Summary

- Gross operating profits of the companies grew by 3.2% in September quarter vs June quarter.

- Australia’s September quarter GDP data is scheduled to be released on Wednesday

- Economists have upgraded their GDP forecasts to as high as 2.5 per cent

- But, higher unemployment rate which surged to 7.2% remains a concern.

Data on Australia’s third quarter GDP is scheduled to be released on Wednesday, 2nd December 2020. The numbers would be closely watched as the gross domestic product (GDP) contracted 7 per cent in the June quarter when coronavirus related curbs brought much of the economy to a standstill. However, the current growth of 3.2% over the previous quarter in the gross profit of the companies have started to reflect a recovery in the consumer demand.

Economists are optimistic this time as the economy opens up steadily. According to a Reuters poll, the economy may record a 2.5 per cent growth in the third quarter.

Image Source: © Kalkine Group

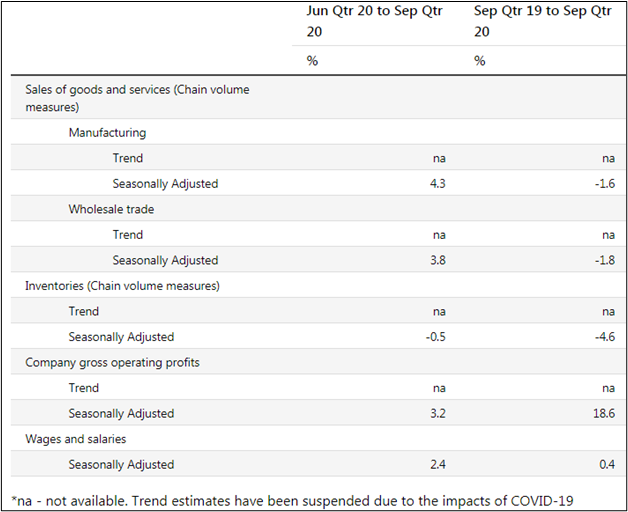

According to the current price estimates by the Australian Bureau of Statistics (ABS) for the September quarter, the company gross operating profits jumped 3.2 per cent (seasonally adjusted). The wages and salaries surged 2.4 per cent (seasonally adjusted). The inventories declined 0.5 per cent (seasonally adjusted), according to the chain volume estimates for the third quarter.

READ MORE: Australia’s Economic Charter: Any Emerging Green Shoots?

The seasonally adjusted estimate for manufacturing sales of goods and services surged 4.3 per cent this quarter. The seasonally adjusted estimates for wholesale trade sales of goods and services jumped 3.8 per cent.

According to a note by analysts at ANZ, the Australian GDP may reach its pre-coronavirus level sometime next year. The growth outlook looks positive for 2021 with robust gains expected in the fourth quarter.

Image source: Australian Bureau of Statistics (ABS) report dated 30th November 2020

In the past few months, consumer spending has seen a rise. Even household spending has surged. The house prices and home loans are on surge as well indicating a resurgence in the economy.

The growth for the third quarter is seen higher as Victoria, the coronavirus hotspot in Australia, came out of its long lockdown period last month. No new community cases have been recorded in Australia for the past few weeks.

READ MORE: How COVID-19 has Impacted Australian Labour & Property Markets?

Concerns for the Australian economy

According to the ABS data released last week, the investment fell to A$25.85 billion after a robust 5.9 per cent decline in the June quarter. Similarly, the rise in the unemployment rate could be a bit of a worry. The unemployment rate rose to 7.2 per cent from under 5 per cent before the coronavirus pandemic.

But, preliminary data released on Monday raised some hopes. According to the data, there were fewer people on the government’s temporary “JobKeeper” welfare payment in the month of October. With the economy steadily reopening, more people are returning to work.

Reserve Bank of Australia (RBA) Deputy Governor Guy Debelle said earlier this week that even as there are hopes for the economy to rebound going ahead, it may still take a long time for economic output to reach its pre-coronavirus levels.