Summary

- Invictus Energy proposed issue of Performance Rights to MD, Mr Scott Macmillan and Non-Executive Chairman, Dr Stuart Lake- to conserve cash reserves, create shareholder value and maintain qualified Board members in a competitive market.

- Other recent developments include a robust June 2020 Quarter, SG 4571 tenure extension and the EIA approval.

- Independent oil and gas exploration company, Invictus Energy Limited is focused on high impact energy resources in sub-Saharan Africa, and its asset portfolio comprises of a highly prospective 250k acres within the Cabora Bassa Basin.

- Having secured a first-mover advantage and a dominant acreage position in the Basin, Invictus plans low-cost, high-impact work program, with a farm-out process currently advancing.

Progressing its 80 % owned Cabora Bassa Project in northern Zimbabwe, Invictus Energy Limited (ASX:IVZ) is at an important stage of development with significant opportunities and challenges likely in the near and long-term. On 20 August 2020, Invictus made a prudent decision to propose the issue of performance rights to the revised remuneration package of its Managing Director, Mr Scott Macmillan and Non-Executive Chairman, Dr Stuart Lake.

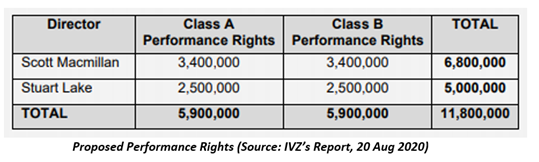

Invictus has proposed to issue up to a total of 11,800,000 Performance Rights to Directors Mr Scott Macmillan and Dr Stuart Lake, or their respective nominees, The issue of these Performance Rights forms a part of the revised remuneration package that has been agreed with both related parties.

ALSO READ: Invictus Marks Significant Milestones: EIA Approved by EMA, Zimbabwe Investment Licence Renewal

Issue of Performance Rights Subject to Shareholder Approval

The proposal, however, is subject to approval at a shareholders’ meeting. The Company intends to release a notice of meeting for the approval of the Performance Rights in due course.

According to Invictus, if the approval is not obtained, but milestones are satisfied such that a class of Performance Rights otherwise would have vested, both related parties will be entitled to receive a cash payment. The payment will be equivalent to the number of Performance Rights that would otherwise have been issued, multiplied by the closing price of shares on the day the relevant milestones are met. If the day is not a trading day, the trading day immediately before that day will be considered.

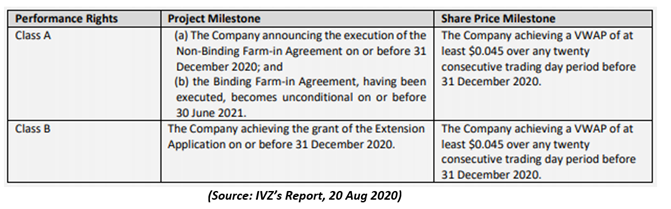

Below are certain project milestones and share price milestones, satisfaction of which will determine the issue of Performance Rights:

ALSO READ: Lens Through Invictus Energy’s Robust June 2020 Quarterly Activities Report

Additional Terms for Director Scott Macmillan

Invictus advised about few additional terms that apply to Director Scott Macmillan. It should be noted that these have been agreed as part of Mr Macmillan's remuneration package-

- If all Milestones in respect of the Class A Performance Rights are satisfied, Mr Macmillan will be entitled to receive a cash payment of $75,000

- If all Milestones in respect of the Class B Performance Rights are satisfied, Mr Macmillan will be entitled to receive a cash payment of $75,000

- Mr Macmillan will receive 10 % of total costs reimbursed to the Company for sunk and historical costs by a Reputable Partner, related to a Binding Farm-in Agreement or Non-Binding Farm-in Agreement up to a maximum of $250,000.

Significance of Invictus’ Performance Rights Proposal

The proposed issue aims to align the efforts of Company Directors and achieve growth of the share price. Subsequently, Invictus expects its “prudent means” to create shareholder value. Besides, incentivising Mr Scott Macmillan and Dr Stuart Lake with Performance Rights may help in conserving Invictus’ available cash reserves.

The Board also believes that offering these Performance Rights may support Invictus in continuing to attract and maintain highly experienced and qualified Board members in a competitive market.

GOOD READ: Invictus Energy: Lens through Strategies and Asset Overview

Market Opportunities and Way Ahead

Firstly, Zimbabwe President Emmerson Mnangagwa has been welcoming foreign investment after declaring that “Zimbabwe is open for business”, with particular attraction in the resources sector.

Secondly, South Africa is confronting a power crisis with lack of domestic energy security, which is having a negative effect on growth in the region and has propelled the urge to adopt gas as an alternative energy source to coal.

Thirdly, Cabora Bassa Project is located in the most prospective acreage in the Cabora Bassa Basin and includes the Mzarabani prospect. Fourthly, and this one is an additional attraction- Mr Scott Macmillan has extensive business experience in Zimbabwe.

Last but not the least, the Company has continued to advance developments at the Project during (and after) June quarter 2020.