InterContinental Hotels Group PLC

InterContinental Hotels Group PLC (IHG) is a Denham, the United Kingdom-based company. It is into hotel operations. The company has its operations worldwide. Currently, the company has 5,795 hotels and 864,699 rooms under its brand name. The company owns, franchise, manage and lease hotel. IHG-Third Quarter of 2019 Trading Update (as on 18th October 2019)

On year on year basis, the net system size increased by 4.7 per cent to 865 thousand rooms and was impacted by the later phasing of openings as compared to the third quarter of 2018, when 19 thousand rooms opened. In the current quarter, the group has opened 13 thousand rooms, with the 400th Candlewood Suites property, and the finest performance for Holiday Inn Express opportunities across a decade. The company had signed twenty-five thousand rooms in the current quarter. Although the pipeline now stands at 289 thousand rooms. In the third quarter of 2019, the companyâs RevPAR reduced by 0.8 per cent and was impacted by the harder trading conditions in China and the United States, and continuing unrest in the Hong Kong SAR. In Q3 YTD, the RevPAR was almost the same. In the current quarter, the bolstering of the United States dollar against many key currencies internationally reduced the companyâs RevPAR to a 1.9 per cent decrease, when reported at an actual exchange rate.

In the financial year 2019, the company may be impacted by $5 million adverse effects from the fee income loss from current trading conditions in the Hong Kong SAR and $10 million favourable effects from non-recurring items comprising accounting treatment relating to IFRS 16 and significant liquidated damages.

In Q3 FY2019, the companyâs Hong Kong market protests have caused regional revenues to drop, while trading conditions are tough in mainland China and in the United States. The company has also witnessed a decline in demand in the Hong Kong market due to a trade dispute between the US-China. China is the rapidly growing market for the hotel industry, but with an increasing dispute between the US and Chinese governments, the growth has been muted. From the perspective of the market, the entire region, including Australia, has been impacted by this economic slowdown.

IHG-Financial Highlights - H1 FY19

In the first half of the financial year 2019, the companyâs revenue from reportable segments surged by 12 per cent to $1,012 million against the $900 million in H1 FY18, while on an underlying basis, it increased by 13 per cent. Revenue from fee business surged by 2 per cent to $730 million against the same period in 2018. Operating profit from reportable segments stood at $410 million as compared to $413 million in H1 FY18, while underlying operating profit rose by 2 per cent. Fee margin from reportable margin reduced by 0.2 per cent to 53.7 per cent as compared with the corresponding period of the last year. Adjusted EPS stood at 143.2 cents, a decrease of 1 per cent from the previous year same period data(up 2 per cent on an underlying basis). The companyâs total revenue increased by 8 per cent to $2,280 million in H1 FY19 against the $2,113 million in H1 FY18. Operating profit climbed by 14 per cent to $457 million as compared to $401 million in H1 FY18. The total revenue and operating profit increased because of an increase in System Fund from a deficit of $12 million in the year to a surplus of $47 million and a decline in exceptional costs. Total gross revenue was up by 2 per cent (5 per cent at CER) to $13.6 billion. The companyâs Basic Earnings per share was 167.2 cents in H1 FY2019 versus 122.6 cents in H1 FY2018, an increase of 36.4 per cent. Interim Dividend per share increased by 10 per cent to 39.9 cents against the 36.3 cents in H1 FY18.

IHG-Share price performance

(Source: Thomson Reuters)

On 1st November 2019, while writing at 11:46 AM GMT, InterContinental Hotels Group PLC shares were clocking a current market price of GBX 4,687 per share; which was more by 0.57 per cent in comparison to the last traded price of the previous day. The companyâs market capitalisation was at £8.46 billion at the time of writing.

On 30th July 2019, the shares of IHG have touched a new peak of GBX 5,770.00 and reached the lowest price level of GBX 3,986.68 on 21st December 2018 in the last 52 weeks. The companyâs shares were hovering at 18.76 per cent below from the 52-week high price mark and 17.56 per cent above from the 52-week low price mark at the current trading level as can be seen in the price chart.

At the time of writing before the market close, the stockâs traded volume was hovering around 55,992. The stock's 5-day average daily traded volume of the company was 446,043.60; 30 days average daily traded volume- 430,112.77 and 90 days average daily traded volume â 449,803.60. The volatility of the companyâs stock was 44 per cent higher as compared with the index taken as the benchmark, as the beta (5Y monthly) of the companyâs stock was recorded at 1.44.

In the last quarter, the shares of the company have delivered a negative return of 18.52 per cent. The companyâs stock surged by 9.66 per cent from the start of the year to till date. The companyâs stock has given investors 13.05 per cent of a positive return in the last year.Â

Smartspace Software PLC

Smartspace Software PLC (SMRT) is a service and technology provider for smart buildings and commercial spaces. The company provides a range of services including design, build and installation. The company caters to corporations, developers, landlords and other commercial property managers. The company was formerly known as RedstoneConnect PLC.

