Summary

- Bowen Coking Coal has entered binding agreements for a new coking coal project within the Central Bowen Basin in Queensland.

- The transaction also provides access to required infrastructure, improving the prospects of a quick start to production.

- Bowen has also received binding commitments for a capital raise worth $2.25 million by issuing 45 million fully paid ordinary shares at a per share issue price of 5.0 cents per share.

Queensland based coking coal exploration and development company, Bowen Coking Coal Ltd (ASX:BCB), has executed binding agreements with Peabody (Burton Coal) Pty Ltd for the acquisition of the Broadmeadow East coking coal project, which is located within undeveloped Mining Lease 70257.

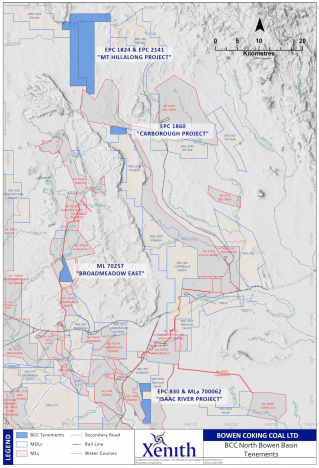

Regional Location of Broadmeadow East project (Source: Company's Report)

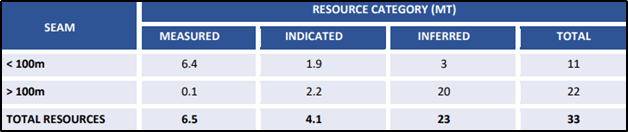

Xenith Mining Consultants, independent consultants for BCB, have issued a JORC compliant Resource Estimate of 33Mt at the project and has identified that Leichhardt seam of the Rangal Coal Measures contains the coal resources of the Project. Other findings include:

- Seam sub crops in the central part of the Mining Lease and generally dips at 8-10 degrees to the east and is very consistent in thickness (3.5m to 4.2m) with limited structural features

- Base of weathering is generally between 13m and 21m with some areas as shallow as 10m, which typically favours low strip ratio, open-cut mining

Summary of the Resource Estimate for Broadmeadow East (Source: Company's Report)

Peabody (Burton Coal) Pty Ltd, a wholly owned subsidiary of US-headquartered Peabody Energy Corporation, has provided a coal quality database for the Broadmeadow East mining lease with raw coal qualities, simulated primary coking and secondary thermal products and clean coal composite qualities.

BCB had initiated the analysis of the washability data and has determined that the coal can be washed at lower density levels to create higher-quality coking coal while still producing a high energy secondary thermal coal.

Previous Update: Bowen Coking Coal Appoints Mr Matt Latimore as Non-Execute Director

Consideration for the Acquisition

The consideration for the transaction comprises of the following:

- Cash consideration of $1,000,000, payable upon Completion

- Royalty payable of $1/t on all coal produced and sold from ML 70257, capped at $1.5 million

- Assumption of environmental rehabilitation obligations

- $500,000 cash consideration for land compensation, payable only upon site works commencing or the renewal of the ML, whichever occurs first.

Capital Raising to Finance the Acquisition

In addition to this, the Company has executed a capital raising pursuant to an offer made to unrelated sophisticated and professional investors and has received firm commitments to raise a total of $2.25 million (excluding costs) by the issue of 45,000,000 fully paid ordinary shares at a per share issue price of $0.05.

Bizzell Capital Partners acted as a lead manager for the capital raise transaction which is well supported by two European Funds and by local investors involving Mr Stephen Bizzell. BCB looks forward to employing the proceeds from the capital raising towards:

- Acquisition and transaction cost of the Broadmeadow East project

- Related environmental and mining studies

- Costs of the Placement

- Supplement working capital

Now, BCB looks forward to engaging with Peabody towards the finalisation of the transaction at the earliest possible time and thereafter direct all its efforts to ensure that the project is in shovel-ready position as soon as possible.

Interesting Read: Bowen Coking Coal Limited Advancing Well in the World-Renowned Bowen Basin

Infrastructure Ready Site

BCB is at an advantage due to the availability of existing regional infrastructure and that the project has a low capital intensity and short development timeframe. Commencing immediately, BCB shall evaluate several mine operations options in order to determine the best value proposition.

Through the transaction, BCB has secured access to the New Lenton Joint Venture Coal Handling and Preparation Plant (“CHPP”) located approximately 20km north of Broadmeadow East, and associated Train Load Out Facility (“TLO”) located 10km to the south.

The New Lenton Joint Venture (Formosa Plastics Corporation & New Hope Corporation Ltd) owns both the CHPP and TLO and had acquired adjoining mining leases and connected infrastructure from Peabody as part of the proposed development of the New Lenton Project.

However, Peabody had retained certain access rights to the CHPP and TLO in that transaction, which have now been granted to BCB as part of the current transaction.

In addition to this, several other wash plants exist in close proximity to Broadmeadow East, which can be used as an alternative if the timing of the re-commissioning of the New Lenton Joint Venture CHPP by the current owners does not line up with the development schedule of BCB.

Way Forward for BCB

BCB looks forward to applying for an Environmental Authority amendment after the de-amalgamation of the Mining Lease; however, the mining lease for the project comes with certain Environmental Authorisations.

Subsequent to the completion of the environmental impact assessments, application for a site-specific EA shall be made. Moreover, coal washability optimisation shall be undertaken in terms of quality, yield and final product specifications aiming to determine the optimal configuration to boost financial value.

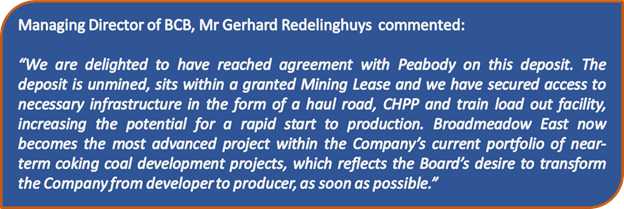

Out of the several advanced exploration and development assets, Broadmeadow East is now the most advanced project in BCB’s current portfolio of near- term coking coal development projects of the Company.

BCB stock was noted trading at a price of $0.056 on 26 June 2020 (AEST:11:51am), with a market capitalisation of $ 44.21 million. During the past three months, BCB stock has returned 103.70% gains to its shareholders.