Australia-based silica sand player, VRX Silica Limited (ASX:VRX) has recently released its quarterly report for the quarter ended 31st December 2019 on the ASX. The Company delivered a commendable performance during the quarter, finalising the Bankable Feasibility Study (BFS) of its high-grade Muchea Project, located 50km to the north of Perth in Western Australia (WA).

The Company published the details of Muchea Project’s BFS and maiden Probable Ore Reserve on 18th October 2019. This was the third BFS reported by the Company of its advanced silica sand projects, after Arrowsmith North and Arrowsmith Central.

Muchea Project has Outstanding Financial Metrics, Showed BFS

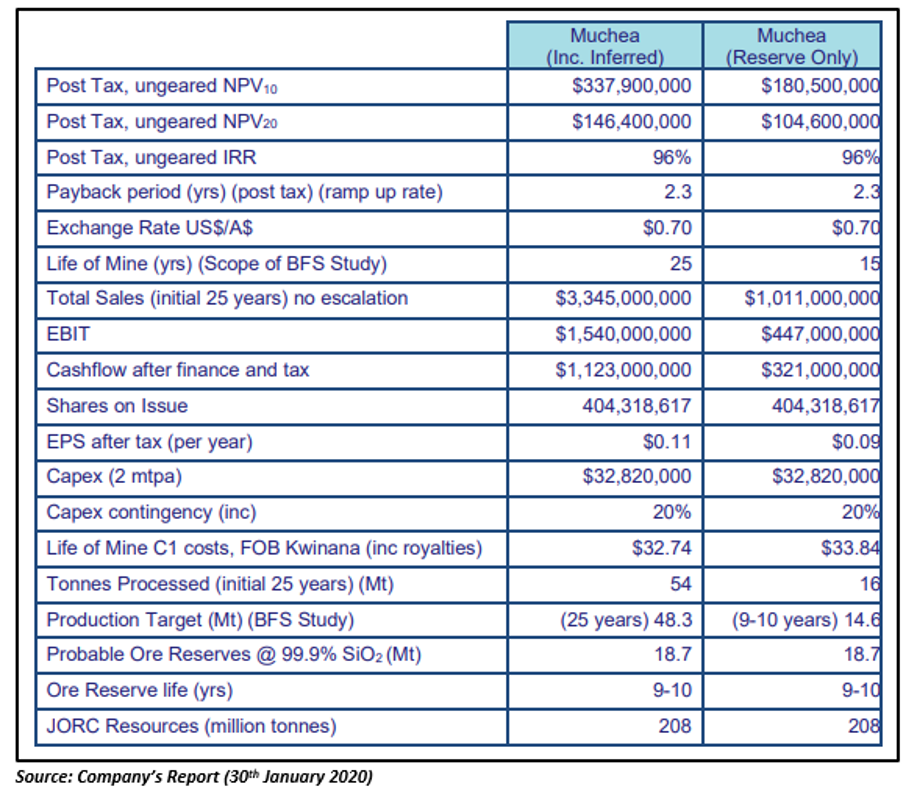

Let us first take a look at the key outcomes from the BFS below:

The BFS demonstrated that the Muchea Project has outstanding financial metrics, with an ungeared NPV10 of $338 million, calculated based on 25 years of a potential mine life of +100 years.

Moreover, the Probable Ore Reserve of 18.7 Mt @ 99.9% SiO2 was reported in accordance with the JORC Code, out of which 14.6Mt @ 99.9% SiO2 is contained within the Company’s Mining Lease application (M70/1390) area for Muchea.

The Company notified that mining from the area of the Probable Ore Reserve supports a 9-10 year mine life, and it intends to mine solely from this area during that period.

From year 10 onwards, the Company has planned to mine from the Inferred Mineral Resource of 61.4 Mt @ 99.6% SiO2 in the proposed mining area.

The BFS validated that the Muchea Project is a world class high-grade silica sand project that can support a significant export industry for WA, offering benefits to the State and the Muchea-Gingin district.

The Muchea Project is expected to produce alternative high-grade products to Arrowsmith projects and supplement the Company’s existing catalogue of products from its silica sand projects.

$4 Million Capital Raised in December 2019 Qtr

On 4th November 2019, the Company announced that it had successfully finalised a bookbuild to raise $4 million (before costs) via a placement of securities to a range of institutional and sophisticated investors, comprising existing shareholders and new investors.

The placement resulted in the issue of ~34.8 million new fully paid ordinary shares at an issue price of 11.5 cents each.

In addition, the Company planned to issue one free-attaching option for every two shares subscribed for in the placement, exercisable at 18 cents and expiring 18 months from their date of issue. About 6 million 2.8c options were exercised during the December quarter, notified the Company.

The Company raised the placement funds to fast-track the development of its advanced silica sand projects, including for:

- long lead capital items,

- hydro and resource drilling,

- permitting and approvals,

- detailed engineering work, and

- working capital purposes.

A general meeting of shareholders was held on 29th January 2020, seeking Listing Rule 7.4 ratification of the issue of the placement shares and Listing Rule 7.1 approval for the issue of the free-attaching options and options to the lead manager, Hartleys Limited.

All the resolutions were passed successfully following the conduct of a poll, and subsequently, the Company issued ~24 million options to subscribe for VRX shares at an issue price of 18 cents expiring on 31 July 2021.

As at 31st December 2019, VRX Silica’s cash balance stood at $3.8 million. The Company has estimated a total cash outflow of $570k for the March 2020 quarter, with $150k expected to be spent to exploration and evaluation activities.

Backed by decent financial position and strong management team, VRX Silica seems to be well-positioned to progress with the development of its high-quality silica sand projects. The Company has targeted to commence construction and production at its advanced silica sand projects by December 2021.

VRX closed the trading session at $0.099 on 5th February 2020.