Summary

- Hydrogen market is expected to grow rapidly with increased hydrogen usage in transport, particularly in buses, trucks and cars, and the power industry.

- Gas company, Real Energy aims to pursue opportunities in hydrogen energy with the establishment of Pure Energy, positioned to be the next ASX energy growth stock- via merger with Strata-X Energy.

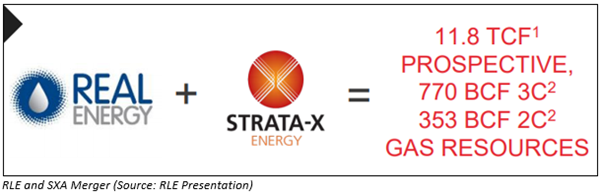

- The merged entity represents a compelling opportunity to create a material gas business with significant holdings in the Surat and Cooper Basins. It will have 11.8 TCF of prospective gas resource in three 100% owned projects.

- In the next 12 months, Pure Energy is likely to test completion methods targeting commercial gas flow rates, using innovative well completion and non-frack reservoir enhancement methods designed to prove commercial gas flows.

Australian east coast focused gas company, Real Energy Limited (ASX:RLE) has acknowledged that hydrogen economy is a vital concept for contemporary energy companies, and that zero emissions hydrogen is the future of transportation fuels. Moreover, the Federal Government’s commitment to this sector underpins Real Energy’s belief that there is enormous potential to develop a hydrogen industry in Australia.

Subsequently, RLE plans to merge with Queensland-based Strata-X Energy (ASX:SXA) to form Pure Energy- with the vision of low emissions hydrogen transition to renewables.

On 21 July 2020, Real Energy and Strata-X Energy hosted a joint webinar focused on the plans for combining their companies into Pure Energy Corporation Limited.

Merger of Equals

A merger of equals, Real Energy and Strata-X Energy, is likely to establish an extremely high potential and well-diversified gas portfolio. Pure Energy represents a compelling opportunity to create a material gas business with significant holdings in the Surat and Cooper Basins, Queensland. Moreover, it will hold 100% of Project Venus and gain from significant upside potential that this exciting project offers.

Besides these, Pure Energy is likely to leverage from a broader asset portfolio in Australia and Botswana. Pure Energy will have a total 11.8 TCF of Prospective Gas Resources, 770 BCF of 3C and 353 BCF of 2C Contingent Gas Resources.

The merger would result in larger market cap with lower emissions hydrogen initiatives, with other advantages including the removal of duplicate administrative functions and listing costs. Moreover, the combined skill sets of successful industry veterans is a great add on, as Pure’s Management has a profound history of creating and building growth companies- ~ $ 5 billion takeovers.

Pure Energy’s Diversified Gas Portfolio

Pure Energy’s gas resource projects offer significant growth potential-

100% Project Venus, Surat Basin CSG, Queensland

- 694 PJ prospective gas resource in proven Surat CSG fairway

- Over 10,000 CSG wells drilled on the CSG fairway

- Given the high gas saturations, optimum completion methods need to be determined to achieve commercial gas flow rates

- Once commercial gas flows achieved, systematic conversion of resources into saleable gas seems feasible

100% Windorah Gas Project, Cooper Basin

- 8.8 TCF basin-centered gas, certified 2C/3C gas resources of 330/770 BCF

- Resource estimates independently certified by DeGolyer & MacNaughton (Queenscliff area) & Aeon Petroleum Consultants (Tamarama area)

- Four gas wells drilled- Tamarama-1, 2 & 3 + Queenscliff-1, all gas discoveries

- Sufficient improvement in flow rates allows for early gas sales

100% Serowe CSG, Botswana (farmed out)

- 2.38 TCF Prospective Resource and 23 BCF 2C

- 100% of 1,475 sq km interpreted high-grade CSG

- 3rd party funded $ 7 million appraisal program to commence Sept/Oct 2020

- Targets predictable reserves growth

It should be noted that these gas projects have several things in common. For instance, wells drilled proving that gas resources are there including third party certifications, primary technical risk is finding completion methods to prove commercial gas flows, and all three projects have ready gas markets.

Pure Energy’s Hydrogen Initiatives

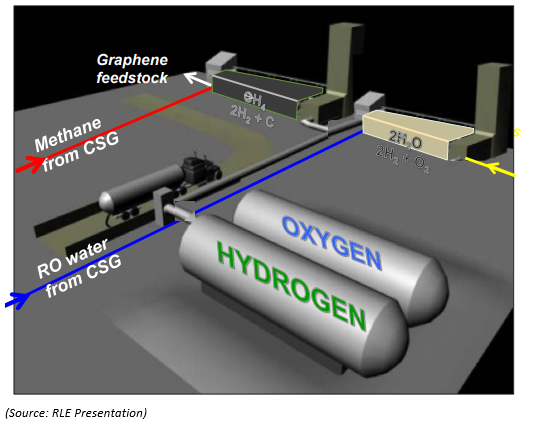

Aimed to fast track a hydrogen economy, Pure Hydrogen Corporation Pty Limited, a wholly owned subsidiary established by RLE in May, offers feasibility of Hydrogen Plant in Queensland, targeting 36 million kgs of Hydrogen per annum. Pure Gas, on the other hand, offers feasibility of value adding methane by conversion to hydrogen and carbon products.

The merged entity also plans to expedite the manufacturing of hydrogen from CSG wastewater and 11.8 TCF of uncommitted methane gas resource. An example of its planned ultra-low emissions hydrogen module is depicted below (module would be located within the Walloon CSG field Adjacent to a RO plant)-

Corporate Update

Post market close on 21 July 2020, RLE quoted $ 0.023 with a market cap of $ 8.12 million. In the past three-month period, the stock has delivered returns of 9.52%.

Real Energy opines that a nil premium merger holds significant benefits for all shareholders and has the goal to create the next ASX energy growth stock. With the huge resources in the three gas projects and the keys to unlock those resources, this goal seems achievable.

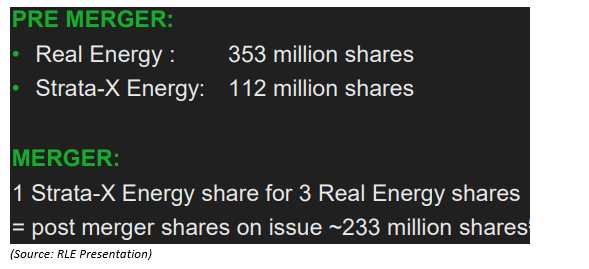

Below explains the merger scheme of arrangement:

FOR MORE INSIGHTS INTO THIS MERGER, PLEASE READ: Compelling Combination! Pure Energy to Form Via Real Energy and Strata-X Energy Merger

(Note: All currency in AUD unless specified otherwise)

_07_04_2025_07_17_24_352003.jpg)