Highlights

- The Toronto-Dominion Bank (TSX:TD) and the Royal Bank of Canada (TSX:RY) are creating a buzz in the Canadian stock market.

- The Canadian bank sector is running hot as the Bank of Canada is under pressure to hike its benchmark interest rate due to inflationary pressure and rising home prices.

- Following a new development, the TD stock hit a new 52-week high of C$ 104.17 during trade Monday and closed at C$ 104.17 apiece.

The Toronto-Dominion Bank (TSX:TD) and the Royal Bank of Canada (TSX:RY) are creating a buzz in the Canadian stock market. The Canadian bank sector is running hot as the Bank of Canada is under pressure to hike its benchmark interest rate due to inflationary pressure and rising home prices.

Let us look at the two big banks in Canada that have outperformed the TSX benchmark index in the past year and find out why they are trending.

Royal Bank of Canada (TSX:RY)

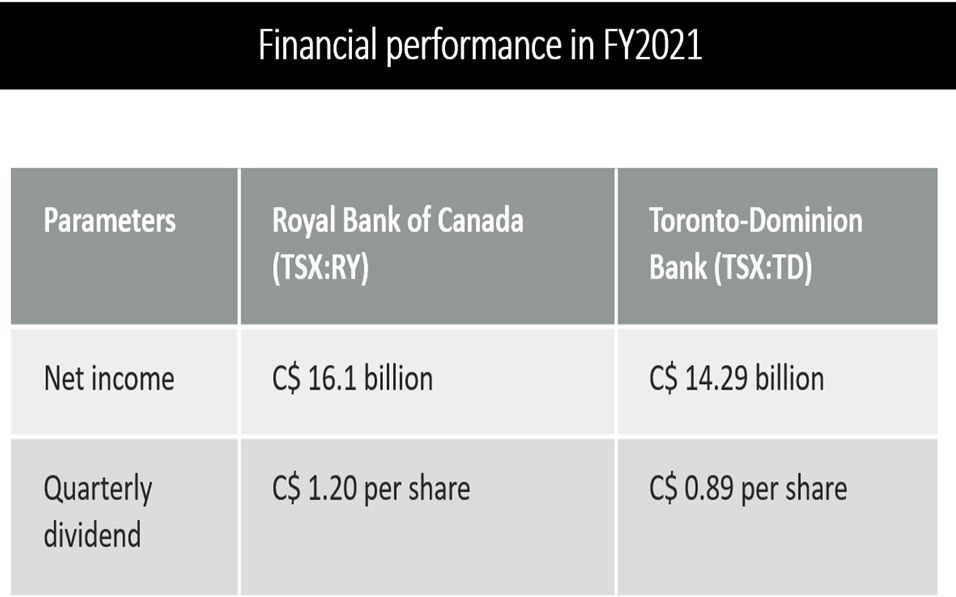

The Royal Bank of Canada, which presently has a return on equity (ROE) of 18.90 per cent, increased its net income by 40 per cent year-over-year (YoY) to C$ 16.1 billion by the end of the fiscal year 2021.

The C$ 212 billion market cap bank will deliver a quarterly dividend of C$ 1.20 apiece on February 24. The bank scrip swelled by roughly 38 per cent over the past one year.

Stocks of Royal Bank of Canada clocked a new 52-week high of C$ 149.595 during the trading session and closed at C$ 149.15 apiece on Monday, January 17.

This surge came as RBC Global Asset Management, its asset management division, announced the cash distribution to unitholders of its ETFs as of January 24, payable on January 31.

Also read: 2 TSX stocks that returned over 100% in a year

Toronto-Dominion Bank (TSX:TD)

The Toronto-Dominion Bank, which currently has a price-to-earnings (P/E) ratio of 13.30, earned net income of over C$ 14.29 billion in the FY 2021, up from C$ 11.89 million in the fiscal2020.

Image source: ©2022 Kalkine Media®

The bank is scheduled for a quarterly dividend of C$ 0.89 apiece, payable on January 31, up from t C$ 0.79 paid on October 31, 2021.

As people are increasingly shifting to online mobile trading, Toronto-Dominion, on January 17, launched TD Easy TradeTM, its mobile application for a streamlined and simplified stock trading experience.

Following this new development, the TD stock hit a new 52-week high of C$ 104.17 during the session and closed at C$ 104.17 apiece on Monday. Stocks of Toronto-Dominion Bank jumped by about 38 per cent in the last one year.

Bottom line

Some investors see bank stocks as reliable investment options that might withstand Omicron’s impact. Also, regular dividend pay-outs, including steady dividend growth, can be an additional factor that many investors look for while investing.

Also read: Enbridge (TSX:ENB) & Vermilion (TSX:VET): 2 oil & gas stocks to watch