US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 14.64 points or 0.38 per cent higher at 3,856.11, Dow Jones Industrial Average Index contracted by 109.66 points or 0.35 per cent lower at 30,887.32, and the technology benchmark index Nasdaq Composite traded higher at 13,711.07, up by 168.01 points or 1.24 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note driven by the improving news flow regarding Covid-19 pandemic. The Chicago Fed’s national activity index had increased to 0.52 during December 2020 compared to 0.31 in November 2020. Among the gaining stocks, Express shares jumped about 89.39% after it announced a deal to add USD 140 million in additional financing. BlackBerry shares gained approximately 40.60% riding on the news that it had settled a patent dispute with Facebook. AMC Entertainment Holdings shares went up by around 37.32% after it had signed deals for the financing of USD 917 million through equity and debt. Shares of Moderna went up by 4.75% after it said that the Covid-19 vaccine would be effective against both variants of the virus. Among the declining stocks, shares of Merck went down by 4.5% after it had ended the Covid-19 vaccine program.

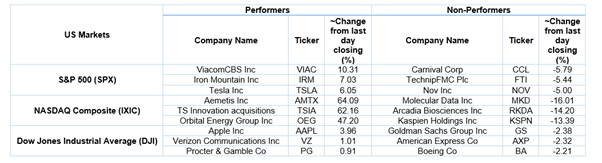

US Stocks Performance*

European News: The London and European markets traded in the red territory due to the low investor confidence regarding tightening of border restrictions and prolonged national lockdown. Among the gaining stocks, Boohoo Group shares grew by 4.21% after it had purchased the Debenhams brand in a lucrative deal. JTC shares jumped by 3.13% after it said that full-year results would be in line with the management expectations. IG Design Group shares went up by 3.05% after it reported a surge in year-to-date revenues amid Covid-19 pandemic. Shares of SThree went up by 2.20% after it had resumed the dividend payments. Among the decliners, Fireangel Safety Technology Group shares dropped by 7.93% after it had warned of the adverse impact of Covid-19 pandemic on the full-year sales. Shanta Gold Ltd shares went down by 4.37% although it had reported 34% growth in the full-year adjusted EBITDA. Shares of International Consolidated Airlines Group had fallen the most on FTSE 100.

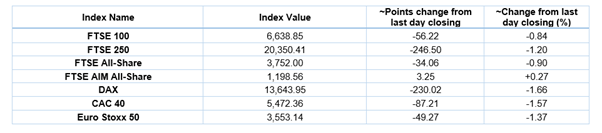

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 25 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 2 Sectors traded in green*: Healthcare (+0.95%) and Utilities (+0.21%).

Top 3 Sectors traded in red*: Energy (-2.66%), Financials (-1.64%) and Consumer Cyclicals (-1.59%).

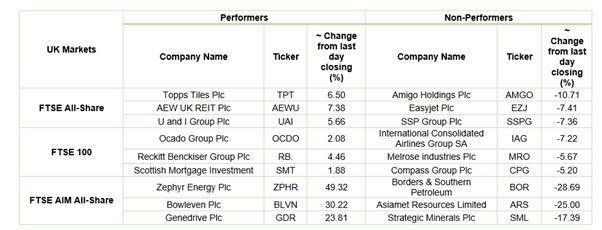

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $55.33/barrel and $52.34/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,857.25 per ounce, up by 0.06% against the prior day closing.

Currency Rates*: GBP to USD: 1.3670; EUR to GBP: 0.8885.

Bond Yields*: US 10-Year Treasury yield: 1.045%; UK 10-Year Government Bond yield: 0.261%.

*At the time of writing

.jpg)