Highlights

- Viva Leisure has delivered AU$9.5 million of monthly revenue run rate.

- Viva Leisure expects AU$10 million of revenue run rate in July 2022.

- The Company has continued its growth momentum after January 2022.

Health leisure industry operator, Viva Leisure Limited (ASX:VVA), shared a performance update for the month of March and April 2022. The health club operator has delivered a strong set of numbers during these two months, after which the shares gained 2.47% on the ASX to trade at AU$1.54 per share at 2:35 PM AEST.

The key highlight of the ASX-announcement was that the company is expected to achieve its milestone targets of 2022 (the year ending in June 2022). The company is rapidly approaching this target.

Viva Leisure has outperformed its broader benchmark index, ASX 200 consumer discretionary (XDJ), as it was 1.71% down today (9 May 2022).

Suggested reading: From VIP to VRT: Top five dividend-paying stocks from ASX healthcare

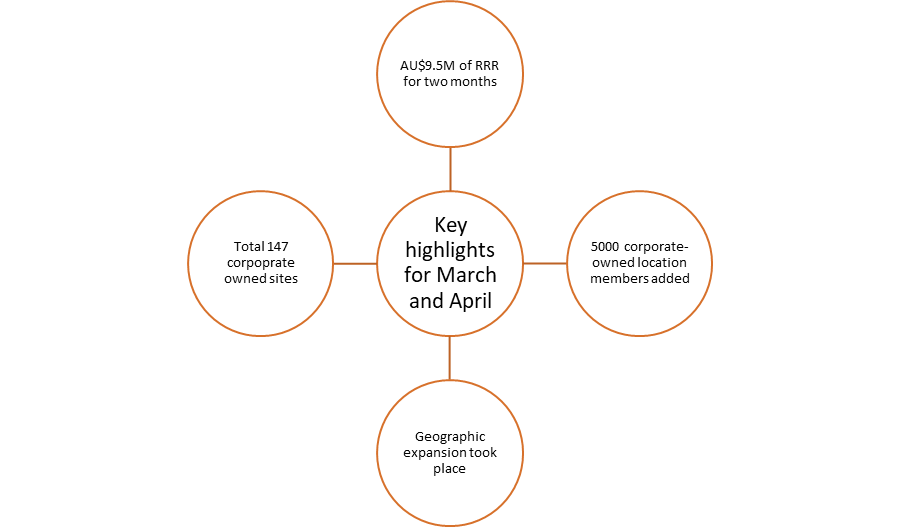

Key highlights of March and April

The consumer services providing company has delivered a record revenue run rate (RRR) of more than AU$9.5 million in March and April 2022. This represents around a 10% increase from the previous month. Even in February, the company delivered record financial metrics across locations, memberships and revenue. The RRR was AU$8.6 million in February. In January and February 2022, the growth rebounded as the normal operating conditions returned.

Image source: © Nito100 | Megapixl.com

Noteworthy here is that the company has set the RRR target of AU$10 million for June 2022. Looking at the current growth in RRR, the company's management is confident that its June 2022 will be met.

Over the span of two months, the corporate-owned location members increased by around 5,000. Reportedly, it reached more than 150,000.

In these two months, the company expanded its geographic footprint considerably. It entered Western Australian market through three Plus Fitness acquisitions. The fitness company informed that another three exchanged contracts are expected to be completed in the coming few weeks. After settling these additional three contracts, the corporate owned site would reach 150 across five states.

Image source: © 2022 Kalkine Media ®

Harry Konstantinou, Viva's CEO and managing director, commented on the company's performance,

Does Viva Leisure give dividends?

To date, Viva Leisure has not announced any dividend. However, its revenue has surged significantly over the years. The company recorded AU$7.60 million of revenue in 2018, AU$31.10 million in 2019, AU$40.63 million in 2020 and in 2021, AU$83.59 million revenue was reported.

Must read: Why is AVZ Minerals (ASX:AVZ) in news today?