Adding dividend stocks to your investment portfolio is one of the best ways to diversify it. This move can increase the value of your investments and protect you from adverse market movements.

Investing in dividend stocks is often advised because it gives you the benefit of passive income and increases the chances of reaping long-term benefits, especially if the value of the stock rises over time. If you are an investor with a low-risk appetite, you could explore dividend stocks as they are generally considered to be in a 'safe' territory by market experts.

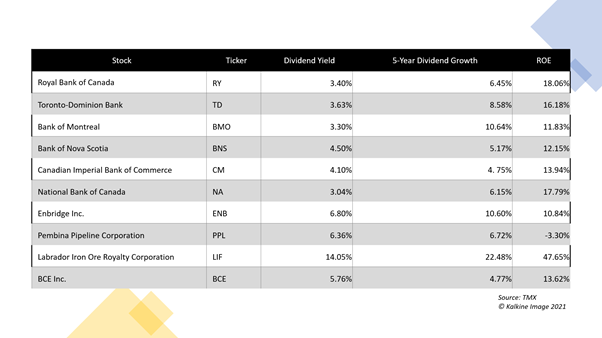

On that note, here's a close look at 10 of the top dividend stocks listed on the TSX, starting with the top six Canadian banks.

- Royal Bank of Canada (TSX:RY)

In terms of market capitalization, Royal Bank of Canada is counted as the largest lender in the country. RBC offers a return on equity (ROE) of 18.06 per cent and a return on assets (ROA) of 0.91 per cent, as per the data on the TMX.

As the biggest bank in the country, RBC has a diversified business model and provides various services to about 17 million clients in Canada, the US and at least 27 different countries.

The C$179.5-billion bank recently announced the launch of RBCx, a platform that seeks to assist entrepreneurs with capital solutions, innovative products, and services.

Royal Bank pays its shareholders C$ 1.08 per share as a quarterly dividend, which expanded by 5.18 per cent in the last three years. It currently offers a dividend yield of 3.4 per cent. RBC started paying dividends in 1987 at C$ 0.5 per unit.

In the second quarter of the fiscal year 2021 (Q2 FY21), RBC's net income catapulted by 171 per cent year-over-year (YoY) to C$ 4 billion. It’s provision for credit losses (PCL) in this quarter reduced to C$ 260 million, as compared to C$ 2,121 million in Q2 2020. Banks noted a substantial elevation in PCLs amid the COVID-19 pandemic last year, hampering their overall financial performance. This year, as the economy marches on its path to recovery from the pandemic lows, PCLs have dwindled significantly, helping banks record an improvement as well.

Due to an improved macroeconomic and credit quality outlook, the bank's diluted earnings per share (EPS) also improved to C$2.76 in the latest quarter compared to C$ 1 in Q2 FY20.

The lender’s net gains in cash flow hedges were C$ 669 million in Q1 FY21, compared to net losses of C$ 1.1 billion in the same comparable period last year. The bank can use the cash flow hedge to overcome an impact of a particular risk on the bank's cash flows.

- Toronto-Dominion Bank (TSX:TD)

Toronto-Dominion Bank comes right after RBC in terms of market cap in Canadian markets, presently standing at C$ 158.5 billion. In Q2 of fiscal 2021, TD bank posted a three-digit YoY increase in profit due to improved PCLs. Toronto Dominion also recorded a bottom line of C$ 3.7 billion in the latest quarter, reflecting an increase of 144 per cent increase YoY.

The lender posted adjusted diluted earnings per share of C$ 2.04 in Q2 FY21 compared to C$ 0.8 in Q2 FY20. Its revenues in the Canadian retail division ballooned to C$ 6.1 billion in the quarter.

Toronto Dominion, which is set to distribute a dividend of C$ 0.79 apiece in the third quarter this year, saw a dividend growth of 8.6 per cent in the last five years and that of 7.3 per cent in the last three years. It currently carries a dividend yield of 3.6 per cent and a price-to-earnings ratio of 11.3, as per the TMX data.

