Summary

- Invictus Energy’s early entry in Sub-Saharan Africa and supply-constrained local/ regional gas and liquids market provide pathway to monetise large gas volumes.

- While South Africa urgently seeks gas as energy transition stalls, Invictus aims to develop potential regional markets in addition to significant local natural gas demand in Zimbabwe.

- Invictus has tapped an elephant size potential in the Cabora Bassa Project in Mzarabani and Msasa prospects.

Generally, first movers/ explorers are known to secure the best acreage, best terms, and most profitable markets. If they secure all these in regions that face a deficit of particular resources and work towards balancing supply/demand dynamics- transformational success is likely.

In this backdrop, we introduce Invictus Energy Limited (ASX:IVZ) - an upstream E&P company focused on oil and gas in Sub Saharan Africa. It is the 80% owner and operator of the lucrative Cabora Bassa Project that comprises EL SG 4571 in the Cabora Bassa Basin, northern Zimbabwe.

The Company’s stock was up by over 4% by the close of trading on 16 July 2020, quoting $ 0.025. The surge in stock performance followed IVZ’s announcement that it is presenting at the Stockhead video conference “Oil & Gas – Buying the bounce”.

Let us cast an eye on the presentation highlights-

Exploration licence SG 4571

EL SG 4571 was granted in August 2017 for an initial 3-year period (renewable) with the first term of work program completed in August 2020. An updated PSC remains in negotiation with GoZ.

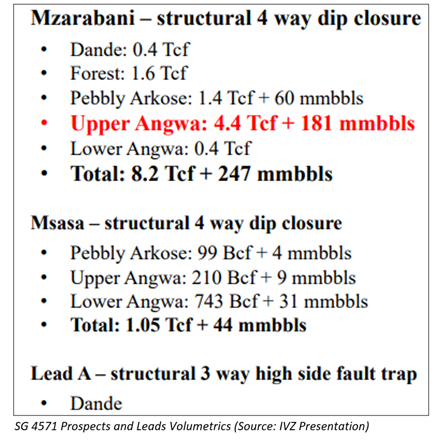

SG 4571 in Cabora Bassa covers 250k acres in most prospective part of the basin. It contains potentially the largest, seismically defined, undrilled structure onshore Africa, with 8.2 Tcf + 249 million bbls worth conventional gas-condensate in Mzarabani Prospect alone. Additional mapped potential provides running room on success, while Estimated well cost is USD 10 million (dry hole cost).

Significant $ 30 million dataset was acquired by Mobil during the 1990s with 2D seismic, gravity, aeromagnetic and geochemical data. However, data has been unavailable in the public domain after Mobil relinquishment.

The licence area has been independently assessed by Getech Group plc. New geological and geophysical work has de-risked the acreage - ingredients for working petroleum system present in the basin.

Invictus Energy’s Lucrative Stance in Cabora Bassa

While early entry into new plays can yield massive rewards, the Company leverages from the first-mover advantage.

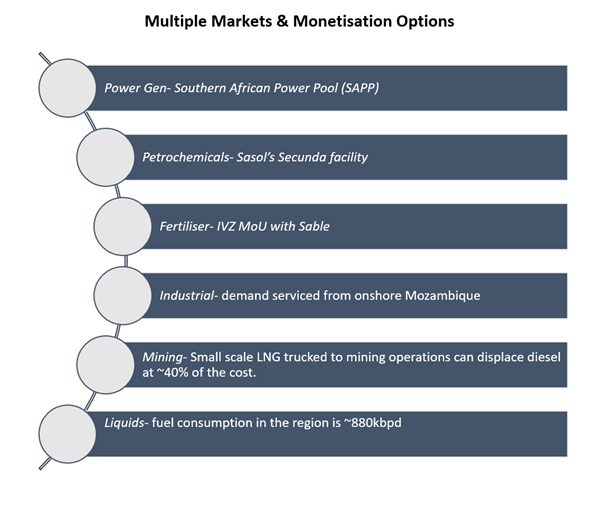

Firstly, IVZ has identified a giant scale potential within SG 4571 with multiple play types providing running room on success. Moreover, low-cost onshore exploration with proximity to infrastructure allows rapid monetisation of discoveries and eases risk vs reward.

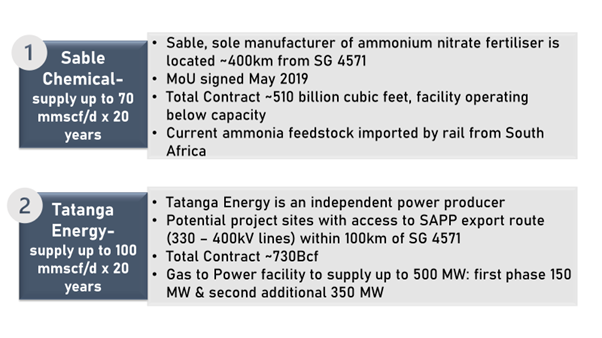

Secondly, the Company has secured significant gas sale MoUs to underpin development and monetisation of even a modest discovery-

Thirdly, the Company has strategically positioned itself in Zimbabwe to supply energy-starved domestic and regional markets, predominantly large South Africa market. It should be noted that Southern Africa is facing an energy crisis with growing shortages of electricity, hampering industry and investment.

Fourthly, Supportive government may propel developments. New Zimbabwe President Emmerson Mnangagwa has acknowledged that “Zimbabwe is open for business”. While investor-friendly economic reforms have been implemented and an experienced mining industry executive has been appointed as Minister of Mines, significant new investment activity in the region remains underway. A new PSA that provides transparent legal and fiscal framework is also nearing finalisation.

Southern Africa’s Energy Crisis

Majority of power in South Africa is coal and hydroelectric. The region is subjected to an energy crisis with its aging coal-fired power plants being retired. Consequently, gas to power has become progressively vital to regional power needs.

Reportedly, >10,000 MW of power supply (~20%) will be lost in the next few years. It is likely for short-medium term supply gap to be filled by diesel-fired power generation (equivalent fuel cost ~USD 27/GJ gas price).

- Decline in Pande-Temane that supplies 85% of South Africa’s Gas commences 2023.

- Depletion in Mossel Bay FA Complex that supplies 15% of South Africa’s Gas, is likely by December 2020.

A study further reveals that South Africa may face a significant gas deficit before 2030 due to lack of supply-

- Low Scenario Supply Deficit: 730 mmscf/d (268 PJ/year)

- Med Scenario Supply Deficit: 1,100 mmscf/d (407 PJ/year)

- High Scenario Supply Deficit: 2,000 mmscf/d (725 PJ/year)

Currently, IVZ seeks to develop potential regional markets in addition to substantial local natural gas demand in Zimbabwe. A farmout process is at advanced stages and would select partner to participate in high impact basin opening well.

(Note: All currencies in AUD unless specified otherwise)