Highlights:

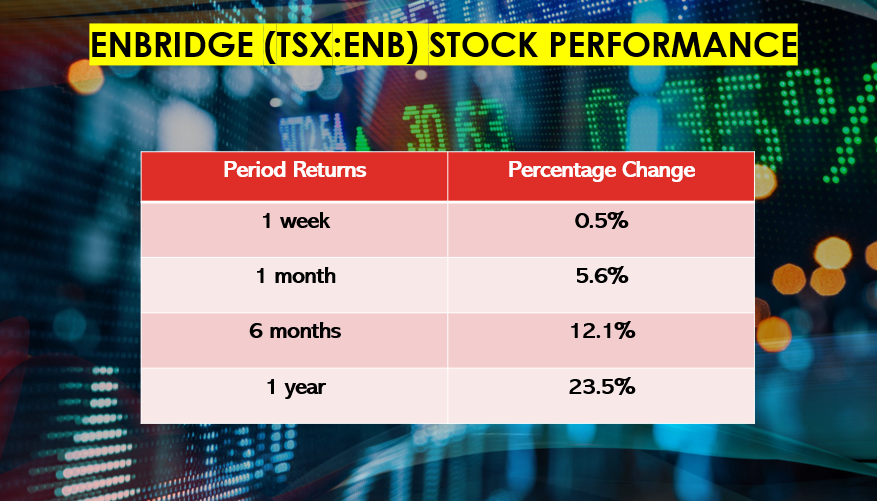

- At the end of the trading session on Thursday, February 10, the ENB stock had closed 0.2 per cent higher at C$ 54.55 per share.

- In December, Enbridge announced that it raised its dividend by three per cent to C$ 0.86 per unit.

- The company has reaffirmed its financial guidance for 2022 and said that it would achieve an adjusted EBITDA between C$ 15 to C$ 15.6 billion.

Enbridge Inc. (TSX:ENB) announced financial results for the fiscal year 2021, and the three months ended December 31. The multinational pipeline company's full-year GAAP earnings were C$ 5.8 billion compared to C$ 3 billion in 2020.

Notably, Enbridge's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased to C$ 14 billion in 2021 from C$ 13.3 billion in 2020.

Also Read: Suncor Energy (TSX:SU): An oil & gas stock for long-term growth?

At the end of the trading session on Thursday, February 10, the ENB stock had closed 0.2 per cent higher at C$ 54.55 per share. Let's take a look at Enbridge's financial results:

Key highlights of Enbridge's (TSX:ENB) financial performance

In the fourth quarter of the previous year, profit attributable to common shareholders was C$ 1.84 billion compared to a profit of C$ 1.78 billion in Q4 2020.

In Q4 2021, the distributable cash flow was C$ 2,487 million compared to C$ 2,209 million in Q4 2021.

©2022 Kalkine Media®

©2022 Kalkine Media®

In December, Enbridge announced that it raised its dividend by three per cent to C$ 0.86 per unit, and it will be payable to shareholders on March 1, 2022.

Bottom line

Enbridge seems to be progressing and is looking to expand its presence. The company announced that it closed Moda Midstream Operating LLC's US$ 3 billion acquisition deal.

Meanwhile, Enbridge said that it would spend US$ 0.4 billion for the Texas Eastern Phase II Modernization program as it looks to upgrade the facility for lowering emissions.

The company has reaffirmed its financial guidance for 2022 and said that it would achieve an adjusted EBITDA between C$ 15 to C$ 15.6 billion and DCF per share between C$ 5.2-C$ 5.5.

The company expects its growth to be driven by an anticipated increase in mainline volumes. Enbridge expects that mainline volumes could average 2.95 million barrels per day.

Also Read: Is Inplay Oil (IPO) the next big energy stock for Canadian investors?