Highlights

- NZ Government has lately published its air quality report stating an improvement in the country’s air quality.

- Mercury NZ gets a BBB+ i.e., a stable rating from S&P Global Ratings.

- Meridian Energy announces an FY22 long term incentive scheme for its senior employees.

Highlights:Stats NZ, along with the Ministry for the Environment has released a report on the country’s air quality.

The said report draws a comparison of each pollutant present in the NZ atmosphere with WHO air quality guidelines.

The report reveals that many urban areas, at times suffer from poor air quality, which is much below the stated air quality as mentioned in the WHO guidelines.

However, there has been a marked improvement in the air quality at most of the sites.

Further, also known as green stocks, NZ’s energy companies are increasingly becoming environmentally conscious and are investing heavily in sustainable, clean, and green sources of renewable sources of energy.

With this backdrop, let us now glance at the top NZX green stocks.

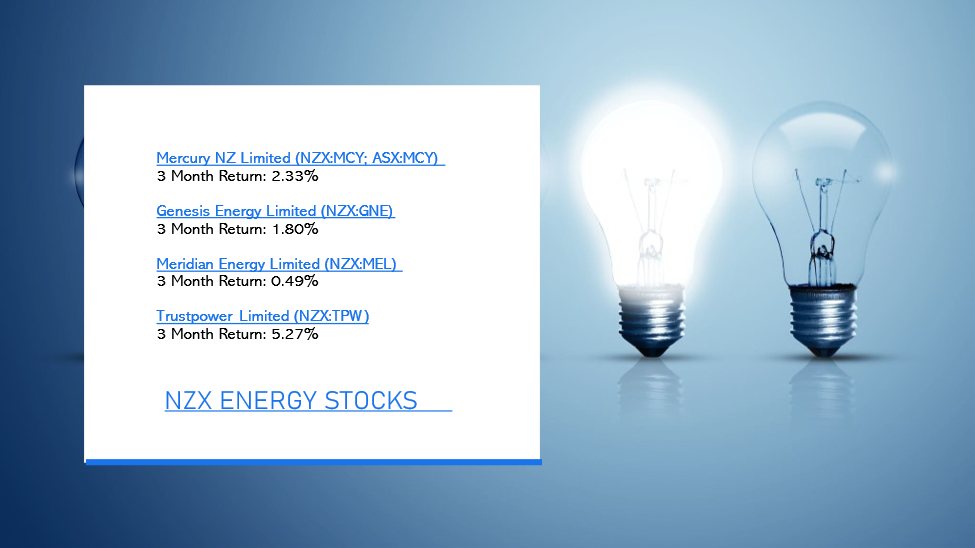

Source: © 2021 Kalkine Media® data source- Refinitiv

Mercury NZ Limited (NZX:MCY; ASX:MCY)

Mercury NZ Limited, New Zealand’s famous energy company has announced that the global credit rating agency, S&P Global Ratings has confirmed BBB+ as its credit rating.

Related Read: Mercury NZ (NZX:MCY): Is it 100% renewable energy company?

The said rating, which was published in late November 2021, signifies a stable outlook of the Company.

On 10 December, at the closing bell, Mercury NZ gained 2.20% at NZ$6.050.

Genesis Energy Limited (NZX:GNE; ASX:GNE)

Genesis Energy Limited boasts of being the largest energy retailer across the country with about 500,000 customers. Recently, the Company revealed that both its Chief Operations Officer and Chief Digital Officer, namely, Nigel Clark and James Magill, respectively, would be leaving GNE next year.

Must Read: Genesis (NZX:GNE): What steps has it taken towards solar development?

While Nigel would step down in June 2022, James intends to seek departure in February, next year.

On 10 December, at the closing bell, Genesis Energy dipped by 0.17% at NZ$2.905.

Meridian Energy Limited (NZX:MEL; ASX:MEZ)

Another leading energy company Meridian Energy Limited had recently announced its long-term incentive scheme for FY22 for its few key employees to retain them.

It has issued rights to acquire ordinary shares in MEL to those who have accepted the said offer.

On 10 December, at the closing bell, Meridian Energy fell by 1.67% at NZ$4.720.

Related Read: Are these the 5 most active stocks on NZX?

Trustpower Limited (NZX:TPW)

Trustpower Limited has disclosed appointing a new General Manager Corporate Services, Phil Wiltshire.

Do Read: Are these 5 NZX mid-cap aiming to become large-cap stocks?

Having a vast experience of over 20 years, Phil would assume office in February 2022 and would oversee TPW’s technology, finance, people, and business performance functions.

On 10 December, at the closing bell, Trustpower gained 0.14% at NZ$7.270.

Which are 4 NZX green stocks for 2022 and beyond?

Bottom Line

Green stocks are environmentally friendly companies that focus on alternative sources of energy rather than relying on fossil fuels and allure the investors with their sustainable long-term goals.

.jpg)