Highlights

- Penny stocks are generally priced below one dollar

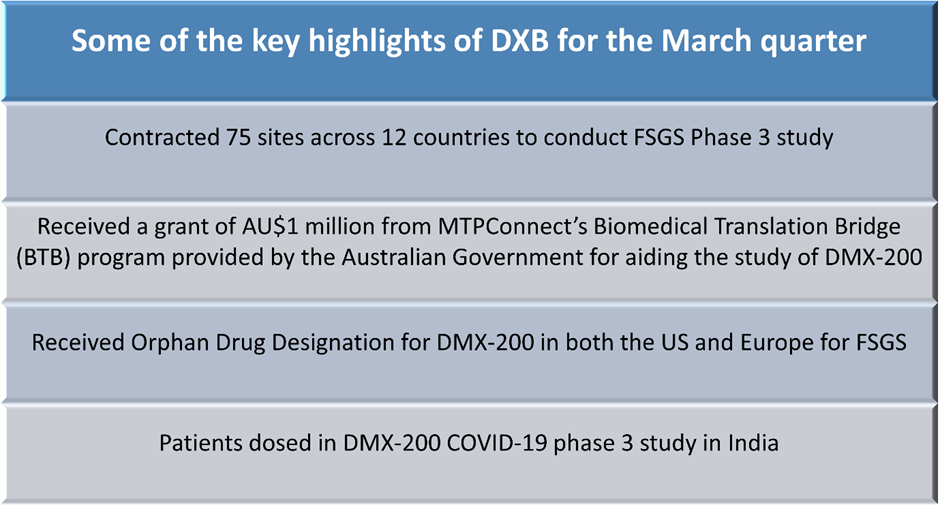

- DXB has received the Orphan Drug Designation for DMX 200 in both the US and Europe for the FSGS

- AT1 benefitted from the Omicron wave, and the company sold nearly 550K COVID-19 rapid antigen tests in Q3 FY22

- JTL is one of the first companies to introduce LED display technology to the UK

The healthcare sector is composed of a broad range of companies that deals in pharma, research, medical care, and equipment. The sector has grabbed investors’ attention as some companies are growing with increased sales of drugs and equipment amid the COVID-19 pandemic.

The sector benchmark S&P/ASX 200 Healthcare has gained 0.67% on a quarter-to-date basis. Let us have a look at how these three penny stocks from ASX healthcare have performed in the quarter ended 31 March 2022.

Do read: BOT, AVE, ALA: 3 ASX pharma penny stocks under $1 with decent YTD returns

Dimerix is a clinical-stage biotechnology company focused on developing innovative new therapies in areas with unmet medical needs. The company is currently developing its proprietary product - DMX-200 - for Focal Segmental Glomerulosclerosis (FSGS) respiratory complications associated with COVID-19 and Diabetic Kidney Diseases and DMX-700 for Chronic Obstructive Pulmonary Disease (COPD).

Atomo Diagnostics Limited (ASX:AT1)

Atomo is a medical device company based in Australia. It supplies unique, integrated rapid diagnostic test (RDT) devices worldwide. Unlike other companies, AT1 benefitted from the Omicron wave, and the company sold nearly 550K COVID-19 rapid antigen tests in Q3 FY22.

Key developments during the quarter:

- Persistent demand for HIV Self-Test from Europe and LMIC markets

- Completed designing a swab-based rapid test device that eases the steps and efforts needed to perform rapid swab-based testing

- Established a US commercial entity and recruited an experienced US business development resource

- Ended the quarter with AU$16.4 million in cash and no debt

Some of the company’s target areas for FY23 are:

- Securing new OEM customer contracts to supply blood test devices

- Complete development of swab design

- Expansion of US activities and in-country capabilities

Do read: Actinogen gets upbeat results from Xanamem trial for Alzheimer’s treatment

Jayex Technology Limited (ASX:JTL)

Jayex Technology is a healthcare service provider based in the UK and Australia. It is one of the first companies to introduce LED display technology to the UK. The company has been focusing on healthcare over the last 25 years. It provides integrated e-health SaaS healthcare services delivery platforms.

In the March quarter, sales of Jayex Connect Display and Jayex Connect Arrive products improved in the UK. The company expects this trend to continue in the second quarter of 2022 as general practice surgeries have become fully operational in the UK.

Monetary activities

- Products and operations costs were the major expenditures in the quarter, totalling AU$698K.

- Receipts from customers totalled AU$2 million, compared to AU$1.65 million previous quarter.

Also read: Life360 Inc’s (ASX:360) subscription revenue rises 63% in FY22