Highlights

- To become successful in stock trading, investors need to have a basic understanding about stocks, including all different types of stocks available in the stock exchanges.

- The financial sector, with nearly 32 per cent share, is the largest contributor to the Canadian benchmark index.

- Multiple factors can influence the different types of stocks in a different manner.

Stock markets can be a gateway to gain significant passive income and financial stability if you know well about stocks and how different market factors can influence their performance.

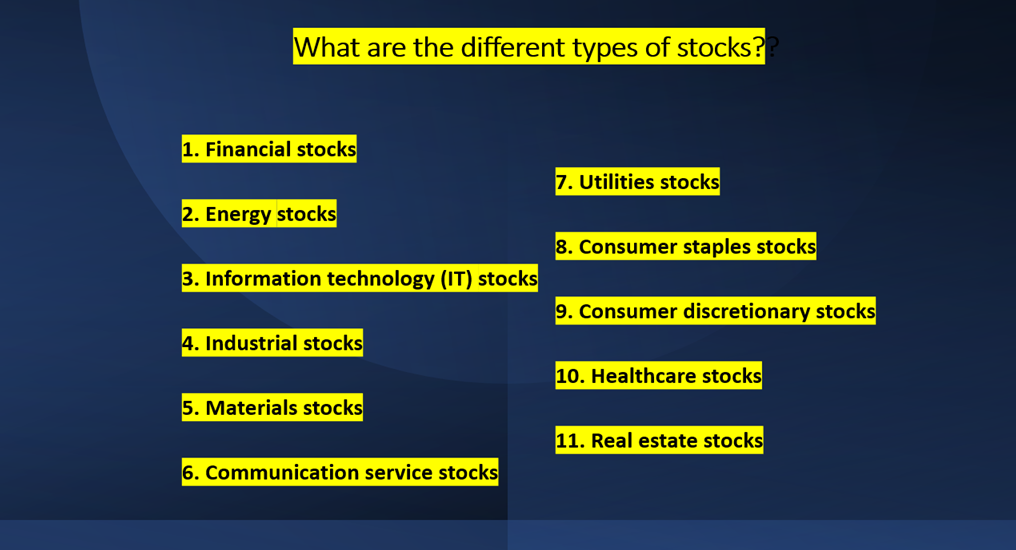

To become successful in stock trading, investors need to have a basic understanding about stocks, including the knowledge of all types of stocks available in the stock exchanges.

So, let us understand different types of stocks available in the Canadian markets.

Image source: © 2021 Kalkine Media®

- Financial stocks

The financial sector, with nearly 32 per cent share, is the largest contributor to the Canadian benchmark index. Royal Bank of Canada (TSX:RY) and fellow top lender Toronto-Dominion (TSX:TD) are among the primary constituents of the index.

The Canadian financial sector, apart from banks stocks, includes insurance, asset and wealth management, payment service providers and other financial service companies.

- Energy stocks

Canadian energy stocks like Enbridge Inc (TSX:ENB) and Canadian Natural Resource Limited (TSX:CNQ) are among the top constituents of the benchmark in term of market capitalization.

Suncor Energy Inc (TSX:SU) is another significant producer of oil and gas in Canada. Likewise, there are many energy companies engaged in the oil and gas.

The energy sector also includes emerging clean technology and renewable energy companies like the ones engaged in the production of electric vehicles.

Also read: Planning to invest? Here are few tips for women investors

- Information technology (IT) stocks

Information technology stocks constituents almost 12 per cent share in the benchmark index. Shopify Inc (TSX:SHOP) and Constellation Software Inc (TSX:CSU) are among the top technology companies around the country.

IT stocks include the companies developing and providing software solutions and services to people and corporate sector. From e-commerce to blockchain technology, tech sector is comprised of all kinds of tech players.

- Industrials stocks

Industrials stocks belong to the companies that manufacture and distributes machinery and supplies to major industries like transportation, defence, construction, and production houses.

Canadian National Railway Company (TSX:CNR) and Canadian Pacific Railway Limited (TSX:CP) are the two major industrial stocks that often makes headlines for their rivalry.

- Materials stocks

Material stocks relates to the companies engaged in production and marketing of commodities like precious metals, base metals, rare earth metals, food grains etc.

Canadian material sector is densely populated with multiple mining and agricultural companies like Barrick Gold Corporation (TSX:ABX) and Nutrien Ltd (TSX:NTR).

- Communication service stocks

These are the stocks of telecom operators, internet and media companies that keep people through their network infrastructure. Technological innovation in communication service industry is evolving the way in which information and data is shared worldwide.

BCE Inc (TSX:BCE) and TELUS Corporation (TSX:T) are some of the popular communication service stocks in Canada.

- Utilities stocks

These companies provide utility services like electricity, natural gas and water supply to individuals and organizations. These stocks are defensive in nature as demand for utilities remains steadier compared to other types of stocks.

Some familiar utility stocks in Canada include Power Corporation of Canada (TSX:POW) and Algonquin & Power Utilities Corp (TSX:AQN).

- Consumer staples stocks

Consumer staples includes essential products used by people in their daily routine like food and beverages, home, and hygiene products etc. As they are always in demand despite the market downturn or slowdown.

Maple Leaf Foods Inc (TSX:MFI) and North West Company (TSX:NWC) are the well-known consumer staples stocks in Canada.

- Consumer discretionary stocks

Consumer discretionary companies like Dollarama Inc (TSX:DOL) and Restaurant Brands International Inc (TSX:QSR), deals in goods and services that bought by consumers at their discretion. These goods and services do not classify as needs but depends on consumers’ desires.

- Healthcare stocks

The healthcare space is a broad sector, which includes pharmaceutical, cannabis, medical equipment manufacturing, tele-healthcare, and online medical service companies.

Health-conscious customers closely track the performance and invest in stocks like Hamilton Thorne Ltd (TSXV: HTL) and Aurora Cannabis Inc (TSX:ACB) are some Canadian healthcare stocks.

- Real estate stocks

Real estate business is traditionally considered as profitable as value invested in property generally tends to appreciate with time, considering accurate strategies are implemented.

Likewise, real estate stocks to companies that owns and manages all kind of real estate assets, including residential and commercial properties. Notable real estate stocks in the country include FirstService Corporation (TSX:FSV) and Colliers International Group Inc (TSX:CIGI).

Also read: Trading signals and indicators: what your trading toolbox must include

Bottom line

Multiple factors can influence the different types of stocks in a different manner. For instance, pandemic-induced lockdown adversely affected the restaurant stocks. On the other hand, it boosted the online sales for e-commerce companies, which positively impacted their stock performance.

Hence, investors should know different stocks where they can invest their money to capture profitable market opportunities.