Highlights

- The US dollar has gained 1.31 per cent in three days

- During the same period, the S&P/TSX Composite Index Metals & Mining (Industry) has lost 10.33 per cent

- All the below companies’ stocks have gained on a year-to-date basis

The US dollar has gained 1.31 per cent in three days. During the same period, the S&P/TSX Composite Index Metals & Mining (Industry) has lost 10.33 per cent.

Some experts say a strengthening US dollar can sometimes trigger profit booking among metal and mining stocks. Generally, commodity prices are thought to weaken against a rising US dollar.

Considering this, let’s look at some TSX metal and mining stocks that may make for an interesting watch.

Franco-Nevada Corporation (TSX:FNV)

A majority of Franco-Nevada’s revenue comes from platinum, gold and silver. Its stock closed Monday, April 26, at C$198.04, having fallen 1.9 per cent.

The stock has risen 11 per cent over the past 12 months and 13 per cent in 2022. Its gain over the last three months is 21 per cent.

FNV has an earnings per share (EPS) of 4.83. Its dividend yield stood at 0.824 per cent.

Agnico Eagle Mines Limited (TSX:AEM)

The gold miner’s stock closed Monday at C$73.14.

On January 28, it hit a 12-month low of C$58.02. It has risen nearly nine per cent this year largely stemming from a 15 per cent rise in the last three months.

AEM’s price-to-earning ratio is 27.2 while its dividend yield is 2.786 per cent.

Also read: Earth Day 2022: 5 lesser-known Canadian renewable energy stocks to eye

Wheaton Precious Metals Corp (TSX:WPM)

The precious metal streaming firm’s stock saw a closing price of C$59.28 on Monday. It is up 11 per cent in a year and nine per cent year-to-date (YTD).

On April 18, it reached a one-year high of C$65.45. WPM’s price-to-earning ratio is 29.1 and its dividend yield 1.291 per cent.

Also read: PAT, ABST, OTEX, BB & DSY: 5 Canadian cybersecurity stocks to consider

First Quantum Minerals Ltd (TSX:FM)

The company deals with an array of minerals and its stock ended Monday at C$35.37.

The stock has soared 28 per cent in a year. On a YTD basis, it has gained about 17 per cent. It has lost 22 per cent from its 52-week high of C$45.38 posted on April 4.

FM’s price-to-earning ratio is 23.5. It pays a semi-annual dividend, and its dividend yield is 0.028 per cent.

Also read: TD, BNS, BMO, CM & NA: 5 TSX bank stocks if large rate hikes worry you

Ivanhoe’s stock closed Monday at C$10.61. Up 21 per cent on a yearly basis, it is in the green by about three per cent this year.

IVN has a price-to-earning ratio of 204.

Image source: © 2022 Kalkine Media®

Also read: Can these 5 TSX oil & gas stocks see high returns in May?

Bottom line

The S&P/TSX Composite Index Metals & Mining (Industry) has gained 16.28 per cent this year. By comparison, the TSX Composite Index has lost one per cent YTD.

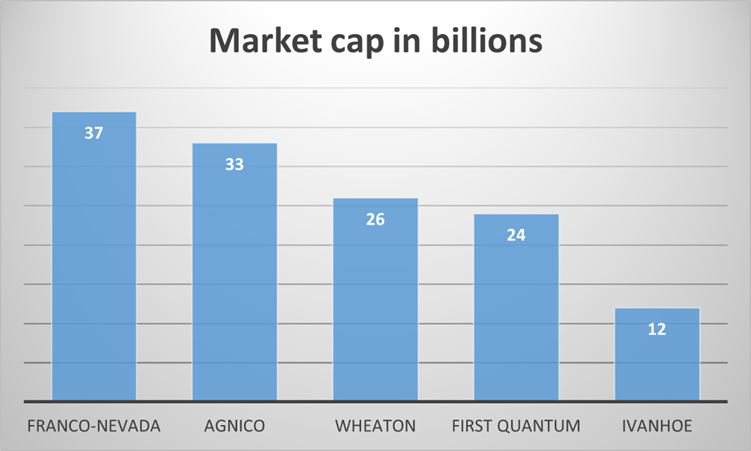

Materials is the third biggest sector of the benchmark index, currently accounting for 13.11 per cent of it. These companies are among the biggest in the sector, going by market cap.

While they have all gained, a strengthening dollar may trigger profit booking and so these stocks make for an interesting watch.

Also read: How does current inflation compare to 1970s stagflation?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.