Summary

- There has been surge in the usage of technological applications and advancements in the technology sector during the crisis

- The coronavirus pandemic has impacted the economy and has also affected many of the tech companies

- If looked at the brighter side of the technology sector, than cloud services are in higher demand than ever

Technology is evolving at such a faster rate that annual predictions of trends can seem out-of-date before they even go live. The coronavirus pandemic has impacted the economy, affecting many of the tech companies, be it companies selling smartphones, semiconductors, servers, or cloud services. The precise effect it will have on tech companies cannot be predicted because of the uncertainty. But major impacts of Covid-19 till date can be identified and actions could be taken as tech companies seek to recover from the crisis and survive. With the continuous evolution of technology, faster change and progress can be seen, causing a spurt in the rate of change.

However, if we look at the brighter side the technology sector then the cloud services are in higher demand than ever. An increase in videoconferencing and remote connect use is apparent at all-time highs as companies scramble to keep employees productive. Companies have been rapidly shifting to cloud services and also appreciate the scalability and resilience of the public cloud. During the course of the pandemic, a paradigm shift in work culture and consumer behavior have been witnessed, with large number of people using digital medium for work commitments, education, and entertainment. A massive rise in popularity of online platforms for work meetings have been seen, and video calling applications have been coming up with innovative features to make it conducive for professionals to work from home.

One must be watchful of the eight technology trends in 2020:

Does the surge in the usage of technological applications and advancements mean the sector has been insulated? Let’s have a look to know how the top tech companies in the UK are performing:

Avast Plc- 1 year return of 38.79 per cent

Avast Plc is the biggest cybersecurity company in the world, which uses advanced technologies against cyber-attacks. The company has been successful in developing a scalable cloud-based security structure that prevents around 1,500 million virus attacks every month with its advanced threat protection.

The trend of work-from-home during the lockdown boosted the core Consumer Desktop business, with an upswing in demand across the product portfolios, including premium AV. Strong growth in customer numbers in H1 2020 (ending 30 June 2020) was witnessed with desktop operating KPI's increasing 5.1 per cent to 13.26 millions. There was a surge in the adjusted Revenue at $433.1 million which was up 1.5 per cent at actual rates. Adjusted EBITDA also saw an increase of 2.1 per cent to $241.4 million.

The company has recently made an announcement regarding the launch of its virtualised 5G security solution, Avast Smart Life. It enables operators to protect subscribers' connected devices at the network level.

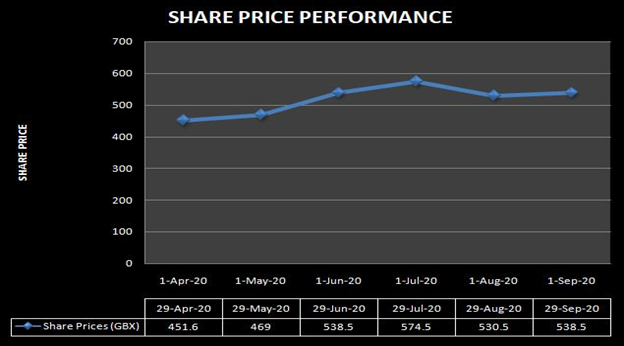

Stock Price Trend

Below is the table and chart representing the stock price performance of the stock in the previous six months:

|

Months |

29 April 2020 |

29 May 2020 |

29 June 2020 |

29 July 2020 |

29 August 2020 |

29 Sep 2020 |

|

Share Prices (GBX) |

451.60 |

469.00 |

538.50 |

574.50 |

530.50 |

538.50 |

Avast Plc (LON:AVST) stocks traded at GBX 533.00 on 30 September 2020 at 11:11 AM, down by 1.02 per cent from its previous close of GBX 538.50. The stock’s 52-week low/high price range was 270.60/600.00 and was having a market capitalisation (Mcap) of £ 5,533.66 million.

AVEVA Group PLC- 1 year return of 31.43 per cent

Incorporated in 1967, AVEVA Group PLC (AVV) is a software and computer service provider. Headquartered in Cambridge, United Kingdom, the company is engaged in providing engineering, design and information management software.

According to the company’s Q1 trading update for period ending 30 June 2020, AVEVA continued to deliver strong growth in recurring revenue with subscription revenue increasing 30 per cent. The company maintained a strong balance sheet and its cash position and treasury deposits stood at £109.7 million on 30 June 2020.

