Summary

- The Materials sector has performed well during the current period with the S&P/ASX 200 Materials sector index reaching the pre-COVID-19 levels. However, the prevailing uncertainty has seen the index go down in the last few weeks.

- Agricultural chemical player Nufarm has updated about its non-cash, impairment charges concerning its European assets which it expects to be nearly A$215 million for FY2020.

- Cement manufacturer Adbri has recently announced the appointment of Dr Vanessa Guthrie as Deputy Chair along with the current role as Lead Independent Director.

- The Company registered a drop of 7% in its revenue in 1H FY2020. The NPAT stood at A$29.1 million, and there was a substantial increase in cash flow from operations.

S&P/ASX 200 Materials sector index is among the few indexes that managed to reach their pre-COVID-19 levels. Higher iron ore prices, coupled with the stimulus packages by the government, aided the sector rally in mid-Q2 CY2020. However, recently, the index has seen a downward trend, affected by the prevailing uncertainty in the market. By the end of the trading session on 02 September 2020, the index settled at 14,282.5, up ~2%.

GOOD READ: Looking at long-term returns - Spotlight on Financial, Materials & Industrials

The performance of the sector index has a direct relation to the performance of its constituents. As Nufarm and Adbri are vital players from this industry, announcements, and developments from them are likely to have a substantial impact on the index. Nufarm Limited has updated about its non-cash, impairment charges concerning its European assets while Adbri Limited has announced its 1H FY2020 results. The shares of both the companies surged on the ASX on 2 September.

Let us look at their recent developments in detail.

Nufarm Limited (ASX:NUF)

Nufarm has manufacturing and marketing operations in various parts of the world like Australia, New Zealand, Asia, the Americas, and Europe. It sells products in over 100 nations globally.

On 2 September 2020, Nufarm updated about its non-cash, impairment charges concerning its European assets which it expects to be nearly A$215 million for the year ended 31 July 2020. The Company advised that the non-cash, impairment charges of A$215 million were confirmed post the review of its assets’ carrying value as per appropriate accounting standards. It is subjected to the finalisation of the audit.

The assessment of the carrying value includes the recent operating performance along with a moderated outlook of future earnings based on an anticipation of ongoing margin pressure in the Company’s base product portfolio because of the elevated manufacturing costs plus an improved competition.

Nufarm pointed out that the raw material costs for products in the portfolios Nufarm that was acquired in 2018 is easing. Still, the input costs for a small number of products would likely to be heightened in the medium term and has been reflected in the carrying value assessment.

Based on initial, unaudited accounts, NUF anticipates underlying group EBITDA for FY2020 to lie in between A$290 million and A$300 million. After the sale of the South American businesses, the underlying EBITDA from continuing operations would likely fall in the range A$230 million - A$240 million.

Also, Nufarm expects foreign exchange losses of nearly A$33 million for the full year. Out of these A$33 million, A$9 million are associated with discontinued operations.

Stock Information:

On 03 September 2020, NUF share price stood at A$3.960 (at 02:56 PM AEST), down 1.493% from the previous close. NUF has a market cap of A$1.53 billion and 379.69 million outstanding shares.

Adbri Limited (ASX:ABC)

Adbri is an ASX 200 listed company and a leading Australian integrated construction materials and lime producing a group of companies.

On 26 August 2020, Adbri Limited announced the appointment of Dr Vanessa Guthrie as Deputy Chair along with the current role as Lead Independent Director.

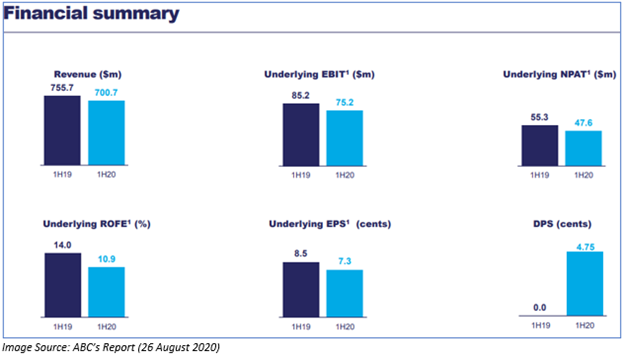

The Company, on the same date, also announced its 1H FY2020 results for the period ended 30 June 2020. Let us take a quick look at the results.

- Net profit after tax for the year was A$29.1 million, and underlying NPAT stood at A$47.6 million.

- Revenue declined by 7% to A$700.7 million with lower residential activity. The revenue declined as a result of bushfires, floods and smoke in NSW and Queensland.

- The Company declared a fully franked interim dividend of 4.75 cents per share. It represents a payout ratio of 65% on underlying earnings.

- Adbri reported a considerable increase in the cash flow from operations. The cash inflow increased by A$71.5 million to A$116.3 million.

- Cost-out program is well on track to provide an anticipated A$30 million in annual savings to over offset cost headwinds.

- Adbri also noted healthier underlying earnings margins in wholly-owned operations. Overall, the EBITDA margin and underlying EBITDA margin were impressive at 16.6% and 17.5% respectively.

- During the period, the COVID-19 situation was well managed, and all its sites remain operational.

- Mitigation strategies are being framed to tackle future decrease in lime earnings after non-renewal of contract by Alcoa from 1 July 2021. The Group also recognised a pre-tax non-cash impairment charge of A$20.5 million, mainly associated with the termination of this contract plus subsequent placement of kiln 5 assets at Munster into care and maintenance in 2021. Restructuring provisions of A$5 million have been brought to account for job losses plus operational effectiveness enhancements.

As a result of uncertainty surrounding COVID-19, Adbri had withdrawn its earnings guidance in April 2020.

ALSO READ: Materials sector Stocks reflecting movements on ASX ledger: ABC, ORA, BKW, CSR

Stock Information:

On 03 September 2020, ABC share price stood at A$2.740 (at 02:56 PM AEST), up 4.58% from the previous close. ABC has a market cap of A$1.71 billion and 652.27 million outstanding shares.