TD Bank started paying dividend at C$ 0.21 per share on June 19, 1987.

In Q2 FY21, TD's cash and interest-bearing deposits climbed to C$ 194.1 billion, up from C$ 170.6 billion in Q2 FY20. Interestingly, TD Bank's artificial intelligence (AI) digital customer support is becoming increasingly popular in the US. Its virtual assistant supported more than three million customers since its launch in April this year.

- Bank of Montreal (TSX:BMO)

Established in 1817, Bank of Montreal holds the record of being one of the oldest lenders in the country. BMO Financial Group provides diversified financial services across North America and reportedly serves more than 12 million customers via retail banking and wealth management services.

Committing to the country's ambitious plans to reduce greenhouse gas emissions (GHGs), BMO Capital Markets launched a dedicated Energy Transition Group earlier in June 2021. This group will aim to support clients in increasing the momentum of sustainable operations.

Copyright © 2021 Kalkine Media

Bank of Montreal current market cap is C$ 82.2 billion, and its debt-to-equity (D/E) ratio sits at 0.66, as per TMX. In its second-quarter 2021 results, BMO capitalized on the economic recovery and posted a net income of C$ 1.3 billion. It represents an increase of C$ 689 million year-over-year (YoY).

BMO, like its peers, posted a solid earnings in the latest quarter as its PCLs reduced to C$ 60 million, compared to C$ 1,118 million in the second quarter of fiscal 2020.

The bank noted that it would continue to distribute a quarterly dividend of C$ 1.06 per piece, which has grown 10.6 per cent in the last five years. On January 27, 1987, BMO paid a dividend of C$ 0.5 per share to its shareholders for the first time.

Maintaining a strong balance sheet, BMO ended the second fiscal quarter as it had a Common Equity Tier 1 ratio of 14.2 per cent.

- Bank of Nova Scotia (TSX:BNS)

Bank of Nova Scotia, commonly known as Scotiabank, is the third top lender in the country and holds a market cap of C$ 96.3 billion. It is said to serve some 10 million customers in Canada and 15 million global customers.

Scotiabank announced the results for its second fiscal quarter on June 1, in which it beat analysts' expectations and posted a net income of C$ 2.45 billion. Like the other top banks, this growth was triggered due to a remarkable drop in its PCLs, which stood at C$ 496 million in Q2 FY21 against C$ 1.8 billion in Q2 FY20.

With its diversified business platform, the bank saw its diluted earnings per share (EPS) climb 88 per cent YoY to C$ 1.88 in Q2 FY21. Its ROE also increased to 12.15 per cent in the latest quarter, up from eight per cent in the same quarter last year.

BNS stock carries a dividend yield of 4.5 per cent at present. Its shareholders will continue to receive a C$ 0.9 per share dividend in the third quarter of this fiscal year. Notably, the bank witnessed dividend growth at the rate of 3.8 per in the past three years. Scotiabank started paying a dividend of C$ 0.18 per unit in 1987.

In Q2 FY21, the total value of Scotiabank’s assets under management (AUM) increased to C$ 331.6 billion.

- Canadian Imperial Bank of Commerce (TSX:CM)

CIBC was founded in 1961 following an amalgamation of the Canadian Bank of Commerce and the Imperial Bank of Canada.

One of the 'Big Six' lenders in the country, the CIBC operates globally and has a client base of at least 10 million people, with an employee strength of over 45,000.

In Q2 FY21, the CIBC recorded a whopping 321 per cent YoY surge in its net income, amounting to C$ 1,651 million. Meanwhile, the bank's core segment of the personal and business banking division witnessed a 270 per cent YoY surge in the latest quarter.

From that of C$ 0.94 in Q2 FY20, CIBC's adjusted earnings per share (EPS) increased to C$ 3.59 in Q2 FY21. Its total revenues jumped to C$ 4.9 billion, while its PCLs dropped to C$ 32 million, down by 98 per cent YoY, in the latest quarter.

