Imugene Limited (ASX: IMU) is a clinical stage biotechnology company that focuses on the development of immunotherapies that have the potential to enable a patientâs immune system to recognise and destroy cancer cells. The company is focused on targeting B cell peptide vaccines which seek to control the patientâs immune system to produce polyclonal antibodies, possibly attaining an identical or greater effect than the currently available commercialised monoclonal antibody therapies.

Imugeneâs product pipeline contains B cell peptide vaccines comprising HER-Vaxx (anti-HER-2), B-Vaxx (anti-HER-2), and PD1-Vaxx (anti-PD-1). The company has also tested B-Vaxx and PD1-Vaxx combination, that has demonstrated better inhibition of cancer growth in colorectal cancer model relative to only PD-1 Vaxx vaccine or monoclonal antibody. With an intention to expand its product portfolio, the company has recently informed about its plan to acquire an exclusive licence to the oncolytic virus CF33 from City of Hope Cancer Centre in LA.

Immunotherapy Market Opportunity

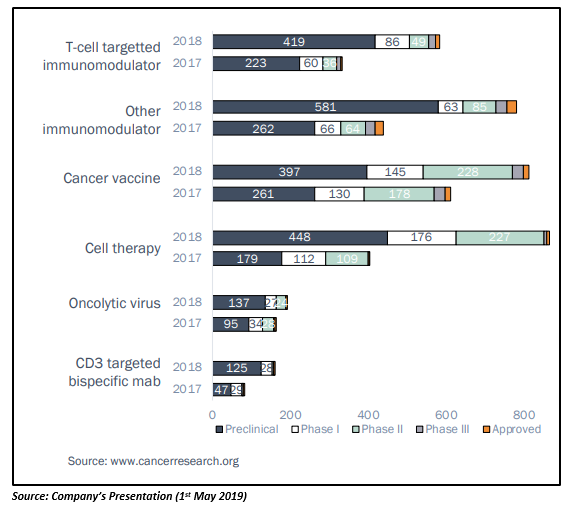

Traditionally, cancer treatment options included radiation, surgery, chemotherapy and targeted therapies. However, the immuno-oncology sector has grown rapidly and is now widely regarded as the 5th pillar of treatment. The emerging immunotherapy market has experienced significant growth in global immuno-oncology pipelines in 2017 and 2018, as indicated in the below figure:

Immunotherapies, when combined with standard chemotherapy treatment, have been shown to improve response rates for cancer treatment. According to BIS Research, the global immunotherapy market was valued at $40 billion in 2017 and is expected to surpass $170 billion over the next decade.

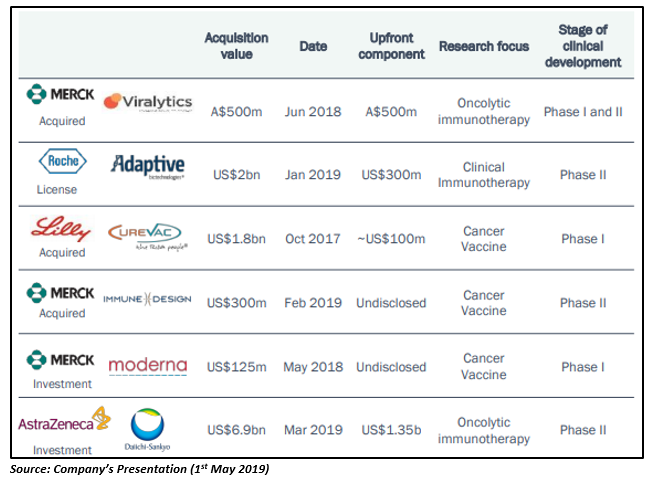

The recently signed M&A and licensing deals suggest that the immuno-oncology market is experiencing robust growth, supported by strong sales for leading immuno-oncology treatments. Let us take a look at the key M&A and licensing transactions held between 2017 and 2019 in the big pharma space:

