US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 9.45 points or 0.21 per cent higher at 4,441.80, Dow Jones Industrial Average Index surged by 135.01 points or 0.38 per cent higher at 35,236.86, and the technology benchmark index Nasdaq Composite traded lower at 14,815.60, down by 44.60 points or 0.30 per cent against the previous day close (at the time of writing – 12:05 PM ET).

US Market News: The major indices of Wall Street traded on a mixed note after the $1 trillion infrastructure bill was passed by US Senate. Among the gaining stocks, 3D Systems (DDD) shares grew by about 39.02% after the Company’s quarterly revenue and earnings came out to be more than the consensus estimates. AMC Entertainment (AMC) shares rose by about 2.46% after the Company had reported a lower-than-expected quarterly loss. Among the declining stocks, Casper Sleep (CSPR) shares plunged by around 17.12% after the Company had reported a quarterly loss despite delivering a quarterly revenue more than the consensus estimates. Planet Fitness (PLNT) shares dropped by about 0.24% after the Company’s quarterly earnings had missed the consensus estimates.

UK Market News: The London markets traded in a green zone as investors digested the latest UK retail sales data. According to the data from the British Retail Consortium (BRC), UK Retail Sales increased by around 6.4% during July 2021 from a year ago.

FTSE 100 listed Flutter Entertainment shares climbed by about 8.23% after the Company had reported a significant growth in the adjusted earnings during the first half benefitted by the acquisition of Stars in the US.

M&G shares went down by around 2.49%, although the Company had reported better-than-expected adjusted operating profit during the first half of the current fiscal year.

Intercontinental Hotels had swung into profit during the first half as the Company recovered from the adverse impact of the Covid-19 pandemic. However, the shares slipped by around 0.31%.

Hargreaves Lansdown shares grew by around 1.55% after the Company’s shares tumbled yesterday post releasing the full-year results.

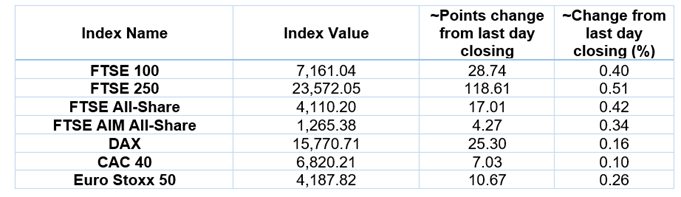

European Indices Performance (at the time of writing):

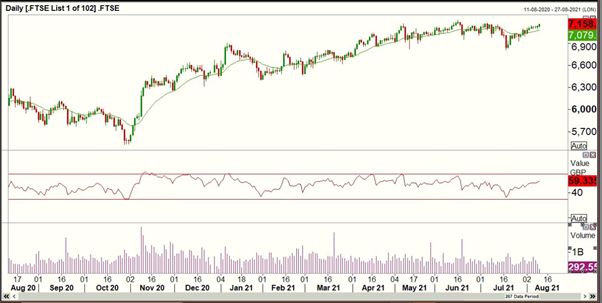

FTSE 100 Index One Year Performance (as on 10 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Consumer Cyclicals (+1.40%), Basic Materials (+0.92%) and Energy (+0.78%).

Top 2 Sectors traded in red*: Healthcare (-0.38%) and Industrials (-0.30%).

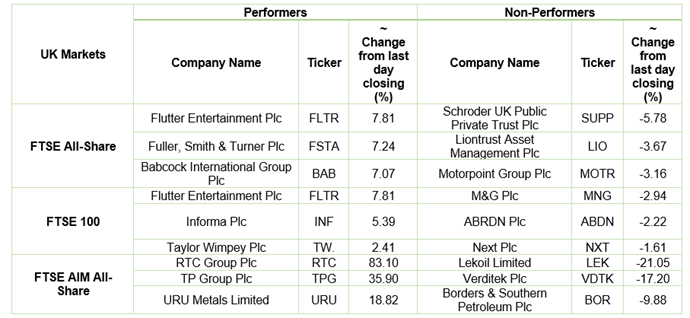

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $70.75/barrel and $68.38/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,731.55 per ounce, up by 0.29% against the prior day closing.

Currency Rates*: GBP to USD: 1.3836; EUR to GBP: 0.8469.

Bond Yields*: US 10-Year Treasury yield: 1.341%; UK 10-Year Government Bond yield: 0.5905%.

*At the time of writing