Summary

- Bowen Coking Coal Limited’s 2020 drilling program resulted in a significant resource estimate for the Hillalong North Coking Coal Project.

- The resource area offers opportunities to expand on the maiden resource estimate.

- Fast float and washability analysis are underway, which will offer a more definitive indication of the potential final product quality.

Coking coal exploration and development company with advanced exploration assets, Bowen Coking Coal Limited (ASX:BCB) owns several active coking coal projects in the world-renowned Bowen Basin in Queensland, Australia and boasts joint venture partners of Sumitomo, which has a 10% interest in Hillalong, as well as Stanmore Coal Limited (ASX:SMR) in the Mackenzie (5% interest) and Lilyvale (15% interest) Coking Coal Projects.

In early May 2020, BCB concluded a drilling program at its Hillalong North Coking Coal Project.

Related: Bowen Coking Coal Limited Advancing Well in the World-Renowned Bowen Basin

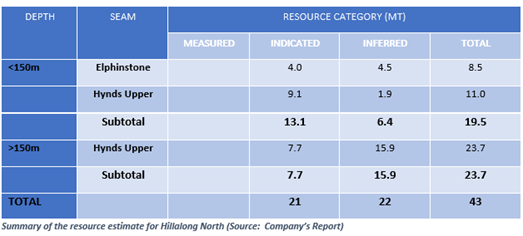

The result of that drilling program was the recently published maiden resource estimate of 43Mt. The target seams intersected in 26 of the 27 sites whereas the main target seams were encountered in around 75% of the holes from depths as shallow as 5m (weathered) and 12m (unweathered).

Moreover, less than 10% of the surface area of the total Hillalong Project was covered in the 2020 Hillalong North exploration program, focussing on the northern prospective target area, identified from a review of historic Rio Tinto drilling data.

A total resource of 43 Mt in accordance with the JORC Code has been estimated by Xenith Consulting, of that 19.5 Mt is shallower than 150 m deep, a typical depth cut-off for open-cut resources.

More interestingly, the resource area is still open in both East and South-West directions, offering BCB additional opportunities to expand its current maiden resource estimate.

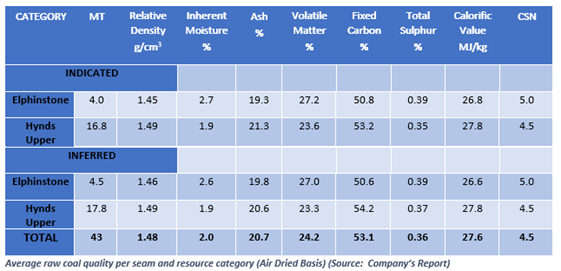

Further, the quality data for raw coal is exceedingly positive, as tested by Bureau Veritas, in terms of coking coal indicators for both the Elphinstone and Hynds seams, as shown in the table below:

In addition to this, fast float laboratory testing indicated the potential to wash to a high-quality coking coal from both the Elphinstone and Hynds Upper seams in all three boreholes for which the results have been received to date.

Fast float laboratory testing is a process designed to provide an indication of the primary coking properties and yields at a 1.375 density cut point.

Moreover, a Crucible Swelling Number (CSN) high of 8.5 (average of 7.5 for all seams) and a fluidity high of 1500 ddpm (average of 735 ddpm for all seams) was returned from the fast float data for the first three holes and in certain sections of the Hynds Upper seam, at yields ranging between 44% and 80% for a primary product only.

Further details are subject to completing the washability tests and receiving all the data.

Way Forward for BCB

Currently, BCB is engaged in undertaking fast float and washability analysis, which is expected to provide a more definitive indication of the potential final product quality.

Moreover, work for defining the next phase exploration plan has already commenced, which shall form part of Phase 2 under the Sumitomo Farm-In, should they elect to proceed. Phase 2 is anticipated to include conceptual mine planning studies and preliminary environmental studies.

The Sumitomo Farm-In agreement provides Sumitomo with a 10% interest having already spent $2.5 million for Phase 1 and offers Sumitomo the opportunity to increase its holding by another 10% if Sumitomo agrees to proceed with Phase 2 and invests another $5 million.

BCB stock is trading at $0.048, up by 2.128% (AEST 11:05 am) with a market capitalisation of $37.78 million on June 9, 2020.