Highlights

- Cybersecurity is becoming increasingly important

- With the digitization of the workplace, cloud technology and ensuring it is secured seems to have taken on a new meaning

- Some experts are predicting upside growth in the cybersecurity space in the coming decade

It seems like the Covid pandemic forced the world online. Cybersecurity, hence, is becoming increasingly important and seemingly this trend may continue.

With the digitization of the workplace, cloud technology and ensuring it is secured seems to have taken on a new meaning. Some data points to the proliferation of cybercrime in the pandemic years.

With this in mind, let’s look at five Canadian cybersecurity stocks to keep an eye on.

Patriot One Technologies Inc (TSX:PAT)

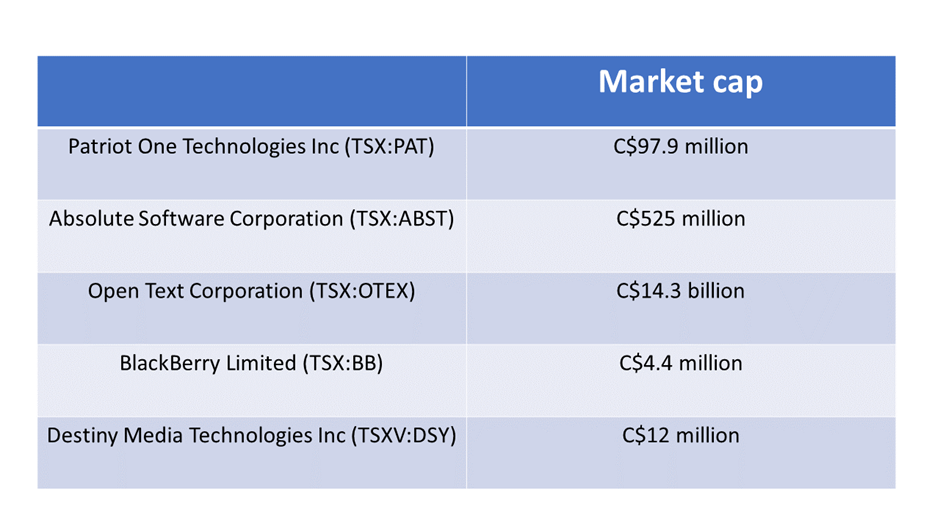

Radar technology for threat detection is the main product of Patriot One. It has a market cap of C$97.9 million.

This year has already seen the trucker protests in Canada and a war in Ukraine. Patriot One provides products that afford valuable time to first responders and security personnel in a crisis.

The company’s stock closed Thursday, April 21, at C$0.59. The PAT stock has gained nearly 60 per cent year-to-date (YTD). It is currently over 93 per cent higher than its 52-week low of C$0.305.

Absolute Software Corporation (TSX:ABST)

Absolute Software Corporation provides cloud-based endpoint control and serves in a diverse range of sectors including government, education, financial services and healthcare among others.

The company has a market cap of C$525 million and its stock closed Thursday at C$10.19. After touching a 52-week low of C$9.16 on January 24, the ABST stock has rebounded about six per cent.

Also read: Shopify (TSX:SHOP) stock falls 14% in 1 day: Is it time to buy?

Open Text Corporation (TSX:OTEX)

The company found its birth in the 1980s in a tech project at the University of Waterloo that involved the Oxford English Dictionary. It helps to archive and retrieve unstructured data.

The company has a market cap of C$14.3 billion. The OTEX stock closed at C$52.94 Thursday.

OTEX is down nearly 12 per cent YTD and is trading just 2.38 per cent above its 52-week low of posted April 18.

Also read: How to handle a bearish phase in the market?

BlackBerry Limited (TSX:BB)

BlackBerry had earned worldwide fame for its uniquely styled smartphones but now it solely deals in software including endpoint solutions.

While its stock has seen losses lately, it is perhaps too big a name to leave out of this list. It has a market cap of C$4.4 billion.

The BB stock closed April 21 at C$7.75. The stock has fallen 34 per cent YTD and 28 per cent in the last 12 months.

Also read: Canada Budget 2022 earmarks $12.5B more for climate: 2 TSX clean stocks

Destiny Media Technologies Inc (TSXV:DSY)

Destiny Media provides proprietary security with regards to audio and video streaming as well as watermarking.

It has a market cap of C$12 million. The stock costed C$1.14 on April 21. Its return on equity (ROE) is 4.08 per cent.

The DSY stock has lost 52 per cent in a year and 25 per cent YTD.

Also read: Is investing in gold worth considering during high inflation?

Bottom line

Some experts are predicting upside growth in the cybersecurity space in the coming decade. However, much is to be gleaned from the products of individual companies and their fundamentals. Tech, in general, has not had a great year so far amid likely increases in interest rates.

Also read: How does current inflation compare to 1970s stagflation?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.