Highlights

- Lithium prices have soared more than 400% in the last one year.

- Lithium is a key component for both grid storage batteries and EV batteries.

The Australian stock market recovered from a three-week low today (24 August 2022) as technology and mining sectors rallied after a slew of famous names announced earnings.

After four days of selling pressure, buyers took advantage of the month's lowest prices.

The benchmark S&P/ASX 200 gained 0.59% at 7,002.50 points today at 2.57 PM AEST.

The demand for lithium is rising with each passing day as people across the world are showing interest in electric vehicles (EVs). It is to be noted that both grid storage batteries and EV batteries need lithium as a key component.

Lithium prices have soared more than 400% over the past year due to a shortage, giving ASX lithium stocks some gale-force tailwinds.

In this article, we at Kalkine Media® will discuss the performance of a few lithium shares in the last three months.

Sayona Mining Limited

Lithium firm Sayona Mining Limited (ASX:SYA), in its last ASX announcement, shared that it has agreed with Acuity Capital to extend and increase the size of its At‐the‐Market Subscription Agreement (ATM). The expiry date has been extended to 31 July 2025, and the ATM facility limit has been increased to AU$200 million.

Acuity Capital currently holds 95 million fully paid ordinary SYA shares as security against the ATM.

Following the ATM extension and limit increase and subject to shareholder approval, the company has agreed to issue an additional 155 million SYA shares at nil consideration to increase the total security held by Acuity Capital to 250 million SYA shares.

Today, Sayona's shares were trading at AU$0.30 per share, up 7.27% on ASX at 2.45 PM AEST. The lithium company's shares have grown over 27% in the last three months.

Core Lithium Ltd

Core Lithium (ASX:CXO) has shared some news about its activities this month. On 15 August, Core Lithium provided an update on its exploration activities about Finniss Lithium Project in Northern Territory.

Diamond drilling

The company said in its last announcement that diamond drilling is nicely underway at BP33, focusing on exploring the intensity and strike extensions of the primary pegmatite intrusions. Diamond drilling at BP33 can be accompanied by extensional exploration and aid definition applications at Carlton, Hang Gong, Lees and Sandras. These applications are designed for additional construction at the Mineral Resource Estimates.

RC drilling

Core Lithium has started a +40,000m RC drill software, a good way to cut up between greenfields and brownfields goal areas. A big RC rig has been mobilised to test a number of the deeper targets. The software may be centered on following up on potentialities in which tremendous exploration consequences had been pronounced from 2021 drilling, such as Bilatos, Penfolds, Centurion and Talmina West, in addition to many new conceptual targets.

Today, Core Lithium's shares were trading at AU$1.41 per share, up 4.06% on ASX at 3.05 PM AEST. The lithium company's shares have increased more than 50% in the last three months.

Image Source: © Olivier26 | Megapixl.com

Pilbara Minerals Limited

Pilbara Minerals (ASX:PLS) is the ASX-listed lithium company, which owns 100% of the largest, unbiased hard-rock lithium operation in the world. Located in Western Australia’s resource rich Pilbara region, the Pilgangoora Project and Operation produces a spodumene and tantalite concentrate.

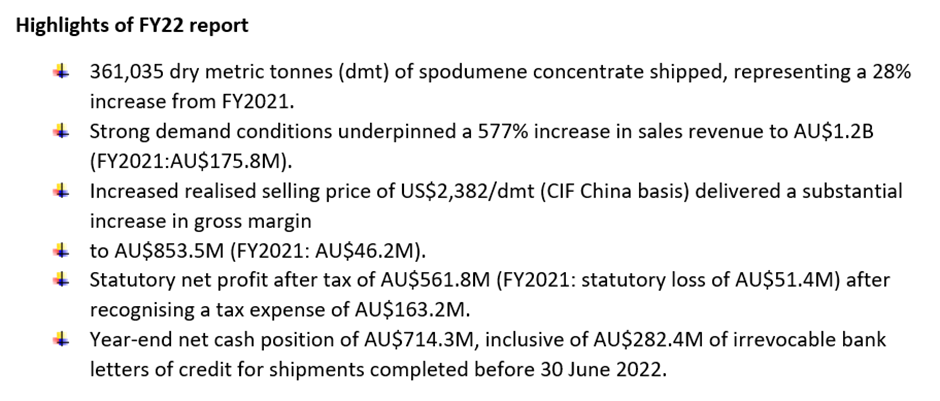

Yesterday (23 August), Pilbara shared financial results for 2022.

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 23 August 2022

Shares of Pilbara Minerals were spotted trading at AU$3.47 apiece, up 6.12% today at 3.11 PM AEST. The company's shares have jumped around 23% in the last three months.

Piedmont Lithium Inc

Shares of Piedmont Lithium (ASX:PLL) were trading 7.32% higher at AU$0.88 per share on ASX today at 3.13 PM AEST. The company's shares have grown around 6% in the last three months.

Although the company shares no news after 7 July 2022, the price rise of shares might be because of the hike in overall lithium price.

In its later release on ASX, Piedmont had informed that it got added to the U.S. Russell 2000 Index and the Russell Microcap Index as its member.

On 29 June, Piedmont and Sayona Mining formalised restart plans for the NAL project in Canada's Quebec. The rehabilitation and restart are anticipated to value CA$98 million (approximately AU$110 million).

Sayona has taken substantial steps to hurry up the manufacturing restart, which includes hiring important personnel, shopping for key long-lead equipment, growing difficult engineering layout work, and getting the desired regulatory clearances. It is anticipated that the NAL concentrator could offer its first manufacturing in the first quarter of 2023.

Allkem Limited

Allkem Limited (ASX:AKE) last week (on 15 August) announced that it has agreed to transfer Borax Argentina S.A (“Borax”) to Minera Santa Rita S.R.L (“MSR”).

Under the Proposed Transaction Allkem will transfer to MSR all the issued stocks with inside the couple of Borax maintaining firms and US$14 million cash. On the other hand, MSR will hand over to Allkem (or its nominee) 100% possession of the Maria Victoria Tenement. Borax’ employees will remain with MSR after the deal.

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 15 August 2022