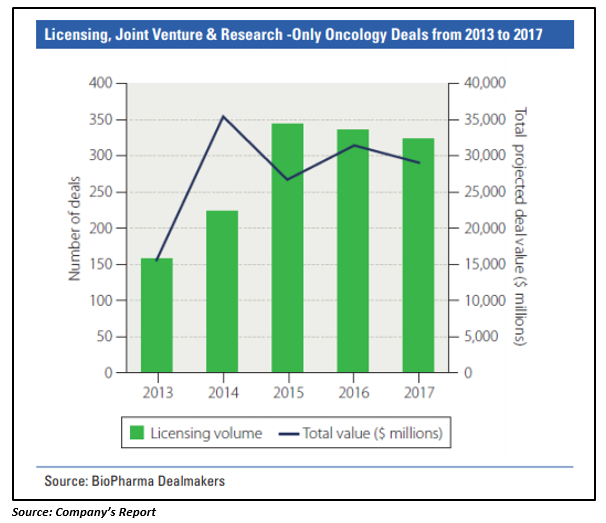

The oncology segment has dominated the deal making landscape in recent times. There has been a substantial growth in the number and value of oncology deals since 2013, with immunotherapy driving the growth in oncology transactions. As reported by the company, out of thirty-five oncology deals (valuing more than $1 billion) signed from 2013 to 2017, thirty-two were focused on immunotherapies.

Market Opportunity Across Imugene Vaccines

Imugene is currently focusing on the lung and gastric cancer markets and is likely to extend beyond these indications in the future. With a strong interest in the sector, the companyâs products have the potential to outperform the existing treatments.

Let us now catch a glimpse of the market opportunity for Imugeneâs two lead B cell peptide vaccines - HER-Vaxx and PD1-Vaxx below:

HER-Vaxx

As reported by the company, out of 1 million gastric cancer cases registered every year across the world, 19 per cent are related to HER2+ cancers. The 5-year relative survival rate of such patients is less than 25 per cent, with the median survival period of 7-10 months. The existing treatments available (Herceptin®) for the disease cost around $140,000 per year.

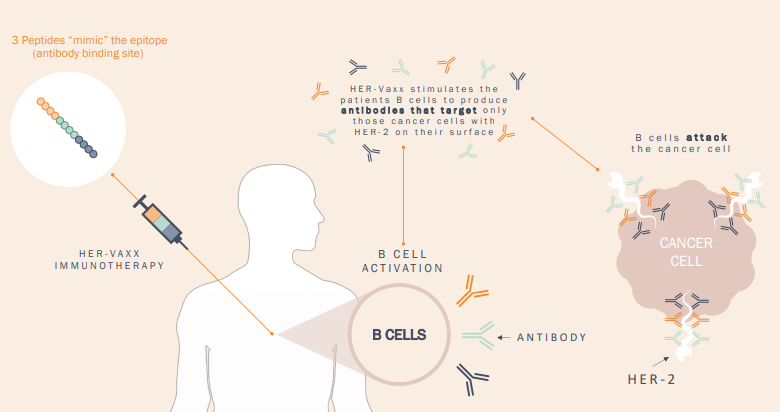

Imugeneâs HER-Vaxx has the ability to improve on the efficacy of current commercialised monoclonal antibodies used to treat cancer that over express the HER-2 protein. HER-Vaxx seems to possess the potential to replace the monoclonal antibodies as the monotherapy or be used along with immunotherapy treatments to enhance the efficacy of these treatments without increasing toxicity.

Working of HER-Vaxx, Source: Companyâs Presentation (1st May 2019)

Working of HER-Vaxx, Source: Companyâs Presentation (1st May 2019)

Currently, Herceptin® and Perjeta® are the two leading monoclonal antibodies that are used for HER-2 cancer treatment. Perjeta® generated sales of $2.8 billion while Herceptin® generated sales of $7.1 billion in 2018, signalling a significant market for these products.

