Source: kamui29, Shutterstock

Summary

- GBP fell considerably against the USD and the euro in the morning trades on Friday.

- The domestic currency regained partial losses as the trading progressed.

- BoE fixed a reference currency rate of 1.3795 USD vs per unit pound on 15 April

The Great Britain pound (GBP) fell considerably against the United States dollar (USD) and the euro (EUR) in the morning trades on Friday, 16 April, while the benchmark equity indicator FTSE 100 managed to hold the early gains. Pound sterling slipped against both the major currency units even as the US dollar index traded little changed from the previous close.

Given the tightened environment from the US Federal Reserve on the back of the still uncertain nature of the coronavirus pandemic, the US dollar is likely to post losses for the second consecutive week. The market participants have remained critical after the US Federal Reserve indicated to pursue the accommodative stance of policy for quite some time as the pandemic unfolds.

According to the latest foreign exchange data available, the GBP to USD pair was trading at 1.3770 (0950 GMT), down 0.12 per cent from the previous close of 1.3786. During the day so far, the currency pair has shuttled between a low and high of 1.3717 and 1.3789, respectively, at the interbank foreign exchange market. The GBP regathered momentum partly as the trading progressed.

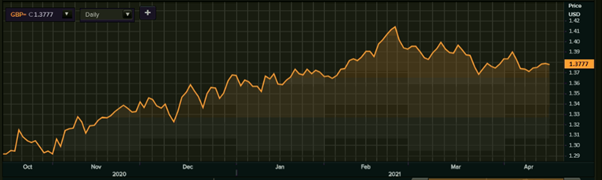

Pound sterling has been largely falling since the last one-and-half months, but it is still trading slightly higher on the year-to-date scale.

GBP vs USD (6-month performance)

(Source: Refinitiv, Thomson Reuters)

Meanwhile, the GBP to EUR pair oscillated in a largely similar fashion. As at 0954 GMT, the currency pair was trading at 1.1502, down 0.13 per cent from the last close of 1.1518. In the intraday session so far, the currency group has touched a low and high of 1.1470 and 1.1522, respectively.

The domestic investors are waiting for the speech by Sir Jon Cunliffe, the Deputy Governor of Financial Stability, Bank of England. The BoE had fixed a reference currency rate of 1.3795 USD and 1.1524 EUR, respectively, against a unit of sterling on 15 April. Both the reference rates are well below each of their 52-week highs.