US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 15.05 points or 0.34 per cent lower at 4,408.10, Dow Jones Industrial Average Index dipped by 282.25 points or 0.80 per cent lower at 34,834.15, and the technology benchmark index Nasdaq Composite traded higher at 14,770.80, up by 9.50 points or 0.06 per cent against the previous day close (at the time of writing – 12:15 PM ET).

US Market News: The major indices of Wall Street traded in mix amid growing investors’ concerns regarding a slowdown in economic growth. Among the gaining stocks, Robinhood Markets (HOOD) shares rose by about 32.03% after making solid gains during the previous trading session. Tupperware Brands (TUP) shares surged by about 5.89% after beating top-line and bottom-line estimates during the second quarter. Among the declining stocks, General Motors (GM) shares dropped by about 8.45% after the Company’s second-quarter earnings missed the consensus forecast. Amgen (AMGN) shares went down by around 5.15% after the Company had highlighted of a tax dispute with the IRS.

UK Market News: The London markets traded in a green zone after the release of UK services data. Moreover, the UK services sector had expanded more than the expectations during July 2021 as the adjusted IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) came out to be 59.6 for July 2021.

FTSE 100 listed Taylor Wimpey shares went up by about 1.91% after the Company had reinstated the dividend and upgraded the annual guidance boosted by a booming housing market.

Legal & General Group shares jumped by around 2.92% after the Company had lifted the interim dividend driven by solid growth in the first-half profits.

Rolls-Royce Holdings had signed an agreement to sell Bergen Engines medium speed liquid fuel and gas engines business. Furthermore, the shares rose by around 1.48%.

Ibstock shares grew by around 1.00% after the Company stated that the revenue had approached 2019 levels with divisional margins back to 2019 levels on a like-for-like basis.

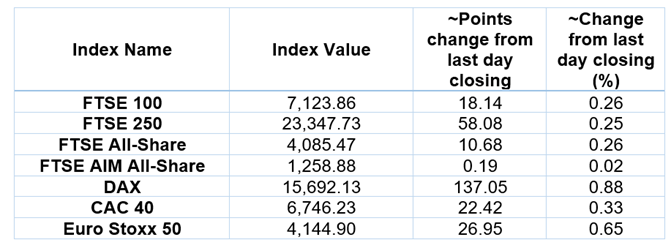

European Indices Performance (at the time of writing):

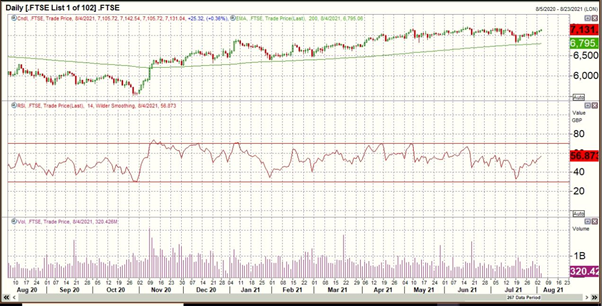

FTSE 100 Index One Year Performance (as on 4 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Real Estate (+1.46%), Industrials (+0.86%) and Financials (+0.84%).

Top 3 Sectors traded in red*: Energy (-0.73%), Technology (-0.33%) and Healthcare (-0.03%).

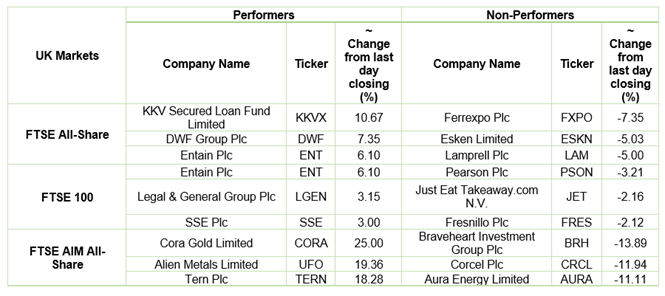

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $70.59/barrel and $68.36/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,814.75 per ounce, up by 0.04% against the prior day closing.

Currency Rates*: GBP to USD: 1.3906; EUR to GBP: 0.8517.

Bond Yields*: US 10-Year Treasury yield: 1.180%; UK 10-Year Government Bond yield: 0.5170%.

*At the time of writing