Imugene recently presented new HER-Vaxx positive clinical data of HER2/neu peptide vaccine IMU-131 plus chemotherapy, from the Phase 1b study of its HER-Vaxx cancer vaccine, at the ESMO World Congress on Gastrointestinal Cancer, held in Barcelona, Spain. The presentation given by leading oncologist Dr Marina Maglakelidze, a professor at the Research Institute of Clinical Medicine situated in Tbilisi, Georgia can be viewed on Imugeneâs website.

PD1-Vaxx

Around 1.8 million lung cancer cases are registered every year across the world. The 5-year relative survival rate of lung cancer patients is approximately 18 per cent, and there is a 17 per cent chance that the patient will survive for at least five years. The existing treatments available for the disease â Keytruda® and Opdivo® - cost around $150,000 and $157,000 per year, respectively.

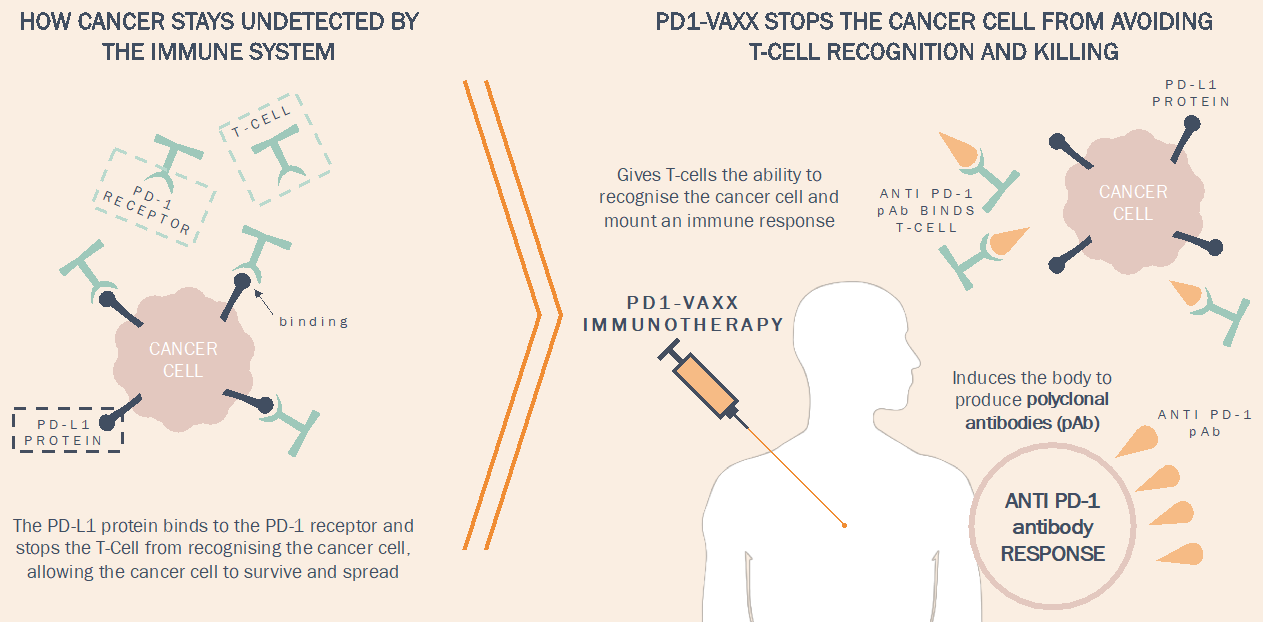

Imugeneâs PD1-Vaxx is a B-cell peptide cancer vaccine that seeks to produce an alternative to the existing commercialised monoclonal antibody immune checkpoint inhibitors. The immune checkpoint inhibitor market has experienced significant growth in recent years and is one of the fastest-growing sectors of the immunotherapy market.

