$4.6 billion. Its price to book ratio is 5.37.

The stock traded in the range of US$30.40 to US$8.86 in the last 52 weeks. On Thursday, its trading volume was 45,246,455 compared to the 90-day average volume of 11,160,193.

The stock closed at US$9.4 on Dec 22, 2021. However, it fell 27.65% YTD.

Also Read: 5 best US oil & gas stocks that returned over 100% in 2021

Bottomline

Although there is sufficient reserve of lithium, copper, and other metals vital for EV production in the US, the opposition to mining might push the cost of these vehicles higher due to import charges. As a result, efforts to electrify the automobile sector may get delayed.