Highlights

- Nearmap started the production of its groundbreaking aerial camera system in April

- From 2H18 to 1H22, the EBITDA of NXT has demonstrated a 36% Compound Annual Growth Rate (CAGR)

- For the nine months ended 31 March 2022, REA reported a 32% Year-on-Year (YoY) growth in revenue

The S&P/ASX All Technology Index (XTX) lists some of the most prominent technology firms spanning many sectors of Australia. The Index builds a new benchmark for technology companies.

The Index includes the following GICS categories:

Image source: © 2022 Kalkine Media®

Image source: © 2022 Kalkine Media®

On this backdrop, let us discuss three technology stocks from the ASX with good and stable revenue growth in last five years.

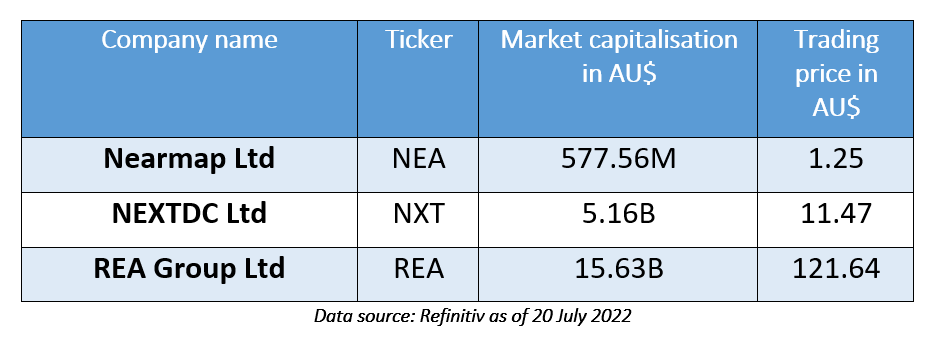

Nearmap Ltd (ASX:NEA)

Initially, a small online start-up, Nearmap, has grown since 2007 to become the next-generation digital content leader. The company offers integrated geospatial tools, city-scale 3D data sets and high-resolution aerial imagery. In April 2022, the company started the production of its groundbreaking aerial camera system. In the quarter ended 31 March 2022, the company delivered an annual contract value of US$2 million in North America.

The company has posted a growth of nearly 63% in its revenue in the past five years.

NEXTDC Ltd (ASX:NXT)

NEXTDC secures and protects physical IT infrastructures and interlinks with Australia’s most dependable national data centre network. It is one of Australia’s top data centres and interconnection solutions providers.

Focal points from the half-yearly report of the company are as follows:

- 19% growth in data centre services revenue

- 29% increment in underlying Earnings Before Interest Taxes and Amortisation (EBITA).

- A 14% surge in contracted utilisation

From 2H18 to 1H22, its EBITDA demonstrated a 36% Compound Annual Growth Rate (CAGR). During the same period, the company’s number of customers grew 16%, and the number of interconnections grew 19%.

Revenue of NXT has increased more than 62% in the last five years.

REA Group Ltd (ASX:REA)

REA Group is leveraging technology as well as global knowledge to offer an innovative range of products and services across Asia, Australia, and North America. It is a digital business company employing over 3,000 people and has more than 16 brands in its network.

Following are the results of the company for the nine months ended 31 March 2022

- 32% Year-on-Year (YoY) growth in revenue

- 29% YoY growth in Operating EBITDA

In the last five years, REA revenue has surged over 21%.