Highlights

- One of the companies listed here posted a dividend yield of 3.048 per cent.

- A stock here rocketed by almost 188 per cent in the past year.

- Of the stocks mentioned, one posted a return on equity of 13.31 per cent.

Many investors are interested in investing their moolah in value stocks which enable them to earn higher returns if there’s an investment strategy in place. Such stocks are priced low at the moment corresponding to their intrinsic value due to temporary nuisance in the stock market, relevant sectors or industries, or any other disturbing news, etc.

These undervalued stocks which have strong fundamentals are likely to overcome the adversity of the market situations and may offer good returns and stability to investors at the time of market recovery or in the long run.

Also read: Fobi partners with Empower Clinics for AI Covid testing. Buy alert?

On that front, let us discuss some of the value stocks listed on the Toronto Stock Exchange (TSX).

1. Badger Infrastructure Solutions Ltd (TSX:BDGI)

The North American hydro excavation service firm Badger Infrastructure Solutions witnessed its scrip wrapping up at C$ 36.03 apiece on Tuesday, October 12, down by 0.853 per cent. At this closing price, its scrip was priced roughly 23 per cent below the 52-week high of C$ 46.58 reached on March 23.

The outbreak of the COVID-19 severely impacted the construction businesses, likewise, BDGI also noted a fall of almost seven per cent in the past year. Its scrip tumbled by nearly 13 per cent in the last six months and was down by more than five per cent on a year-to-date (YTD) basis.

However, the Calgary headquartered hydro excavation firm appears to be recovering from the pandemic’s setbacks with roughly nine per cent growth in the past three months and climbed almost eight per cent in the last month.

BDGI, in its latest quarter, posted a revenue of C$ 135.6 million up from that of C$ 134.5 million in Q2 2020. After normalizing the foreign exchange effects, the firm recorded an 11 per cent year-over-year (YoY) growth in its revenue.

It reported an adjusted EBITDA of C$ 14.4 million in Q2 2021, down from that of C$ 35.6 million and the consolidated revenue per truck per month was C$ 26,333, up from that of C$ 23,458 in the same quarter a year ago.

With the recovery in the pandemic and market situations, Badger expects to match its operating expenses with its revenue in order to exploit long-term opportunities and capture the non-destructive excavation market across North America.

On Wednesday, October 13, Badger held a dividend yield of 1.749 per cent, a price-to-earnings (P/E) ratio of 254.80, a price-to-book (P/B) ratio of 4.3, and a return in equity (ROE) of 0.07 per cent. Its five-year average dividend growth rate stood at 10.73 per cent on this day.

2. CES Energy Solutions Corp (TSX:CEU)

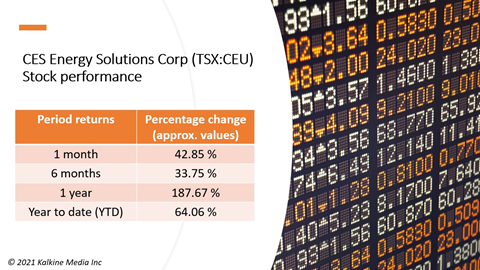

The Canadian consumable chemicals provider CES Energy Solutions Corp noted its stock closing at C$ 2.10 apiece on October 12, up by 0.96 per cent. Its stock scored its 52-week high of C$ 2.13 on Friday, October 8, which is more than one per cent above the mentioned closing price.

Its stock rocketed by nearly 188 per cent in the past year and soared about 64 per cent on a YTD basis. In the last one month, its stock jumped by almost 43 per cent.

CES reported a YoY rise of 59 per cent in its total revenue to C$ 253.6 million in the second quarter of 2021. It noted a net income of C$6.7 million in the latest quarter, up from that of net loss of C$ 24.9 million incurred in the same quarter a year ago.

CSE is expected to pay a quarterly dividend of C$ 0.016 to its shareholders on Friday, October 15.

The Alberta-based company held a dividend yield of 3.048 per cent, a P/E ratio of 13.90, a P/B ratio of 1.20 and an ROE of 8.80 per cent, at the time of writing.

3. Yamana Gold Inc (TSX:YRI)

The precious metals producer Yamana Gold’s stock was priced at C$ 5.18 apiece on October 12, up by 1.17 per cent. At this point, its stock was more than seven per cent above its 52-week low of C$ 4.82 on October 7.

The Toronto-based miner’s stock plummeted by about 36 per cent in the past year and slipped by almost 29 per cent on a YTD basis. In the last three months, it slumped roughly eleven per cent. However, it seems to be on the rise as it jumped up by more than four per cent in the last week.

Yamana recorded adjusted net earnings of C$ 70.7 million and net cash flows from operating activities of C$ 153.5 million, in the second quarter of 2021.

The C$ 4.9 billion market cap mining company held a P/E ratio of 23.90, a P/B ratio of 0.884, an ROE of 3.76 per cent and a dividend yield of 2.515 per cent, at the time of writing.

The company announced that it will be releasing the operation and financial results for the third quarter of 2021 after the market close on October 28.

Also read: 5 Canadian retail stocks to buy in October

4. VersaBank (TSX:VB)

The Ontario-based fully digital financial services provider VersaBank saw its scrip closing at C$ 14.62 per share on October 12, down by 1.08 per cent. It slumped by more than 17 per cent from its 52-week high of C$ 17.64 (February 25).

VB’s scrip soared by 123 per cent in the last year and YTD growth was up by nearly 65 per cent. Its scrip slightly increased by less than one per cent in the past three months while it improved by rising almost 12 per cent in the last month.

The bank reported a net income of C$ 5.4 million and a net interest income of C$ 14.5 million in the third quarter of 2021.

VersaBank held a P/B ratio of 1.684, an ROE of 7.89 per cent and a dividend yield of 0.684 per cent, on the valuation front.

5. iA Financial Corporation Inc (TSX:IAG)

The Quebec headquartered life and health insurer iA Financial Corporation witnessed its stock priced at C$ 72.65 apiece, at market close October 12, up by 0.069 per cent. Its stock surged almost 53 per cent in the past year and increased more than nine per cent in the last three months.

iA Financial’s net income attributable to common shareholders amounted to C$ 231 million in the second quarter of 2021.

The over C$ 7 billion market cap company held a P/B ratio of 1.224, a debt-to-equity (D/E) ratio of 0.23, an ROE of 13.31 per cent and a dividend yield of 2.67 per cent.

Bottom line

Many companies with sound fundamentals are expected to withstand tough market situations and enable investors to fetch higher profits.

Also read: Rent the Runway IPO: How to buy the fashion rental company's stock?

However, before investing your hard-earned money, it is important to research the company, its stock performance, future prospects, sector and industry performance, etc. to judge the fundamental strength and profit potential of the stock to earn good returns, considering the risk factors.