Highlights

- With a 43% yoy (year-on-year) increase in paying circles and a 63% yoy (year-on-year) growth in subscription revenue, Life360’s main business is gaining traction.

- Core Life360 has a global monthly active user (MAU) base of 38.3 million, a 2.8 million increase over the December 2021 quarter.

- MAU base in the US of 25.1 million, up 1.4 million, or 6% from the December 2021 quarter and 39% year-on-year.

Software firm Life360 Inc’s (ASX:360) share price is in the limelight today after another quarter of growth. Life360 shares slipped over 28% to trade at AU$3.830 per share (at 3:30 PM AEST).

Life360 is a platform that connects today’s busy families by allowing them to better know, interact with and safeguard the people they care about most. The Life360 mobile app, the firm’s primary offering, is a market leading app for families, with capabilities ranging from communications to location sharing and driving safety.

Good read: ASX 200 shoots higher at open; Life360, Computershare lead gains

Let’s take a look at the firm’s most recent earnings report.

- Life360 has released its business activities report and quarterly cash flow report (ending 31 March 2022).

- With a 43% yoy (year-on-year) increase in Paying Circles and a 63% yoy (year-on-year) growth in subscription revenue, Life360’s main business is gaining traction.

- Annualised Monthly Revenue (excluding hardware) rises to US$166.1 million.

- The trial results of the Tile upsell offer were quite positive, with a 35% increase in Life360 subscriptions compared to the control group.

- Accelerated integration of Jiobit and Tile to achieve projected long-term positive cash flow by late CY23, with the first full year of positive cash flow in CY24.

- After taking into account the tile transaction, quarter-end cash and cash equivalents were US$98.2 million, compared to a proforma forecast of US$94 million on 31 December 2021, stated in Appendix 4C.

- Core Life360 has a global monthly active user (MAU) base of 38.3 million, a 2.8 million increase over the December 2021 quarter. MAU climbed 36% yoy.

- ARPS (Average Revenue Per Subscription) climbed 16% yoy (including Jiobit and Tile) and 15% for core Life360.

- MAU base in the US of 25.1 million, up 1.4 million, or 6% from the December 2021 quarter and 39% year-on-year. The 13.2 million global MAU base climbed by 1.4 million, or 12% from the December 2021 quarter and 32% yoy.

Management remark

Chris Hulls, Life360 Chief Executive Officer, commented:

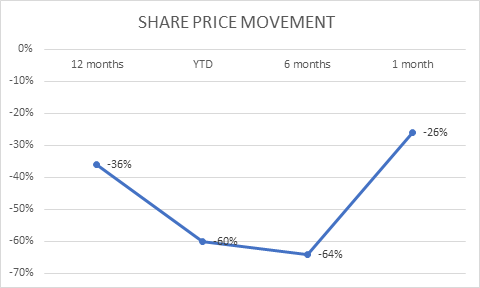

Share price movement

Life360 has been on a negative streak as it declined 36% in one year. The stock has plunged 60% YTD and 64% in the last six months. Recently, the firm failed to gain investors’ attention by falling 26% in a month.

Image source: © 2022 Kalkine Media®

Good read: SUN, 360, RMD: How are these ASX-listed shares faring today?