Summary

- Current monetary policy decision by the RBA indicates no changes to the present policy set up.

- Recovery has been observed in employment and consumer demand, but overall revival remains uneven.

- The current unemployment rate is 7% and is expected to increase over the coming months.

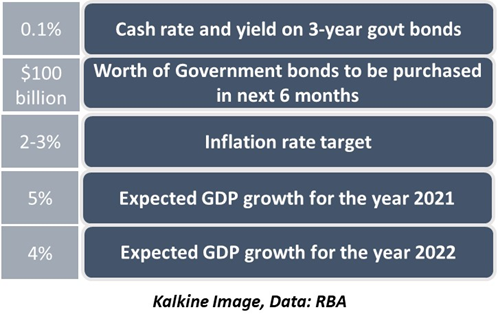

The Reserve Bank of Australia (RBA) has decided to maintain its monetary policy stance, with no new changes announced. With a target of 10 basis points for both the interest rate and the yield on 3-year Australian government bonds, RBA continues to maintain its previous settings.

To recall, RBA announced open market operations in early November to inject money into the economy. In his speech at the November monetary policy meeting, RBA’s Governor Mr Philip Lowe announced the central bank would purchase $100 billion worth of government bonds of ~5-10-year maturity over the next six months. These measures are expected to continue in the month of December as well; however, the RBA has decided to put its bond-purchase plan under review.

The cash rate is not expected to rise anytime soon, more specifically, at least not for the next 3 years. As was seen in November, the RBA continues to maintain job creation as their priority in all policy measures.

Economic Recovery on the Cards?

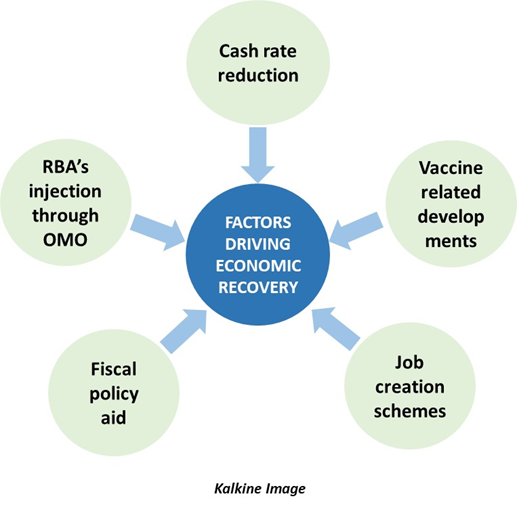

The Australian economy has been on the path to recovery and has started to emerge from the pandemic-related tightening. However, this recovery is still quite uneven and at the same time, uncertain. Although, one cannot neglect that vaccine-related developments have boosted demand up to a certain degree, supported by favourable fiscal and monetary policy changes.

Current policy measures are expected to keep the economic recovery going. Recent data has been better than expected. GDP growth is expected to be 5% next year and 4% over 2022. However, RBA estimates that the level of GDP that was seen at the end of 2019 would not be achieved till the end of 2021.

Employment figures have also shown strength as the unemployment forecast for December was quite promising. However, further slump in unemployment is expected in December, with jobless rate likely to rise beyond the current rate of 7%. This would have subsequent effects on the wage rates and prices, which are expected to remain restrained over the coming years.

Related Read: Australia’s Economic Charter: Any Emerging Green Shoots?

Monetary Policy Steps

RBA’s decision to lower interest rate was largely debated because of the strain put by such move on the financial sector. RBA’s interest rate policy has lowered borrowing costs and has bolstered demand in the economy besides reducing the exchange rates.

Under the open market operations, RBA has purchased $19 billion of government bonds in the past one month. RBA has also bought $5 billion worth of Australian government securities to support the 3-year yield target. These changes have been adopted with the intent of providing greater liquidity in the economy. As a result, the RBA balance sheet has increased by around $130 billion since the start of 2020.

The cash rate is expected to be maintained at the current level until the inflation target of 2-3% is achieved. Significant improvement to wages is essential for the same to be attained, which is unlikely to happen over the next few years. Importantly, RBA has promised to do more if required.