Summary

- Low-risk investors often seek out blue-chip companies as they are generally industry leaders and mostly distribute dividends.

- Royal Bank of Canada (RBC), the country’s largest bank by market capitalization, distributes a quarterly dividend of C$ 1.08.

- Bank of Montreal has a P/E ratio of 13.6 and an ROE of 10.34, reports TMX.

While the ultimate objective of every equity market investor is to score good gains from their investment, each of them has a different approach and risk profile. Low-risk investors often seek out blue-chip companies as they are generally industry leaders and mostly distribute dividends. With that in mind, here are some blue-chip dividend stocks to explore this year – Royal Bank of Canada (TSX:RY) and Bank of Montreal (TSX:BMO).

Royal Bank of Canada (TSX:RY)

Royal Bank of Canada (RBC), the country’s largest bank by market capitalization, distributes a quarterly dividend of C$ 1.08. In the last three years, it registered a dividend growth of 5.95 per cent.

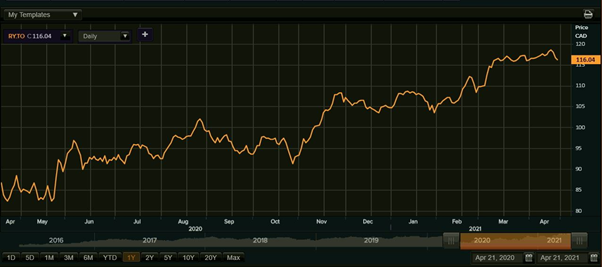

RBC stock's year-to-date (YTD) growth stands at about 13 per cent. In the last one year, the scrip has soared by roughly 58 per cent.

The bank's return on assets (ROA) is 0.71 per cent, while its return on equity (ROE) stands at 13.91 per cent on TMX data.

1-year chart of stock performance of Royal Bank of Canada (Source: Refinitiv/Thomson Reuters)

In Q1 2021, the bank's net income was up by 10 per cent year-over-year (YoY) C$ 3.8 billion. Its diluted earnings per shares, on the other hand, increased by 11 per cent YoY to C$ 2.66 in the latest quarter.

Bank of Montreal (TSX:BMO)

Bank of Montreal has a P/E ratio of 13.7 and an ROE of 10.61 per cent, reports TMX. The C$ 73.7-billion market cap company witnessed a three-year dividend growth of 10.55 per cent and presently distributes a dividend of C$ 1.06 on a quarterly basis.

BMO stock soared by about 18 per cent YTD. The scrip touched a new 52-week high of C$ 115.84 on April 12 and has since dwindled by about two per cent.

1-year chart of stock performance of Bank of Montreal (Source: Refinitiv/Thomson Reuters)

In the first quarter of fiscal 2021, BMO posted a revenue of C$ 6,975 million, up from C$ 6,747 million in Q1 2020. During the latest quarter, the net income rose by 27 per cent to C$ 2 billion.

The above constitutes a preliminary view and any interest in stocks should be evaluated further from investment point of view.