Benchmark US indices closed higher on Thursday, October 14, boosted by strong quarterly results of major banks and upbeat economic data that helped alleviate investors’ concerns.

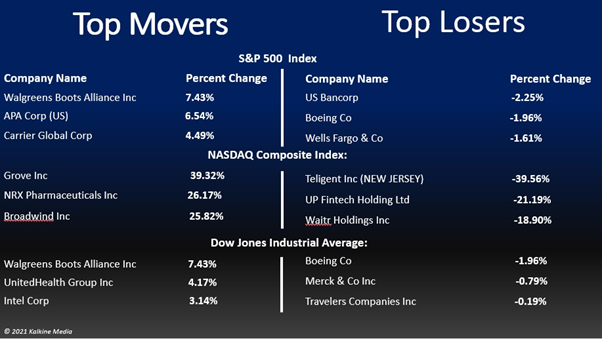

The S&P 500 was up 1.71% to 4438.26. The Dow Jones rose 1.56% to 34912.56. The NASDAQ Composite rose 1.73% to 14823.43, and the small-cap Russell 2000 climbed 1.44% to 2274.18.

The US stock market has been volatile in recent weeks over concerns about inflation, rising energy costs, and economic slowdown. Money-managers interviewed by Wall Street Journal have downplayed Thursday’s rally, stressing that markets could expect more bumpy road ahead.

On Thursday, the Labor Department said that US jobless claims fell to 293,000 in the week ended Oct 9 from 329,000 in the previous week.

Global Markets soared higher

Basic materials and technology stocks were the top gainers on the S&P 500. All the 11 stock segments of the index rose on Thursday. Industrials, financials, healthcare, and real estate stocks were among the top movers, while consumer non-cyclicals, energy, and utilities were the bottom movers. Investors were motivated by strong quarterly results of major banks reported Thursday.

The Bank of America Corporation (BAC) stock jumped more than 4% after reporting strong third-quarter results before the opening bell. Its revenue rose by 12% to US$22.8 billion in the quarter.

Global investment bank Citigroup, Inc. (C) stock rose 0.75% in intraday trading after reporting a 48% jump in third-quarter net revenue to US$4.6 billion, boosted by lower credit costs. CEO Jane Fraser said higher consumer spending and growing engagement across digital channels lifted the results.

Shares of Morgan Stanley (MS) jumped 2.67% in intraday trading after its revenue rose to US$14.8 billion in the quarter from US$11.7 billion a year ago. Its net income also rose to US$3.7 billion from US$2.7 billion in the same period last year.

Wells Fargo & Company (WFC) stock fell 2% after reporting revenue decline in the quarter. It fell by 2% YoY to US$18.83 billion. Its net income rose to US$5.12 billion from US$3.2 billion a year ago.

Domino's Pizza, Inc. (NYSE:DPZ) stock was down 0.30% after reporting its quarterly results. Its net income rose 21.5% YoY to US$21.3 million, in the third quarter, helped by strong global retail sales. However, its same-store sales in the US dropped 1.9% YoY.

In healthcare stocks, UnitedHealth Group Inc (NYSE:UNH) jumped 3.93% after raising its full-year guidance. Its third-quarter revenue beat Wall Street forecast. It was up 11% YoY to US$72.3 billion.

In technology stocks, Taiwan chipmaker TSMC (TSM) rose 1.95% in intraday trading after its third-quarter net profit surged 13.8% to US$5.56 billion on strong global demand for semiconductors.

Shares of Walgreens Boots Alliance (WBA) rallied more than 7% after the pharmacy chain reported a revenue boost of 12.8% to US$34.3 billion from the year-ago quarter. It also announced to acquire a controlling stake in primary-care network VillageMD.

Also Read: Wells Fargo (WFC), Morgan Stanley (MS) Q3 profits beat estimates

Also Read: UnitedHealth (UNH) raises guidance on strong Q3 growth, revenue up 11%

Also Read: Fed signals bond-purchase taper by mid-Nov as inflation worries weigh

Futures & Commodities

Gold futures were up 0.15% to US$1,797.35 per ounce. Silver was up 1.71% to US$23.567 per ounce, while copper rose 2.08% to US$4.6098.

Brent oil futures increased by 1.25% to US$84.22 per barrel and WTI crude was up 1.28% to US$81.47.

Bond Market

The 30-year Treasury bond yields fell 1.05% to 2.020, while the 10-year bond yields declined 2.25% to 1.514.

US Dollar Futures Index decreased by 0.10% to US$93.983.