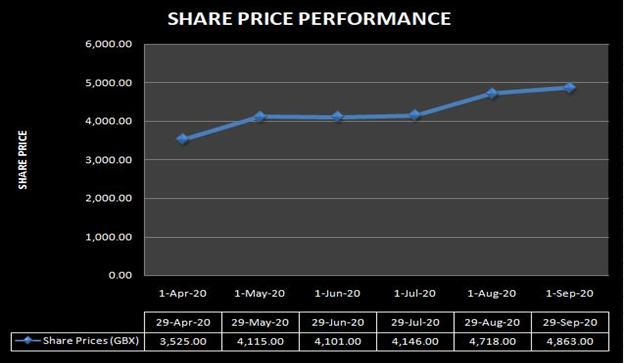

Stock Price Trend

Below is the table and chart representing the stock price performance of the stock in the previous six months:

|

Months |

29 April 2020 |

29 May 2020 |

29 June 2020 |

29 July 2020 |

29 August 2020 |

29 Sep 2020 |

|

Share Prices (GBX) |

3,525.00 |

4,115.00 |

4,101.00 |

4,146.00 |

4,718.00 |

4,863.00 |

AVEVA Group PLC (LON:AVV) stocks traded at GBX 4,796.00 on 30 September 2020 at 11:09 AM, down by 1.19 per cent from its previous close of GBX 4,863.00. The stock’s 52-week low/high price range was GBX 2,846.00/5,315.00, having a market capitalisation (Mcap) of £7,797.81 million.

Softcat PLC– 1 year return of 20.56 per cent

A reseller of infrastructure technology solutions in the UK and Ireland, Softcat PLC is engaged in providing and supporting a range of technology services to corporate and public sectors. The Group is segmented into three types of products – Software, Hardware, and Services.

In the recent trading update released by the company for the period ending 31 July 2020, it continued to trade satisfactorily during the final three months of the year, delivering operating profit exceeding the Board's expectations. The cash position of the company also remained strong.

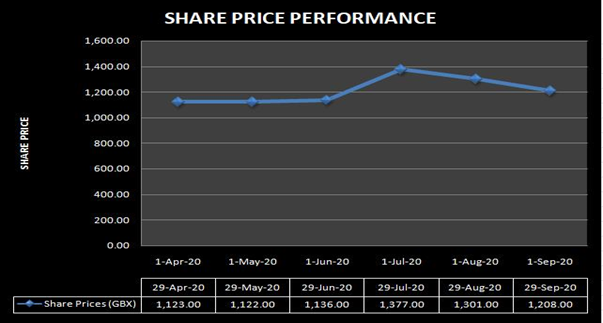

Stock Price Trend

Below is the table and chart representing the stock price performance of the stock in the previous six months:

|

Months |

29 April 2020 |

29 May 2020 |

29 June 2020 |

29 July 2020 |

29 August 2020 |

29 Sep 2020 |

|

Share Prices (GBX) |

1,123.00 |

1,122.00 |

1,136.00 |

1,377.00 |

1,301.00 |

1,208.00 |

Softcat PLC (LON:SCT) stocks traded at GBX 1,194.00 on 30 September 2020 at 11:05 AM, up down by 1.14 per cent from its previous close of GBX 1,208.00. The stock’s 52-week low/high price range was GBX 905.50/1,425.00 and was having a market capitalisation (Mcap) of £ 2,400.10 million.

Sage Group PLC- 1 year return of 6.19 per cent

Sage Group belongs to the technological sector which provides digital solutions and cloud technology assistance to the small and medium scale companies.

According to the Sage Group’s trading update for the nine months period ending 30 June 2020, it displayed a decent growth in the organic total revenue of 4.1 per cent, driven by the rise in the company’s software subscription base, recording a growth of 22.6 per cent to £885 million (Q3 19 YTD: £722 million).

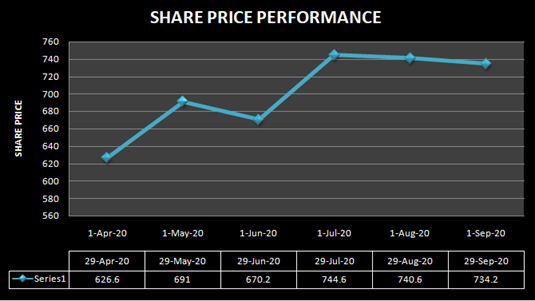

Stock Price Trend

Below is the table and chart representing the stock price performance of the stock in the previous six months:

|

Months |

29 April 2020 |

29 May 2020 |

29 June 2020 |

29 July 2020 |

29 August 2020 |

29 Sep 2020 |

|

Share Prices (GBX) |

626.60 |

691.00 |

670.20 |

744.60 |

740.60 |

734.20 |

Sage Group PLC (LON:SGE) stocks traded at GBX 720.80 on 30 September 2020 at 11:01 AM, down by 1.77 per cent from its previous close of GBX 734.20. The stock’s 52-week low/high price range was GBX 534.80/794.60 and was having a market capitalisation (Mcap) of £ 8,020.40 million.

Technology companies are considered to be the heart of the UK economy. Due to the Covid-19 pandemic, the tech sector has really seen a boom time like never before and their performance on the stock market has also been remarkable.