Working of PD1-Vaxx, Source: Companyâs Presentation (1st May 2019)

Working of PD1-Vaxx, Source: Companyâs Presentation (1st May 2019)

Currently, Merckâs Keytruda® and Bristol-Myers Squibbâs Opdivo® are the leading monoclonal antibody immune checkpoint inhibitors. Keytruda® and Opdivo® generated sales of $7.2 billion and $6.7 billion, respectively, in 2018. According to Allied Market Research, the global immune checkpoint inhibitor market was worth more than $10 billion in 2017 and is estimated to surpass $56.5 billion by 2025.

The immune checkpoint inhibitors can be used alone or in combination with other immunotherapy treatments for advanced-stage cancers. The size and growth potential of the immune checkpoint inhibitors offers a significant opportunity for Imugene in the event the clinical trials yield favorable results. As reported by Imugene, PD1-Vaxx can potentially elicit demand from pharma companies seeking to expand their oncology portfolio to incorporate a checkpoint inhibitor treatment.

Opportunity in Oncolytic Virus Market

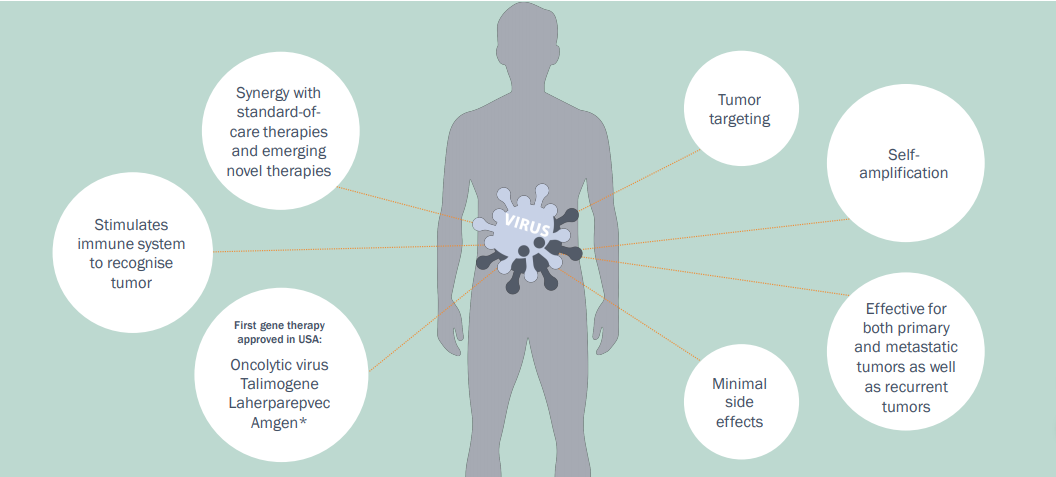

Imugeneâs intention to acquire CF33 is also likely to offer the potential for significant value add to the company as the oncolytic viruses are the developing class of immunotherapy agents for cancer treatments. As reported by Imugene, there has been only one oncolytic virus in the market to date that has gained FDA approval - Talimogene Iaherparepvec (T-VEC or Imlygic®).

Advantages of Oncolytic Viruses, Source: Companyâs Presentation (15th July 2019)

Advantages of Oncolytic Viruses, Source: Companyâs Presentation (15th July 2019)

The oncolytic virus market is driving interest from big pharma companies as the growing body of clinical research suggests that oncolytic viruses used in combination with other immunotherapy treatments improve efficacy. Due to this, the big pharma companies are showing interest in potential therapies that will add to their existing product portfolio.

The immunotherapy market is currently in a robust growth phase, offering Imugene with a significant opportunity to seek partners for its products. The successful trials of the companyâs therapies are likely to provide substantial potential partnering opportunities.

Stock Performance

IMU is currently trading at AUD 0.021 on the ASX (as at 1:10 PM AEST on 20th August 2019. The stock has delivered a return of 16.67 per cent on a YTD basis and 23.53 per cent in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.