The lender stock currently offers a dividend yield of four per cent. It will continue to pay C$ 1.46 per piece as a quarterly dividend to its shareholders in the third quarter this year. CIBC paid a dividend of C$ 0.27 for the first time in March 1987. It recorded a dividend growth of 4.8 per cent in the last five years.

- National Bank of Canada (TSX:NA)

The sixth biggest lender in the country, National Bank of Canada has branches in almost every Canadian province and employs over 21,000 staff. NBC's market cap is C$ 30.9 billion, and it holds a price-to-book (P/B) ratio of 2.01, as per TMX.

In Q2 of fiscal 2021, the NBC posted a net income of C$ 801 million, up 111 per cent YoY. National Bank's total revenues jumped by 10 per cent YoY to C$ 2,238 million in Q2 FY21, while its diluted EPS climbed by 123 per cent YoY to C$ 2.25.

The value of the lender's total assets amounted to C$ 350.7 billion in Q2 FY21. On the dividend front, NBC will continue to pay C$ 0.71 apiece as a quarterly dividend in Q3 FY21, currently posting a dividend yield of three per cent.

NBC's dividend growth remained almost constant in the last three and five years, standing at 6.1 per cent and 6.2 per cent, respectively. The lender started paying a dividend of C$ 0.14 apiece in 1987, with dividend growth of 407 per cent to date.

Will these banks hike their dividends?

As per the rules set in place by the Office of the Superintendent of Financial Institutions (OSFI), the 'Big Six' banks of Canada could not change their dividends in the latest quarter.

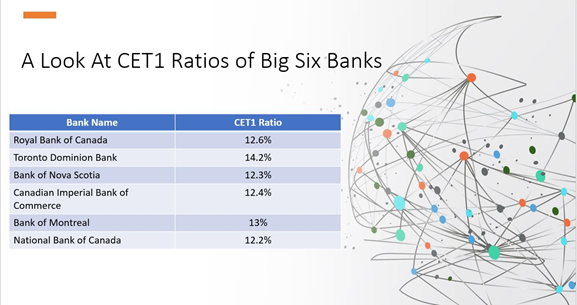

However, as of April 30 this year, all the top lenders reportedly have an excess common equity tier 1 (CET) capital - the fund banks have to set aside for use during a financial crisis.

According to the OSFI, the CET1 ratio currently sits at nine per cent after it was lowered from 10.25 per cent during the peak pandemic period last year. However, as the banks have now surpassed that mark and have excess capital, they are expected to either re-invest the funds or boost dividend payments and send the money to the shareholders.

Copyright © 2021 Kalkine Media

Since the dividends remained unchanged in the latest quarter, there are chances that the banks may increase it at some point this year.

Now that we are done with the major banks, let's explore the other top dividend stocks for the year.

- Enbridge Inc. (TSX:ENB)

Apart from being one of the top oil and gas producers in Canada, Enbridge is engaged in business activities in the US as well. Its pipeline network comprises the Canadian Mainline system and other regional oil and gas networks.

ENB stock, on the other hand, is one of the top dividend payers in Canada as its dividend grew at the rate of 10.6 per cent in the past five years. The stock pays C$ 0.835 every quarter and currently offers a yield of 6.8 per cent, as per TMX.

As the oil prices rebound from last year's pandemic lows, Enbridge's performance is also expected to improve.

In the first quarter of 2021, Enbridge's GAAP earnings were C$ 1.9 billion, as compared to a GAAP loss of C$ 1.4 billion in Q2 2020. In addition, the company said in its full-year guidance that it expects its adjusted EBITDA, which was C$ 3.7 billion in Q1 2021, to be about C$ 13.9 billion in 2021.

Enbridge's market cap is C$ 100.1 billion at the moment, and it offers an ROE of 10.8 per cent and a ROA of 3.8 per cent, as per TMX data.

On June 7, the energy company announced that it is selling its minority stake in oil producer Noverco Inc. for C$ 1.14 billion in cash. It plans to utilize this capital to repay its short-term debts.

