Summary

- Reckitt Benckiser Group's net revenue grew by 13.3% on a like for like basis in Q3 FY20. The performance was driven by demand for health and hygiene products.

- The Group expects a low double-digit net revenue growth for FY20.

- PZ Cussons generated revenue of £158.1 million in Q1 FY21.

- The performance was supported by the demand for hygiene products.

Reckitt Benckiser Group PLC (LON: RB.) and PZ Cussons PLC (LON:PZC) are two consumer stocks. The performance of both stocks in their recent reported results was supported by the resilient demand for health and hygiene products. Shares of RB. were up by around 1.05%, and shares of PZC were down by around 1.19%, respectively from their last closing price (as on 20 October 2020, before the market close at 1:20 PM GMT+1).

Reckitt Benckiser Group PLC (LON: RB.) - Strong performance of Health and Hygiene products

Reckitt Benckiser Group PLC is a UK based multinational consumer goods company. The Company produces health, hygiene and nutritional products. Some of the key brands of the Group include Dettol, Air Wick, Hapric and Mortein, and these products are available in around 200 countries. Reckitt Benckiser is included in the FTSE-100 index.

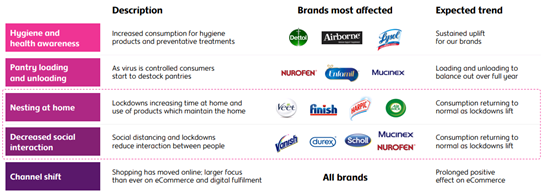

Brands well-positioned against covid-19 trends

(Source: Group website)

Q3 FY2020 trading update as reported on 20 October 2020

The Group reported net revenue of £3,513 million in Q3 FY20, which grew by 13.3% on a like for like basis. The performance was underpinned by the strong penetration of hygiene products and products launched in new markets. The volume growth was 10.5% and price/mix increased by 2.8%. The performance of the volume sales was driven by hygiene products. Some of the essential brands of the Group, such as Dettol, Lysol. Finish and Durex gained market share on year to date basis. The e-commerce sales were robust and grew by 45% year on year in Q3 FY20.

Performance by operating division in Q3 FY2020

Hygiene segment’s net revenue grew by 19.5% on a like for like basis and it stood at £1,490 million in Q3 FY20. The volume growth was 18.2%, and the price/mix growth was 1.3%. Disinfectant and dish wash brands drove the performance. Health division revenue was £1,217 million in Q3 FY20, and it increased by 12.6% on like for like basis. The volume and price/mix growth was 9.1% and 3.5%, respectively. The sale of Dettol was the major contributor as its sales grew by 50% in the quarter. The demand for sexual well-being products also grew as Durex witnessed double-digit growth in Q3 FY20. Nutritional segment revenue was £806 million in Q3 FY20, and it moved up by 4.1% on a like for like basis. The volume and price/mix growth was 0.8% and 3.3%, respectively.

Performance by geography in Q3 FY2020

The net revenue in North America was £1,068 million, and it increased by 24.2% on a like for like basis. The growth was supported by resilient demand for Lysol, Finish, and Air Wick. The net sales in Europe/Australia & New Zealand stood at £1,142 million. The net revenue in the Developing Market was £1,303 million. The market conditions in Hong Kong remained challenging amid its stiff relationship with China.

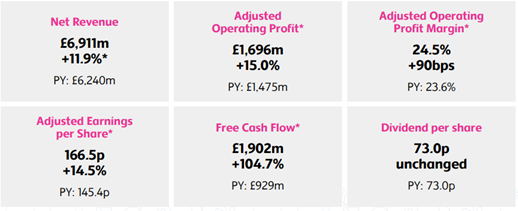

H1 FY2020 Financial Highlights

(Source: Group website)

Share Price Performance Analysis

1-Year Chart as on October-20-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Reckitt Benckiser Group PLC's shares were trading at GBX 7,280.00 and were up by close to 1.05% against the previous closing price (as on 20 October 2020, before the market close at 1:20 PM GMT+1). RB.'s 52-week High and Low were GBX 8,020.00 and GBX 5,130.00, respectively. Reckitt Benckiser had a market capitalization of around £51.25 billion.

