An experienced oil producer & explorer, Triangle Energy (Global) Limited (ASX: TEG) operates in the highly prospective and underexplored Perth Basin, focusing on strengthening its position in the basin.

Robust TEG Project Portfolio in Perth Basin

The Company owns and operates the flagship Cliff Head operations (78.75%), including an offshore platform (Cliff Head Alpha) and an onshore stabilisation plant (Arrowsmith). The Cliff Head operations produce light sweet crude oil from a total of 5 oil wells, operating at a capacity of over 1,000 bpd. The Company expects to further increase the production capacity and economic life of its flagship asset.

Triangle Energy’s Cliff Head Oil Field Exceeds 1,000bopd; Are the Share Prices Justified? Read Here

Triangle owns a 45% stake in a joint venture with Norwest Energy NL (25%) and 3C Group (30%) for the TP/15 Xanadu prospect. In October 2019, TEG also announced the completion of a farm-out agreement for the acquisition of a 50% stake in the L7 Mt Horner asset.

State Gas Limited - Reid’s Dome Gas Project Owner

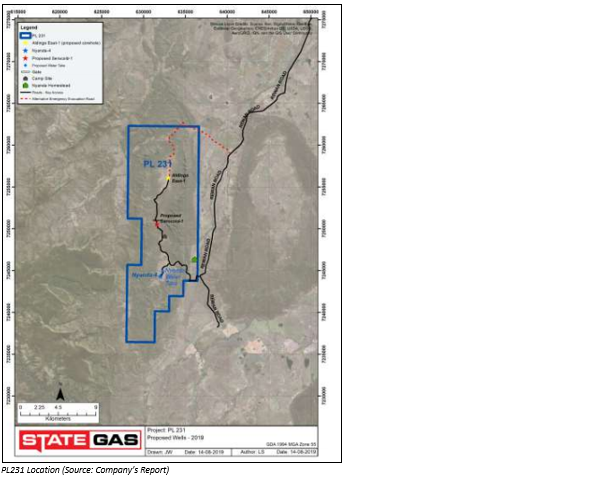

TEG also holds a substantial 32.71% stake in State Gas Limited (ASX:GAS), a gas company which went public in 2017, raising $5.25 million. State Gas wholly owns and operates the Reid’s Dome Gas Project in PL 231, in central eastern Queensland, the Denison Trough, about 50km from Rolleston.

Mr Rob Towner, Managing Director and CEO of the parent Triangle Energy, sits on the Board of State Gas as a Non-Executive Director, facilitating and advising the investment to achieve its target of commercial production.

Located less than 50km from the Queensland high pressure gas pipeline network, the petroleum licence (PL 231) hosts both conventional and non-conventional gas in the Bowen Basin.

State Gas drilled the first coal seam gas (CSG) well into the Reid’s Dome Beds and created the potential for a substantial CSG project in the licence, during late-2018. By the end of 2018, a Pipeline Survey Licence 2028 was issued to State Gas to evaluate the possibility of a pipeline route to market. The Reid’s Dome beds were not explored for CSG until the December 2019 quarter.

The Go to Market Strategy for Target 2021 – Meeting East Coast Shortfalls

Recently, State Gas adopted the “Target 2021”, a strategy to bring gas from PL231 to the market, as early as 2021. If State Gas makes to the market in 2021, it would help the project to benefit from the anticipated shortfalls in the east coast domestic gas market.

A phased appraisal program in parallel to the permitting for an export pipeline and development facilities have been planned to further fast track the commercialisation of the gas project.

With the established potential for the substantial CSG project in PL 231, State Gas has been progressing on different gas wells.

Nyanda-4 CSG Well

State Gas commenced production testing at the Nyanda-4 CSG well by late-December 2019. Gas flows are being monitored and recorded at 227 mscf/d after six weeks of dewatering. Also, water production from the well has been on the lower range, which in combination with gas flow rate, makes a strong case for the commercialisation of the Nyanda-4 well.

Aldinga East-1A Well

The well was drilled in October 2019; however, production testing is yet to commence. A pressure build-up has been observed at the wellhead and the well would be continued to be monitored. Further testing of the well may be expected in the upcoming months.

Serocoid-1 Well

Testwork at the Serocoid-1 well commenced in January 2020, with substantial indications of dewatering within a week of dewatering commencement. State Gas is confident about the potential of coal seam gas production from the well.

Triangle Energy Portfolio Growing with Positive Prospects

Achievement of “Target 2021” would be a significant milestone for both State Gas and Triangle Energy, which would lead to higher value generation upon the commencement of the gas to market project.

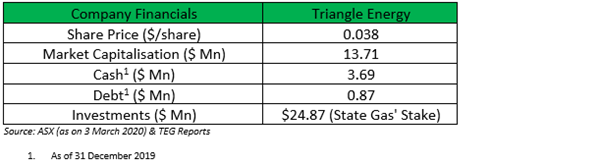

Triangle Energy last traded at $0.038 a share on 3 March 2020 with a market capitalisation of $13.71 million. TEG’s stake in State Gas is worth $24.87 million, considerably up from its market cap of $13.35 million.

To sum up: Triangle Energy holds an excellent portfolio of assets and investments with high potential for upside in the upcoming future.