SMRT-Financial highlights for H1 FY20

On 31st October 2019, the company released interim results for the period ended 31st July 2019. The companyâs revenue surged by 57 per cent to £3.0 million in H1 FY20 as against £1.9 million in H1 FY19. The companyâs recurring revenue surged by 332 per cent to £782 thousand in H1 FY20 from £181 thousand in H1 FY19. The companyâs LBITDA stood at £3.1 million in H1 FY20 as against LBITDA of £1.9 million in H1 FY19. The companyâs loss before taxation from continuing operations stood at £4.0 million in H1 FY20 as against a loss of £2.7 million in H1 FY19. The companyâs basic loss per share (continuing operations) stood at 16.1 pence in H1 FY20 as against a loss of 12.8 pence in H1 FY19. The companyâs net cash position stood at £3.8 million as on 31st July 2019.  Â

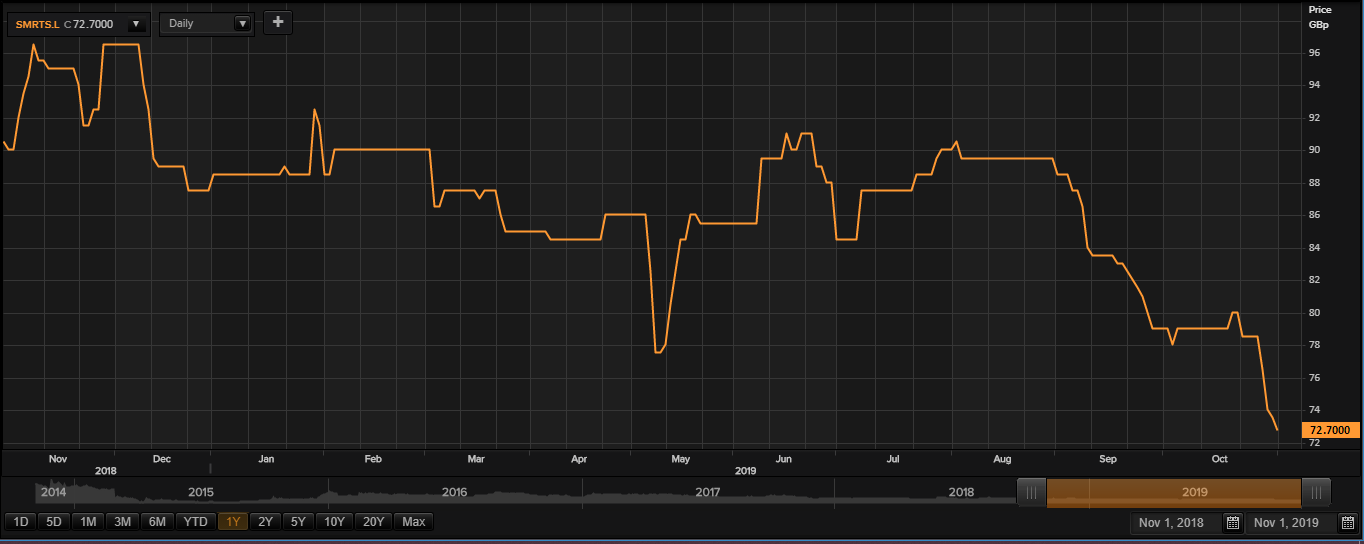

SMRT-Share price performance

(Source: Thomson Reuters)

On 1st November 2019, while writing at 11:52 AM GMT, Smartspace Software PLC shares were clocking a current market price of GBX 72.70 per share; which was less by 1.08 per cent in comparison to the last traded price of the previous day. The companyâs market capitalisation was at £16.29 million at the time of writing.

On 30th November 2018, the shares of SMRT have touched a new peak of GBX 99.65 and reached the lowest price level of GBX 72.00 on 31st October 2019 in the last 52 weeks. The companyâs shares were hovering at 27.04 per cent below from the 52-week high price mark and 0.97 per cent above from the 52-week low price mark at the current trading level as can be seen in the price chart.

At the time of writing before the market close, the stockâs traded volume was hovering around 13,043. The stock's 5-day average daily traded volume of the company was 75,021.00; 30 days average daily traded volume- 30,120.00 and 90 days average daily traded volume â 26,220.18.

In the last quarter, the shares of the company have delivered a negative return of 18.33 per cent. The companyâs stock plunged by 16 per cent from the start of the year to till date. The companyâs stock has given investors 18.78 per cent of a negative return in the last year.Â