Highlights

- CMCL’s EBITDA rose sharply to USD 9.9mn in Q1FY24 from USD 2.3mn in pcp

- The company’s FY23 saw a 3% increase in gross revenue and a 33% drop in gross profit

- The company’s management declared a quarterly dividend of USD 0.14 per share, payable on 26 July 2024

Caledonia Mining Corporation PLC (LSE: CMCL) is a cash-generative gold producer with its primary asset in the Blanket Mine, Zimbabwe. It has a market capitalization of GBP 165.79 bn and is listed on the FTSE AIM All-share index.

Caledonia Mining's EBITDA rose to USD 9.9 million in Q1 FY24 from USD 2.3 million in Q1 FY23, driven by increased volumes of gold sold at higher average realized prices.In FY23, the company's gross revenue increased by approximately 3% due to higher gold sales at an increased average realized sales price, which rose by 7.8%. However, gross profit decreased by about 33% because of higher production costs at Blanket Mine, totaling USD 69.6 million, and increased operating costs at the small-scale Bilboes oxide mine, totaling USD 13.1 million.

Regarding dividends, management declared a quarterly dividend of USD 0.14 per share, payable on 26 July 2024. This announcement translates to an annualized dividend yield of approximately 5.50% based on the closing stock price on 12 July 2024.

Recent business update

According to the company's latest update, gold production at Blanket in Q2FY24 rose to 20,773 ounces, up 19% from 17,436 ounces in pcp. In H1FY24, Blanket produced 37,823 ounces of gold, showing a 13% increase from 33,472 ounces in pcp. Caledonia has reaffirmed its forecast for Blanket's gold production in 2024 at 74,000-78,000 ounces.

Company outlook

Caledonia Mining is reviewing early findings from updated feasibility studies for Bilboes, with the goal of reducing initial capital costs and enhancing project profitability. The company's current strategic priorities involve achieving gold production targets of 74,000 to 78,000 ounces annually at Blanket for FY24 and FY25, updating the resource assessment to prolong the mine's operational lifespan, and progressing exploration activities at the Motapa project.

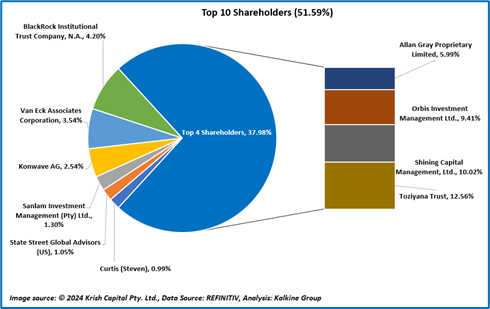

Top 10 Shareholders

The top 10 shareholders of CMCL together own approximately 51.59% of the total shares. Toziyana Trust holds the largest share, comprising around 12.56% of the total shareholding, followed by Shining Capital Management, Ltd., which holds approximately 10.02% of the shares, as illustrated in the chart provided.

Stock performance

Over the past six months, the stock price of CMCL has declined by approximately 10.88%. Its trading range over the last year spans from a low of GBX 600.00 to a high of GBX 1,040.00, and it is presently trading below the average of this range.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 12 July 2024. The reference data in this report has been partly sourced from REFINITIV.