Highlights

- Cryptos can be of different types, for example, a meme token or a blockchain network token

- NFTs are not like cryptoassets, in that each asset in the former class is distinctive

- Regardless of the asset’s market cap or category, it can manifest volatility at any given time

Cryptos are increasingly becoming alternative investment assets for both institutional and retail investors. Often, the latter category of market participants overlooks what lies beneath the hype.

Downside risks aside, there could be assets launched only to pump them initially to be subsequently dumped.

Due to this, it is ideally crucial to differentiate between digital assets and identify the types of cryptos. Yes, there are multiple categories, with any particular cryptocurrency project aiming for a certain solution.

1. Bitcoin (BTC)

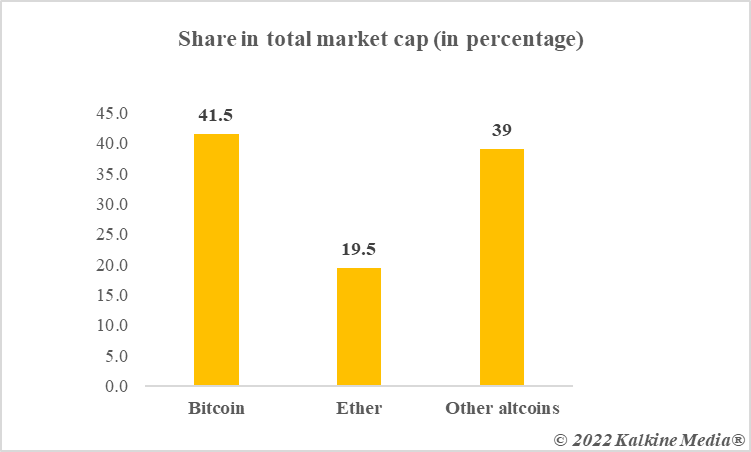

Bitcoin is a category in itself. It holds more than 41 per cent share in the total market cap, according to CoinMarketCap, which has over 19,100 cryptos listed. Assets other than BTC are also called altcoins.

Bitcoin is also considered the first crypto. It was launched with a view to facilitate remittances in digital assets, complementing or even replacing the dominance of fiat currencies like the USD.

Today, Bitcoin ETFs are listed on multiple global stock exchanges, and S&P Dow Jones indices track BTC prices.

Also read: What is Fidelity’s Bitcoin 401(k) offering? What to keep in mind?

Last year, El Salvador adopted BTC as legal tender. Based on proof-of-work consensus, which is often considered energy inefficient, Bitcoin has yet to be toppled from its number one position.

2. Blockchain networks

In this category of cryptoassets, Ethereum held dominance for many years. However, Solana, Cardano, Fantom, and many other later participants have emerged as so-called Ethereum killers.

These blockchain networks have their linked native tokens, for example, ETH in Ethereum and SOL in Solana, that usually function as a medium of exchange within the network.

The native token is used by network developers to pay fees. Additionally, these tokens can be listed on crypto exchanges in the form of tradable assets.

3. Meme tokens

Meme tokens often start from some joke or meme, but they may grow in both status and value. At least two tokens, DOGE and SHIB, have become huge, having a multi-billion dollar market cap.

Also read: What's in Canada Budget 2022 for cryptocurrency enthusiasts?

Meme tokens, some say, can be used as rewards on platforms like Twitter. DOGE surged on the news of Elon Musk’s Twitter takeover as its use in Twitter rewards was speculated by some.

Any meme token may later add other features to the project. For example, Shiba Inu may add a new blockchain soon, and there are also speculations about a SHI stablecoin.

4. Stablecoins

This is the only category within the cryptoverse that is immune to large-scale ups and downs in value, thanks to their peg to some stable asset like fiat currency.

Tether (USDT) has the highest market cap in this category, and USDT is said to be pegged to the USD. Multiple other stablecoins exist including Binance USD and TerraUSD.

Recently, it was reported that TerraUSD may add Bitcoin as a reserve currency. Stablecoin GYEN, on the other hand, is pegged to the Japanese Yen.

Also read: Deciphering debate around Bitcoin as reserve currency

Stablecoins are often used by crypto investors to trade in other cryptoassets.

Data provided by CoinMarketCap.com

5. Metaverse

Metaverse is an emerging category. Games that use the decentralized blockchain tech are often clubbed under this. Popular metaverse tokens are Axie Infinity (AXS), Decentraland (MANA), The Sandbox (SAND), and Gala Games (GALA).

Non-fungible tokens, which are often confused with cryptocurrencies, are usually a feature of metaverse projects. For example, Axie Infinity’s playable characters and Decentraland’s virtual lands come in the form of NFTs.

Bottom line

New categories can be added to cryptoassets any day. The above five are arguably the types of cryptos that dominate the crypto market.

All cryptos, regardless of the category they fall under, are prone to price volatility and speculative trade. It is better to be cautious than to be impulsive.

Also read: Bitcoin bond and Bividend: 2 new extensions of Bitcoin?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

_02_05_2025_05_53_40_418159.jpg)