Highlights

- Saving is best done when money is invested in any asset to make it illiquid for the time being

- Liquid cash and easily accessible bank balance can trigger impulsive spending

- SIPs are one way to invest small amounts of money at regular intervals and create more money

To save, you need a parking space. Liquid money in the form of cash or in a savings account, more often than not, gets exhausted in discretionary spending.

The point is ‘out of sight, out of mind’. You can take a systematic investment plan (SIP). This is a saving plus an investment strategy that parks small amounts after regular intervals in a mutual fund, retirement account or similar other spaces. The money is automatically withdrawn on the due date from investor's savings account and deposited into the preferred asset.

Also read: Planning to save? 2 fall investment resolutions to mind

Difference between savings and investment

There is a very thin line that separates savings from investment. The latter is a better alternative as it provides cushioning against inflationary pressures.

SIPs provide a brilliant opportunity to save in securities listed on any exchange at a time when markets are scaling new peaks. So, $20 saved in a conventional manner without being invested in a space that can create more wealth out of the same wealth is not prudent considering high inflation amid a pandemic that is refusing to subside.

Also read: Middle-aged Canadians warming up to ecommerce & online brokers

Consistent saving needs commitment, and there can be no commitment unless you have a parking space for the saved money.

Individual stocks with strong fundamentals

If not SIPs, the next available option can be individual stocks with strong fundamentals. Indices like the S&P 500 Index or the TSX Composite Index are made up of stocks that command a very high market cap. The stocks are often dividend paying stocks that can ensure a steady flow of income for investors.

Also read: Smart financial planning tips for parents: Include RRSP & stocks

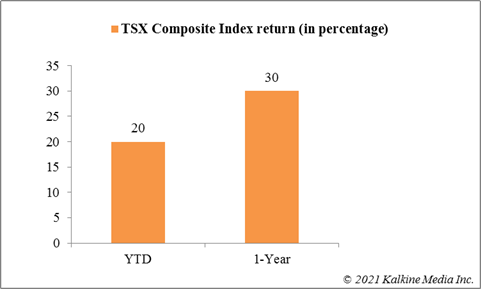

TSX Composite Index has rewarded its backers with good returns. The 1-year return of the index is over 30 per cent, while the YTD return is over 20 per cent. Global stock market is experiencing a bull run due to increased participation of retail investors.

Bottom line

The trick to save is investing a little money in some asset to make it illiquid and inaccessible for the time being. Liquid cash is often termed as spare cash and we tend to spend it on things we may not even need. Investment can be done in index funds that track the movement of stocks part of a certain index, like the S&P/TSX Composite Index or the S&P 500 Index.