Summary

- COVID-19 pandemic has increased digital dependency for all like never before.

- With majority of people working from home, the HR role becomes more significant in managing workforce remotely through digital tools.

- Xref delivered a solid sales result, launched new integrations and introduced new clients during June quarter, despite turbulent and disrupted market conditions.

- CV Check's sales rebounded in June and July after dampened orders in April and May. CV1 emerged stronger, leaner and well positioned from the turbulent June quarter.

COVID-19 pandemic has been a transformative period for all, teaching everyone to keep going despite unprecedented challenges and to be prepared for any such crisis in the future. At this stage, there is no clarity on how long this pandemic will continue, when a vaccine or any other effective treatment will be developed or how effective will be the new remedies.

The coronavirus crisis has led to fundamental changes in the ways we did everything before this period. Everything has changed from how we socialise, educate ourselves and work. For all these activities, we are dependent on digital tools like never before. Technology has been the saviour during this crisis. Also, it has been the period of more advancement in the technology sector, so that we can be better equipped for any such disaster in the time to come.

Good Read: What Could Be the New Technology Trends Post-COVID-19?

When most of the people are working from home now, the role of HR becomes ever so important. However, the rapid adaptation to digitalisation is required to manage the remote workforce. It is the time to restart in a new way, re-think and re-examine the solutions. That said, other than challenges, it is also an opportunity to experiment with how we work while ensuring that people remain empowered and motivated at home.

In this light, let us discuss two HR tech stocks - XF1 and CV1.

Xref Achieved Strong Sales During COVID 19

HR technology company, Xref Limited (ASX:XF1) empowers recruitment decisions and removes distractions of manual processes. The company has offices in Australia, United States, Canada, Norway, New Zealand, and the United Kingdom.

Its quarterly update for the period ended 30 June 2020 released in early July 2020 highlighted strong sales despite the pandemic challenges and disrupted business environment. The company reported sales of its Xref credits at AUD 2.7 million in Q4, down by only 25 per cent and the second highest sales quarter to date for Xref.

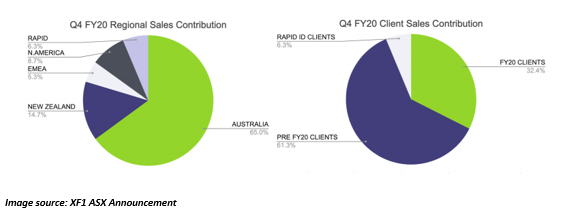

Of the total credits sold, new client sales accounted for 14 per cent, while 14 per cent came from the company’s international offices in Europe and North America, and 63 per cent were from clients deemed essential services during the crisis.

Cash receipts stood at AUD 2.4 million and credit usage was noted at AUD 1.7 million for Q4, only 18 per cent down from the same period a year ago. All these are unaudited results.

COVID 19 has skyrocketed the global demand for remote working, and now employers are looking for better solutions for candidate verification. Xref is focussed on capturing the growing demand. The company continued introducing new integration partnerships during Q4, and integrations with LinkedIn Talent Hub, Greenhouse, PageUp, and next stage of the CVCheck partnership have been rolled out.

Also read: Three tech stocks to watch out for: XF1, ADA, MOB

During the reported period, XF1 onboarded new clients - Zip Co, Frucor Suntory, NSW Public Service Commission and Laureate International Universities in Australia. Land Information New Zealand, The Norwegian Tax Administration and The Telegraph Media Group in the United Kingdom were also added to the new client list.

Executive Director / CEO Lee-Martin Seymour stated that the business is well-positioned, and the company’s people, product and brand are the most reliable in the world. During the pandemic, XF1 worked through both the national and global crisis, and focused on growing sales and reducing costs. Mr Seymour highlighted that the company has a robust growth strategy for FY21, with excellent opportunities in front of Xref.

At the end of July 2020, the company also entered a new four-year secured AUD 5 million debt facility with PURE Asset Management Pty Ltd. The funding will further support and accelerate its growth strategies, while providing additional working capital.

On 7 August 2020, XF1 settled at AUD 0.140, moving upward by 3.704 per cent from its previous close. The company has a market cap of AUD 24.4 million.

Good Read: Advantages of working from home for businesses, employees, and employers

Resilient Revenue, Strong Broad-Based Recovery for CV Check in June/July

CV Check Limited (ASX: CV1) provides a range of screening and verification products to industry associations, employers and individuals through the CVCheck brand.

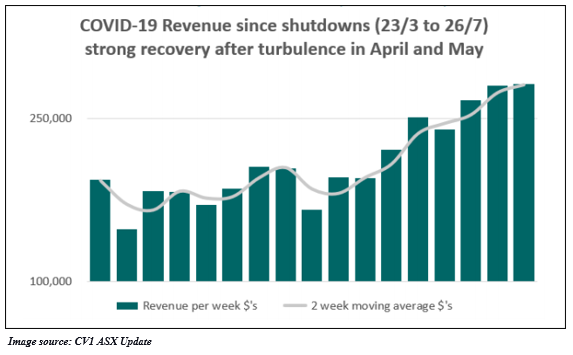

The COVID-19 crisis resulted in dampened orders during April and May; however, CV1 strongly rebounded in June and July. In June, its revenue recovered strongly, only 7 per cent lower than the same period a year ago. Revenue for the June quarter stood at AUD 2.4 million, down 23 per cent year-on-year, with sales coming from B2B and B2C customers noted at AUD 1.7 million and AUD 0.7 million, respectively.

New client wins accelerated through June and July, and the company emerged from the turbulent quarter stronger, leaner and well positioned, as the recovery appears to gain momentum.

During the June quarter, first orders were booked from new clients included Tassal Group Ltd, Summerset Group Holdings Ltd, Flybuys, Grill’d, The Nudge Group, Zip Co and Northpower. The company also completed its phase 2 integration with Xref and new integration with Livehire.

Despite cash receipts dropped to AUD 2.5 million, CV1 cash burn stood at just AUD 0.2 million in Q4, thanks to cost-saving measures and some benefit from government aid. The company reported a decrease of AUD 929k of net staff-related cash outflows and AUD 232k of benefit from government packages. Cash balance was AUD 4.6 million at the end of the June quarter with no external borrowings.

Also read: CVCheck’s Best-of-Breed Background Screening Solution Available Via Livehire; Xref Phase 2 Live

FY20 revenue from customers stood at AUD 12.4 million, in line with FY19, and booked Annual Recurring Revenue (ARR) grew to AUD 9.6 million for the 12 months ended 30 June 2020.

On 7 August 2020, CV1 closed the day’s trade downward by 3.333 per cent to settle at AUD 0.087, with a market cap of AUD 26.3 million.

Good Read: COVID Diary: Strategies that helped these 100 Companies create History