Summary

- Australian east coast focused gas company, Real Energy Corporation has executed a term sheet to sell its non-core interest in ATP1194 located in the Cooper Basin to Venator 1194 Pty Ltd.

- The strategic step may rationalise the Company’s Cooper Basin acreage to its preferred area of interest and direct greater investment to Project Venus.

- Concurrently, Real Energy is pursuing several initiatives through its 100% owned Pure Hydrogen Corporation. MD Scott Brown affirmed that the Company has a great deal of optionality across the asset base.

- Real Energy share price marked an uptick of over 5% on 9 September 2020 and traded at $ 0.02. The stock has delivered returns of over 26% in the past six months.

Real Energy Corporation Limited (ASX:RLE) leverages from a number of attractive prospects in Australia. The gas company has interests in the Cooper Basin, Australia’s most prolific onshore producing petroleum basin, and the Surat Basin in Queensland.

It has 100% ownership in two large permits, ATP 927 and ATP1194 in Queensland, besides a 50:50 joint venture with Strata X Energy Limited (ASX:SXA) to develop Project Venus (ATP2051 permit). Furthermore, Real Energy intends to develop a Hydrogen Project in Queensland.

ALSO READ: Real Energy’s Action-Packed June 2020 Quarter and Subsequent Compelling Merger

Recent attention has been graciously fetched by the Company’s wholly owned subsidiary Pure Hydrogen Corporation and the compelling proposed merger with Strata X to form Pure Energy.

On 9 September 2020, the Company aroused market attention yet again by highlighting its move to rationalise the Cooper Basin acreage and direct greater investment to the Project Venus. For these purposes, the Company has decided to sell ATP1194.

Term Sheet Executed for ATP1194 Sale

Real Energy has executed a term sheet with Venator 1194 Pty Ltd to sell its non-core interest in ATP1194. According to the term sheet, the sale will be for $ 225,000 in cash involving a non-refundable deposit of $ 25,000 and a royalty of 1.5% of gross sales.

However, the term sheet remains subject to few customary conditions. These comprise due diligence and government approval for transfer of the permit.

Real Energy has further notified that it continues to maintain interest in its main gas projects- the Windorah Gas Project and Project Venus.

Motive of ATP1194 Sale

Managing Director Scott Brown stated that the Company is pleased to be executing this term sheet. He cited the below reasons for the sale-

- The sale allows the Company to rationalise the Cooper Basin acreage to its preferred area of interest.

- Real Energy can now direct greater investment to the Project Venus in the Surat Basin, which reportedly holds a lot of near-term upside.

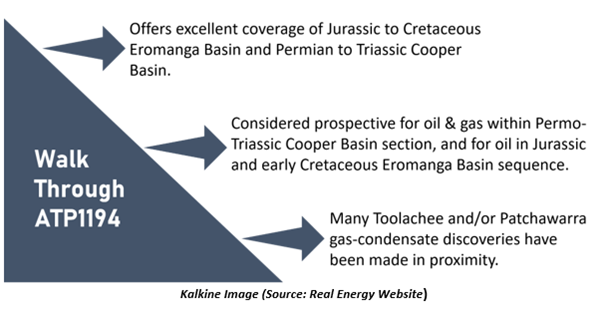

Acquainting with ATP1194

Queensland Oil Pty Limited, a wholly owned subsidiary of Real Energy, was appointed the preferred tenderer for the 2014 gazettal block 2014-1-4, now known as ATP 1194PA.

ATP 1194PA is located in the Cooper-Eromanga Basins of South West Queensland. It comprises 340 sub-blocks, covering an area of ~ 1,043 km2. The permit land has been relatively under-explored when compared to the adjacent areas to the south and west. However, two exploration wells have been drilled within the ATP 1194PA area (both of which were P&A).

Way Forward

Real Energy is pursuing a number of initiatives through Pure Hydrogen Corporation. Mr Brown stated that the Company has a great deal of optionality across the asset base. Besides, preliminary work on Project Venus continues.

In the coming days, the Company may release the Scheme Booklet for its merger with Strata-X, which is progressing to plan. Shareholders are likely to meet and approve the merger proposal in late October 2020.

To acquaint with the compelling merger, PLEASE READ: Compelling Combination! Pure Energy to Form Via Real Energy and Strata-X Energy Merger

RLE stock marked an uptick of over 5% on 9 September 2020 and traded at $ 0.02. The stock has delivered returns of over 26% in the past six months.