Highlights

- Horizon generates over $20M in gold-related revenues

- First free cashflow from Phillips Find totals $1.5M

- Processing of additional ore planned through September

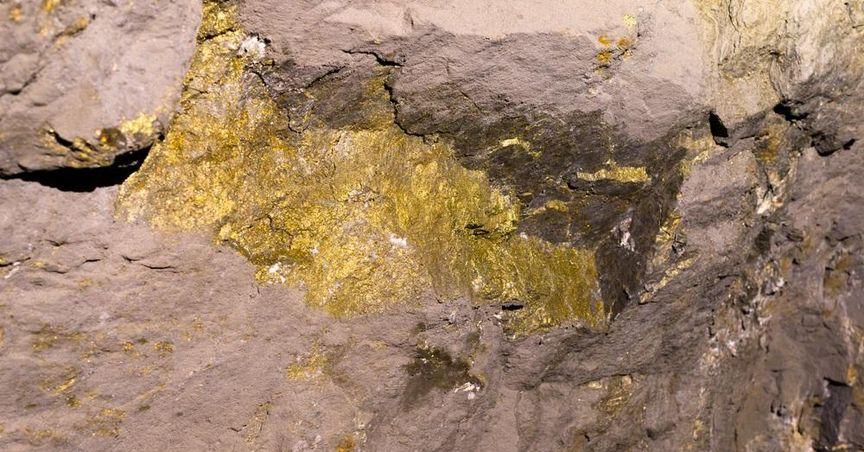

Horizon Minerals (ASX:HRZ) is strengthening its cash position with ongoing gold production success across its Western Australia projects, notably Phillips Find and Boorara. The company has reported generating a robust $20.3 million in revenue to date, supported by consistent output and favourable gold pricing.

Revenue Boost from Multiple Sources

So far in the June quarter, Horizon Minerals has received $12.8 million from operations linked to the Paddington site. Additionally, $7.5 million was secured through toll treatment of 51,228 tonnes of ore grading at 0.92g/t gold. This yielded 1,439.3 ounces at a metallurgical recovery rate of 94.71%, with an average sale price of $5,195 per ounce.

At Phillips Find, 18,676 tonnes of ore were processed at an average grade of 1.97g/t, achieving 95.5% recovery. The 1,132.2 ounces produced fetched an average of $5,140 per ounce, translating into $5.8 million in revenue. Most notably, this led to Horizon’s first free cashflow milestone from the site, generating $1.5 million in net returns.

Strong Pipeline Ahead

Further value is anticipated with 70,000 tonnes of ore from Phillips Find scheduled for processing in September and October at Three Mile Hill, operated by Focus Minerals (ASX:FML). This is expected to continue the strong cash generation trend through the second half of 2025.

In August, 87,000 tonnes of ore will be treated at the Greenfields Mill, including 27,000 tonnes from Boorara. This effort is part of concluding the toll milling agreement with FMR Investments.

At Boorara, Horizon reports having stockpiled 190,000 tonnes of high-grade ore and another 126,000 tonnes of lower-grade material. The high-grade portion is being prioritised under an agreement to process 1.24 million tonnes at the Paddington Mill, in partnership with Norton Gold Fields.

The company has already collected March 2025 quarter revenue from Paddington operations, totalling $6.3 million.

Gold Prices Add Support

Gold prices have trended upward amid global uncertainty, recently topping US$3,390 (A$5,239.25) per ounce. As of 9am AEST on 18 June, gold was trading at A$5,245.91 per ounce, further enhancing the economics of Horizon’s output.

With a market capitalisation of approximately $125.76 million, Horizon Minerals is also set to present at the Noosa Mining Investor Conference from 23–25 July at Peppers Noosa Resort.

While not a constituent of the S&P/ASX200, Horizon’s growing revenues, strong ore reserves, and clear production roadmap highlight its rising profile in Australia’s mining sector.