ENB is a cash cow as it has a proven track record of dividend distribution irrespective of the economic cycles. The company generated predictable cash flows via its long term take or pay fee-based contracts, supporting its dividend distribution. Being a regular dividend-payer, Enbridge may hike its dividend at some point in 2021. However, this will depend on its performance in the remaining quarters of the year.

- Pembina Pipeline Corporation (TSX:PPL)

As Canada builds on its clean economy dream, Pembina Pipeline has joined hands with peer TC Energy Corporation (TSX:TRP) to develop a carbon transportation and sequestration system.

This project is set to be carried out in the western Canadian province of Alberta, and upon completion, the energy companies are expected to have the capacity to transport 20 million tons of carbon dioxide per year.

Pembina has been creating a buzz lately as it looks to acquire fellow oil distributor Inter Pipeline Ltd (TSX:IPL) in an all-stock deal worth C$ 8.3 billion. It is engaged in a bidding war with Brookfield Infrastructure Partners LP (TSX:BIP.UN) and has sought Alberta Securities Commission's intervention.

If the deal is finalized, Pembina will become one of Canada's largest companies, and its pro forma enterprise value will reportedly increase to C$ 53 billion. Pembina shareholders will also receive an increased dividend once the deal is closed.

Presently, the energy company offers a dividend yield of 6.4 per cent and distributes a monthly dividend of C$ 0.21 apiece. Pembina paid a dividend of C$ 0.078 per piece for the first time in August 2005.

In Q1 2021, Pembina's net revenues increased to C$ 999 million and its cash flow from operating activities increased to C$ 456 million.

The S&P/TSX Energy Index has soared by 48 per cent year-to-date (YTD) and about four per cent month-to-date (MTD). As the country bounces back from the pandemic and the demand for oil increases worldwide, energy companies are expected to grow along with it.

- Labrador Iron Ore Royalty Corporation (TSX:LIF)

Labrador Iron generates most of its revenues from its equity investments in the Iron Ore Company of Canada. The enterprise pays a quarterly dividend of C$ 1.75, which has grown at a notable rate of 22.4 per cent in the last five year and 26.2 per cent in the last three years. For the first time, Labrador distributed a dividend of C$ 0.25 on March 29, 2006.

LIF stock ranks among the top companies on the TSX for offering the highest dividend yields, which presently sits at 15.2 per cent.

Due to higher iron ore prices, Labrador Iron recorded an increased revenue of C$ 65.7 million in Q1 2021. Its net income rose to C$ 86.6 million in the same period.

According to the S&P Platts Global, iron ore prices will likely remain strong this year, which could impact LIF stocks in the coming months.

- BCE Inc. (TSX:BCE)

A well-known wireless and internet service provider in Canada, BCE Inc is also among the top three national carriers in the country. It nearly holds 30 per cent of the market size and serves about 10 million customers nationally.

On May 31 this year, BCE announced that its network acceleration plan would increase up to C$ 1.7 billion over the next two years. In the same month, the Canadian Radio-Television and Telecommunications Commission (CRTC) reversed its 2019 decision on wholesale Internet, which was considered a big win for top telecommunication companies like BCE.

With the wholesale rates of 2016 now in effect, BCE could see an increase in profits in the upcoming quarters, which, in turn, will impact shareholders.

BCE, at present, pays a quarterly dividend of C$ 0.875 apiece and currently carries a dividend yield of 5.7 per cent. Formerly known as Bell Canada, the telecommunications company pays a dividend to its shareholders since 1987.

In Q1 2021, BCE's free cash flow surged by 53.8 per cent YoY to C$ 940 million. Its cash flows from operating activities amounted to C$ 1,992 million in the latest quarter, up against C$ 1,451 million in Q1 2020.

The telecommunications company recorded a 1.2 per cent YoY increase in its revenues in the latest quarter, which amounted to C$ 5,706 million. Its adjusted EBITDA in Q1 2021 climbed by 0.5 per cent YoY to C$ 2,429 million.

The above constitutes a preliminary view, and any interest in stocks should be evaluated further from an investment point of view.