Summary

- Rank Group, William Hill, and Flutter Entertainment have been positioning themselves in recent years to make the most out of the growing sports betting market

- Given the prevalent state of the economy, people are looking up at online betting sites

- Another lockdown might impact the business of these companies in the near term

The UK has a long history when it comes to gambling, and people have been betting on horse racing since the industrial revolution. With the passage of time, people looked up to Gambling as a normal form of entertainment, which can also be used for generating passive income. Over the last few decades, the industry has matured further with the advent of Casinos and other sports betting-based activities.

However, gambling and sports betting have their own share of demerits. A majority of the people tend to lose money as these activities are extremely risky since they are totally based upon speculation and can impact the lives of the people instantly. Putting money in gambling and sports betting is different from other forms of investment as the latter is supported by empirical analysis and behavioural science.

Must read: Five Online Gaming and Betting Stocks That Are Worth Paying Attention To

As the coronavirus pandemic washed up the shores of the UK in a totally unprecedented manner, travel restrictions and lockdown were imposed to curb the spread of the deadly pandemic. The people living indoors had no other option than to resort to home entertainment choices. Online Gambling and sports betting have emerged as a popular option for Britons during the lockdown. However, in order to prevent the exploitation of people, a limit was imposed on online betting games by the Gambling Commission.

With an unprecedented surge in online sports betting activities, the Gambling stocks have become the talk of the town for most of the investors. In this article, we would take a sneak-peek into various gambling stocks listed on the London Stock Exchange.

- Rank Group Plc

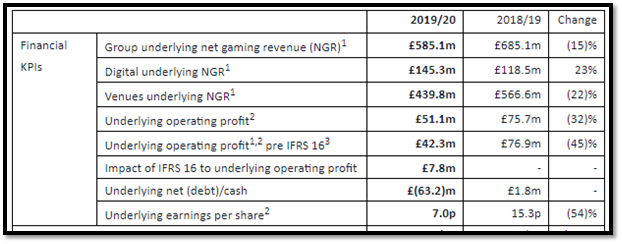

FTSE 250 listed multi-channel gaming operator, Rank Group Plc (LON:RNK) operates through three brands – Grosvenor Casinos, Mecca, and Enracha. The overall net gaming revenue of the company was down by 15 per cent for the fiscal year 2020. Rank Group has not proposed a final dividend for 2020 in the light of coronavirus pandemic. The Group had a net debt of £63.2 million (IFRS 16 adjusted) on 30 June 2020.

(Source: Company’s filings, LSE)

Rank Group shares last traded at GBX 100.00 on 9 October 2020, posting a gain of 1.83 per cent from previous day closing price level. From January till date, Rank Group shares have delivered a negative price return of 64.29 per cent.

Also read: A look at Pubs and Gambling Stocks Post Lockdown Relaxation

- William Hill Plc

Sports betting has picked up steam in the United States. The British gambling company, William Hill Plc (LON: WMH) recently made headlines as it signed a multiyear deal with sports programming network, ESPN. Moreover, US casino operator Caesars Entertainment is likely to take over the company.

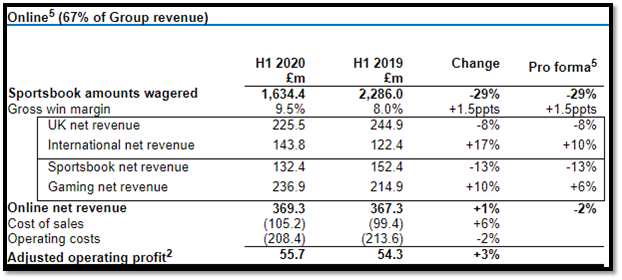

The net revenue for H1 2020 was down by 32 per cent year-on-year due to the temporary shutdown of retail activities and COVID-19 disruption to sporting events.

However, the online net revenue for the first half of 2020 got a major boost with a progressive resumption of sports events post-lockdown and with improved by 1 per cent year-on-year, aided by growth in International net revenue and successful product launches.

(Source: Company’s filings, LSE)

During the first half of 2020, the company’s adjusted operating profit was £11.8 million ahead of expectations due to new Online content and cost optimisation processes introduced by the company.

William Hill stated that it made a good start to the second half of 2020 after underlying profits decreased by 85 per cent year-on-year during the first half of 2020 due to lockdown induced by COVID-19 pandemic. The Company could not provide financial guidance for the fiscal year 2020, primarily due to the uncertainties prevaling in the UK’s economy.

William Hill shares last traded at GBX 277.10 on 9 October 2020, losing 1.14 per cent from previous day closing price level. From January till date, William Hill shares have delivered a price return of 41.85 per cent.

- Flutter Entertainment Plc

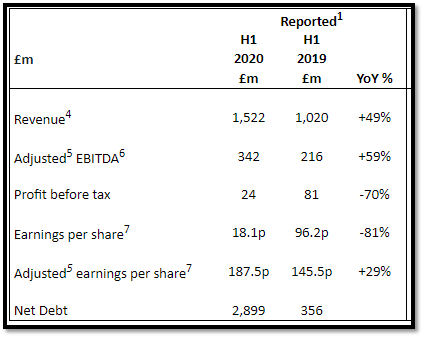

Flutter Entertainment Plc (LON: FLTR) is a global sports betting, gaming and entertainment operator. During the first half of 2020, the reported revenue increased by 49 per cent year-on-year to £1,522 million (H1 2019: £1,020 million), following the successful merger with TSG (The Stars Group).

(Source: Company’s filings, LSE)

However, the reported profit before taxation was down by 70 per cent to £24 million during the first half of 2020 (H1 2019: £81 million).

Flutter Entertainment shares last traded at GBX 13,005 on 9 October 2020, gaining 1.80 per cent from previous day closing price level. From January till date, Flutter Entertainment shares have delivered a price return of 37.62 per cent.

The regulatory and legislative regimes for betting and gaming are constantly under review and can change at short notice due to any sudden spike in the number of Covid-19 cases. These changes can have a severe impact on the businesses in this sector. Another lockdown in the wake of COVID-19 can also pose a massive risk to business operations and could lead to a substantial decline in profits. Most importantly, economic fallout can massively influence consumer spending on leisure activities.