Business Outlook

The Group highlighted that the growth momentum set in H1 FY20 continued in Q3 FY20, and it expects to post a like for like net revenue growth in low double-digit for FY20. The Group plans to invest £2 billion over the next three years on growth-related initiatives. It is undertaking a strategic plan to achieve mid-single-digit revenue growth in the medium term and targeting margins in the mid-20s by the mid-2020s.

PZ Cussons PLC (LON:PZC) - Expects the future to be challenging

PZ Cussons PLC is a UK based consumer goods company. It manufactures and sells goods such as Personal Care & Beauty products, Homecare, Food & Nutrition and Electricals. The key brands of the Group include Haier Thermocool, St.Tropez, Carex and Cussons baby. PZ Cussons is included on the FTSE-250 index.

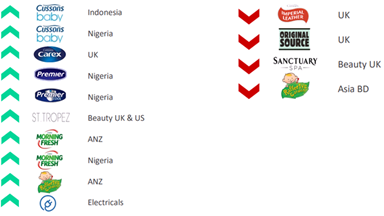

Q1 FY21 Brands Performance

(Source: Group website)

Disposal of Nutricima

On 10 October 2020, the Group announced that it completed the disposal of its Nutricima diary business in Nigeria. The business was sold to FrieslandCampina WAMCO.

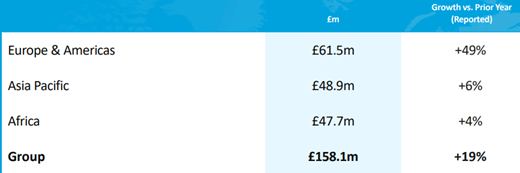

Q1 FY21 trading update (ended 31 August 2020) as reported on 23 September 2020

(Source: Group website)

In Q1 FY21, the reported revenue grew by 19% year on year to £158.1 million. The performance was driven by the demand for hygiene brands. Based on the regional performance, the revenue in Europe & the Americas grew by 49% year on year to £61.5 million. The growth was supported by the demand for personal care products and the bounceback of beauty products. Carex was the key contributor to the market share in the handwashing segment in the UK as it increased to around 40%. The Asia Pacific revenue was £48.9 million, and it increased by 6% year on year. Morning Fresh and Cussons Baby supported the growth in Australia and Indonesia. The revenue in Africa was £47.7 million, which grew by 4% year on year.

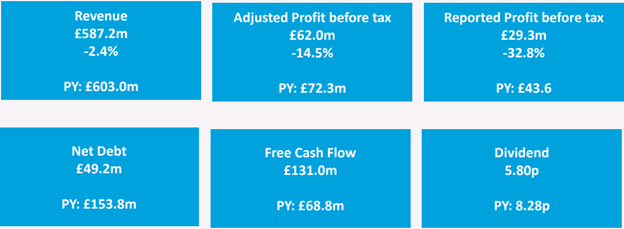

FY2020 Financial Highlights

(Source: Group website)

Share Price Performance Analysis

1-Year Chart as on October-20-2020, before the market close (Source: Refinitiv, Thomson Reuters)

PZ Cussons PLC's shares were trading at GBX 249.00 and were down by close to 1.19% against the previous closing price (as on 20 October 2020, before the market close at 1:20 PM GMT+1). PZC's 52-week High and Low were GBX 265.24 and GBX 149.00, respectively. PZ Cussons had a market capitalization of around £1.08 billion.

Business Outlook

The Group expects the future to be challenging, despite its strong performance in the first quarter. The pandemic will continue to impact the demand for personal care and home care products. The Group sells its products in many countries, and it is cautious that some of the economies are on the verge of entering a recession, which can cripple consumer demand. Given the high level of competition in the business, the cost and discount factors would continue to loom. In Q2 FY21, the Group plans to invest in expanding its capabilities and brand reach.