Holding a more than decade experience as an oil & gas developer and operator, Triangle Energy (Global) Ltd (ASX:TEG) is targeting to expand its current operations in the highly prospective and underexplored Perth Basin.

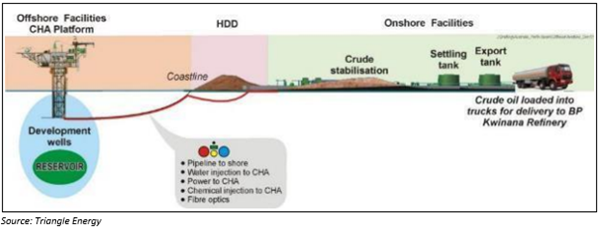

TEG owns a 78.75% interest in the flagship Cliff Head operations, which include onshore Arrowsmith Stabilisation Plant and offshore Alpha Platform. The Company also owns a 45% stake in the TP/15 (Xanadu) joint venture with Norwest Energy (25%) and 3C Group (30%) and a 50% participating interest in the L7 Mt Horner asset in the North Perth basin.

Additionally, TEG holds a significant 33.34% stake in State Gas Limited (ASX:GAS), which owns (100% stake) and operates the Reid’s Dome property, located in the Bowen Basin in Queensland.

The Company remains committed to expanding its portfolio through acquisitions or participating in joint ventures.

Crude Oil Desired Qualities

There are multiple desirable crude oil properties based on several criteria. However, the two major criteria are density and sulphur content, which largely impact the final product type and operating costs.

Sulphur Content

Crude oil has been classified on the basis of its sulphur content among sweet and sour crudes.

- Crude oil with less than 0.5% sulphur is considered as Sweet Crude Oil, as per the New York Mercantile Exchange.

- Oil with higher amounts of sulphur is considered as Sour Crude Oil.

Crude Oil with high sulphur content (Sour Crude Oil) requires additional desulfurization during refining to produce fuel products compliant to the regulatory norms, therefore escalating the refining expenses. Sweet Crude Oil is easier to refine with lower refining cost.

Density of the Crude (API Gravity)

Crude Oil is further classified into Light and Heavy Crude Oil, on the basis of the API gravity,

API gravity, as defined by the American Petroleum Institute (API), indicates the density of oil with respect to water.

API gravity is defined as-

API = (141.5/Specific Gravity) - 131.5

API gravity of 10 indicates oil with density equal to water. A greater than 10 API gravity means crude oil is lighter than water and lower than 10 is crude oil with density higher than water.

As per industry experts, crude oil is segregated among Light, Medium, Heavy and Extra Heavy Crude Oil-

- Light – API > 31.1

- Medium – API between 22.3 and 31.1

- Heavy – API < 22.3

- Extra Heavy – API < 10.0

A light crude oil contains smaller and high-value hydrocarbons with lower processing cost. In contrast, heavy crude oil contains long hydrocarbon chains requiring extensive refining to produce a higher proportion of heavier carbon chain products.

Light Sweet Crude Oil Production at Cliff Head

Cliff Head operations produce light sweet crude oil, which leads to a higher sales price for the crude oil produced. Sweet crude oil is produced with an API of ~330 (Light Crude Oil), which is then transported to the BP Kwinana refinery for refinement, leading to a Brent derived crude oil price earning for Triangle energy.

Cliff Head Aiming for Higher Economic Life

Cliff Head, coveted to be the first commercial oil operations of the Perth basin, includes probable prospects which are currently under evaluation to further expand the asset economic life beyond 2030. A final investment decision is awaited, upon which further development of the prospects around the cantilevered platform would commence.

Cliff Head Increases Oil Throughput

Triangle produces crude oil from 5 operating wells (3 horizontal and 2 directional oil wells) at a steady state production rate well above 1,000 bopd. The late-2019 resumption of production from the CH-13 well following the Electrical Submersible Pump (ESP) workover, led to ramping up of the production to the 1,000+ bopd level.

Triangle Energy’s Cliff Head Oil Field Exceeds 1,000bopd: Read Here

IMO 2020, as it is popularly known as, is the new stricter regulation, which caps the upper limit of the sulphur content in the marine fuel to 0.5% from January 2020. The amendment requires the creation of new fuel products, compliant to the new standards including VLSFO (very low sulphur fuel oil) and ULSFO (ultra-low sulphur fuel oil).

The refiners are restricted to the two following options-

- Investing in additional expensive desulphurization process and bearing higher operating costs

- Acquiring sweeter crude oil as feed for the products

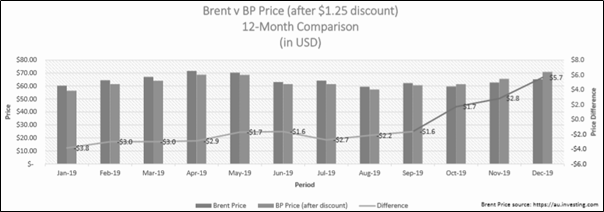

The announcement of the regulation led to the impulse buying hunt by refineries, with sweeter crude oil (low sulphur content) selling on premium as compared to the US sweet crude benchmark “Brent Crude” prices.

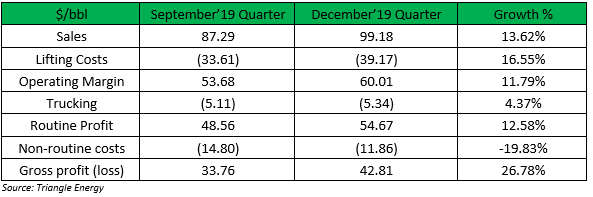

The Cliff Head operational results for the last quarter are as follows-

Revenue from the Cliff Head operations increased in the December 2019 quarter, primarily due to 2 factors-

- Higher crude oil production

- Higher realised crude oil price, backed by higher demand for sweet crude triggered by IMO 2020

Interesting Read: Triangle Energy Reports Excellent Quarterly Results; Sales and Production Reaches 73,663 Barrels

The light sweet crude oil is the most desired crude oil, and the surge in sweet crude oil demand led to a premium pricing of the light sweet crude oil against Brent Crude Oil prices from Triangle Energy’s Cliff Head operations.

Xanadu Crude Oil Analysis

It is essential to let the au courant audiences know that TP/15 confirmed similar crude oil discovery as Cliff Head operations, with the Xanadu-1 samples yielding an API of 34.7o with no Hydrogen Sulphide and extremely low levels of carbon dioxide.

Triangle Energy expects to expand the economic life and production at Cliff Head to over 4,000 bopd by 2021, and with development of Xanadu, the Company anticipates further revenue growth from high-quality light sweet crude oil delivery to the market.

On 25 February 2020, the TEG stock closed the day’s trade at $0.043, up 4.878% from its previous close, with a market cap of $14.79 million.