Summary

- Bowen Coking Coal has been progressing activities across its exploration and development assets in the world-renowned Bowen Basin in Queensland.

- BCB looks forward to completing the transaction at Broadmeadow East Coking Coal project as early as possible.

- BCB is also keen to focussing its efforts towards getting the project area shovel ready at the earliest.

- At its Hillalong Project, BCB looks forward to releasing coal quality results from the recently completed drilling program, together with securing Sumitomo’s commitment to fund the second phase exploration program.

- BCB also plans to advance negotiations on Isaac River infrastructure access, along with the lodging of the Environmental Authority, which is anticipated to be finalized during the quarter.

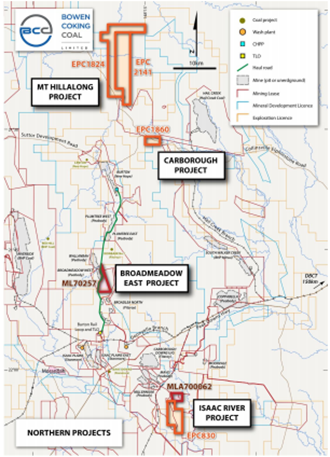

Coking coal exploration and development company, Bowen Coking Coal Limited (ASX:BCB) owns advanced exploration and development assets in the world-renowned Bowen Basin in Queensland, Australia and fully owns the Isaac River, Cooroorah, and Comet Ridge coking coal Projects. BCB (90%) is also joint venture partners with Sumitomo Corporation (10%) at the Hillalong Coking Coal Project and with Stanmore Coal Limited in the Lilyvale coking coal Project (15% interest) and Mackenzie coking coal Project (5% interest).

Regional Location of BCB's Projects (Source: ASX Announcement dated 30 July 2020)

Recently, BCB has been progressing activities across its projects for their advancement. Over the past few months, BCB has made significant progress, and the results indicate significant upside remains for the Company’s shareholders.

Let us look at BCB’s plan of action for future and ongoing activities across its portfolio.

More at: A Walk-Through Significant Projects of Bowen Coking Coal Limited

Transaction For ML 70257 To Wrap Up Soon

At the Broadmeadow East Coking Coal project (ML 70257), work is in progress regarding the completion of the transaction. This is anticipated to take around 3 – 6 months from the announcement of the transaction.

June Quarterly Report: Bowen Coking Coal Limited Plans Key Activities for Upcoming Quarter, Registers Significant Progress During June Quarter

The transaction pertains to the binding agreements with Peabody (Burton Coal) Pty Ltd to acquire the Broadmeadow East coking coal project located within undeveloped Mining Lease 70257. The transaction includes access rights to the following:

- New Lenton Joint Venture Coal Handling and Preparation Plant

- Train Load Out Facility,

These are connected by an established haul road passing immediately adjacent to ML 70257.

BCB is keen to wrap up the transaction quickly and subsequently focus all its efforts towards getting the project area shovel ready as soon as possible. The Company has the benefit of the presence of existing regional infrastructure, which means the project has a low capital intensity and short development timeframe.

BCB will immediately evaluate multiple mine operation options to determine the best value proposition. The option chosen shall assist the environmental impact assessments carried out by specialist environmental consultants to get the project shovel ready at the earliest possible time.

ML 70257 will have certain Environmental Authorisations, however, BCB has plans to apply for an Environmental Authority amendment when the project is de-amalgamated from the existing ML.

Post completion of the environmental impact assessments, BCB looks forward to lodging an application for a site-specific EA.

Interesting Read: A Walk-Through Bowen Coking Coal’s Progress at Hillalong Coking Coal Project, Exploration Programs Returned Significant Results

Moreover, with an aim to assist an optimal structure in exploiting financial value, BCB shall undertake coal washability optimisation of quality, yield, and final product specifications.

Advancing Discussions With Sumitomo To Finance Second Phase Exploration Program At Hillalong

At the Hillalong project (EPC 1824 & EPC 2141), BCB is currently progressing with coal quality and washability analysis after completing the exploration program, and the analysis is anticipated to be concluded in forthcoming weeks.

In addition to this, planning for Phase 2 exploration is in progress with a balanced focus on developing and increasing Hillalong North at the same time as exploring other areas within the project.

Notably, BCB has obtained environmental approval for the 2D seismic program at Hillalong South, which is anticipated to contribute to part of the Phase 2 exploration program design.

Other than this, BCB looks forward to obtaining Sumitomo’s commitment to provide an additional $5 million as part of the Phase 2 exploration program. If agreed, this additional funding will result in Sumitomo securing an additional 10% interest in the Hillalong Joint Venture, taking their total to 20%.

Environmental Authority at Isaac River to Conclude in Current Quarter

Another area of BCB’s focus is its Isaac River Coking Coal Project (MDL 444 & EPC 830), with key emphasis on permitting and access to infrastructure. BCB has completed studies at the project and is presently engaged in advancing additional negotiations on infrastructure access.

Moreover, BCB anticipates completing the lodging of the Environmental Authority during the ongoing September quarter, which follows the Mining Lease Application lodged last quarter.

Did you read: Bowen Coking Coal Limited’s Maiden Resource Estimate of 43Mt @ Hillalong North Highlights Extremely Positive Coking Properties

BCB’s business strategy is underpinned by an aggressive exploration and development program.

Did you read: Bowen Coking Coal Limited’s Stance in Changing Scenario for Global Coal Market

BCB held $2.4 million cash at the bank as at 30 June 2020, including $0.5m from the July Placement. Moreover, BCB received an additional $1.75 million of Placement funds on 3 July 2020. On 18 August 2020, BCB share price was settled at $0.051, with a market capitalisation of $44.14 million.