Highlights

- FOBI AI Inc’s stock rocketed by about 809 per cent in the past year.

- Fobi posted a return on equity of 381.55 per cent on October 12.

- According to research, the COVID-19 Antigen Testing Market is expected to grow at a 6.7 per cent compound annual growth rate by 2027.

After a market closing of C$ 3.02 apiece on Friday, October 8, the Fobi AI Inc (TSXV:FOBI) stock slightly dipped by 0.331 per cent and stood at C$ 3.01 on Tuesday, October 12, at the time of writing.

The Vancouver-based artificial intelligence (AI) company, on Tuesday morning, announced deepening its partnership with the healthcare provider Empower Clinics Inc (OTCQB:EPWCF).

As per the service agreement, Fobi’s data application and wallet pass technology will be integrated with Empower’s Kai Care COVID-19 Testing solutions and back-end data management system. This arrangement will enable the Vancouver-based integrated health firm to provide verified credentials for secure real-time online healthcare support solutions like notifying, scheduling, education, etc. to the Kai Care Clients.

According to Grandview Research, the COVID-19 Antigen Testing Market’s size is expected to expand at a compound annual growth rate (CAGR) of 6.7 per cent from 2021 to 2027, and to grow by US$ 8.3 billion.

The Fobi-backed Empower and Kai Care products ensure a secure customer experience for the COVID-19 tests and verifications, which further adds to expectations that Empower will expand its share in the testing marketplace.

Also read: 5 TSXV penny stocks to buy in October

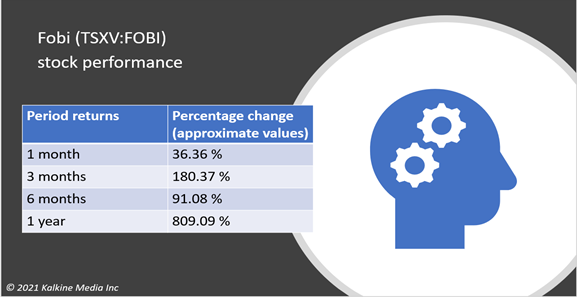

Fobi AI Inc (TSXV:FOBI)’s stock performance

Fobi’s stock rocketed by about 809 per cent in the past year and soared by more than 46 per cent on a year-to-date (YTD) basis. Its stock jumped approximately 91 per cent in the last six months while it nearly grew by more than 180 per cent in the past three months. In the last month, its stock climbed more than 36 per cent.

The company held a price-to-cash flow (P/CF) of 2.40 and a return on equity (ROE) of 381.55 per cent with a 10-day average trade volume of 1.12 million at the time of writing.

Also read: Rent the Runway IPO: How to buy the fashion rental company's stock?

Bottom line

Research indicates that the testing marketplace, specifically for the COVID-19, is expected to grow in the future, which means that the Fobi-backed Empower Clinics is likely to have a chance to increase its market share and expand its business to provide secure and real-time healthcare digital solutions.

_09_03_2024_01_03_36_873870.jpg)