Summary

- NZ meat and edible offal export values took a sharp dip post March 2020, amid COVID-19 period till date.

- The recent months NZ meat and offal export values came down by more than half up to NZ$0.4429 billion compared to NZ$1 billion in total meat exportable values during March 2020, creating a fear in the NZ meat industry.

- Despite a drop in export values, the meat industry emerged as a saviour for the overall New Zealand export market.

- The recent government restrictions (in favour of climate emissions) via new freshwater rules, and Emissions Trading Reform bill did not go well with the NZ beef farmer fraternity.

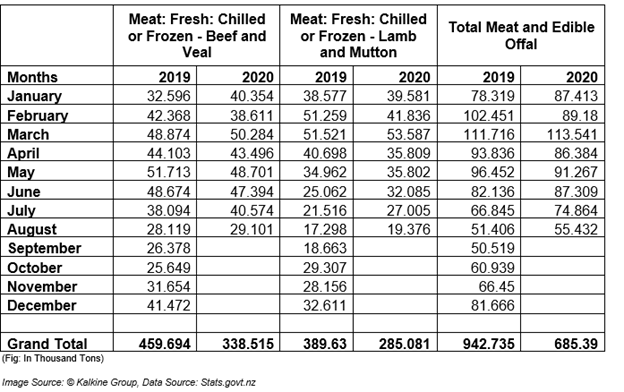

New Zealand’s total meat and edible offal export was valued at 685.39 thousand tons for the period (between January-August 2020), which is slightly higher by 0.33% compared to the same period last year.

The country’s exports totalled at 683.161 thousand tons of total meat and edible offal for the period (amid January-December 2019). During the coronavirus outbreak, the meat industry turned out to be a saviour of NZ export industry, considering the fall observed in export figures from various other industries in the same period.

Did You Miss Reading; NZ Exports and Opportunities: NZ Farmland and Forestry Produce

What is edible offal?

Offal is the internal organ and entrail of the butchered animal. A standard edible offal prepared from animals like buffalo, sheep and goat are processed and exported to different regions.

Meat Industry: Saviour of NZ Export Industry during COVID-19 Period

The total meat, beef and veal exports moved up by 1.2% for the period (between January-August 2020) to stand at 338.51 thousand tons compared to 334.51 thousand tons exported a year earlier.

Similarly, lamb and mutton meat exports increased to 285.081 thousand tons between January-August period for 2020 compared to 280.893 thousand tons exported a year earlier.

NZ Meat and Edible Offal Export Values: Major Cause of Concern

Chart Source: Thomson Reuters Refinitiv, Date: 6 October 2020

New Zealand’s meat and edible offal export values came down sharply in the last few months. The reasons for the same can be attributed to lower demand of such products amid lesser stocking of packaged/frozen foods by people.

The loosening of restrictions in the post COVID-19 period by governments across the world urged the importers to ask lower CIF prices of meat shipments from NZ exporters/processors.

Also, demand of meat was affected because of the subdued food service sector, which was already suffering from COVID-19 restrictions and imposed lockdown since March 2020.

Must Read: Fall in Export Meat Prices During March 2020 Quarter

Challenges in front of Beef Farmers & Industry

Essential Freshwater Rules

The recent Essential Freshwater rules did not go down well with beef farmers, which included pointers like winter grazing of forage crops, which allows the grazing activity if they fulfill certain terms and conditions.

As per the rule, pugging (which damages the soil as heavy livestock eat the pasture and push down the wet soil, which causes poor plant growth) is not allowed for more than 20 cm deeper and must not comprise of 50% of the region.

Emissions Trading Reform Bill

Lately, NZ government passed the bill, which led the conversion of sheep and beef farms into pine tree farms (to absorb carbon emission). This would change the land usage from pastoral farming to exotic pine trees farming. Such government restrictions lowered down the confidence level of the beef farmer community.

Did You Read; Prices Fall for Beef and Sheep Farmers

A ray of hope for Meat Industry from e-commerce space

Silver Fern Farms Tied Up with Gourmet Direct

Recently, Silver Fern Farms, the largest producer and exporter of red meat collaborated with Gourmet Direct to sell its products online to NZ consumers. During COVID-19 period, contactless purchasing of food has become a trend and has been helping the farms release their soaring stocks in an efficient manner.

Notably, e-commerce expenditure reached US$82.5 billion in May 2020, reflecting a rise of 77% year-over-year, encouraging the farms to go for online selling model along with the supply of a various range of products through its retail partners.

Silver Fern Farms also tied up with their distribution partner, the US based entity Marx Foods and Beef + Lamb New Zealand, unveiling an array of Angus beef sampler boxes for online purchase in the US region.

The three new sampler boxes consist of premium Silver Fern Farms selection of country best grass-fed and pasture-raised Angus beef that is safely packaged and delivered to the customer directly to their doors.

Do Read; A Brief About Meat Industry in New Zealand

The Road Ahead

E-commerce turned out to be a game-changer for various sectors. In the challenging time of COVID-19, selling of meat via online platforms is the need of the hour, when people around the world are practicing social distancing and prefer a contact less purchase model.