Highlights

- Qantas shares have been rising over the last few days as international travel has gained momentum of late.

- Most of the countries have now removed Covid-19-led restrictions on international travel.

- Covid-19 pandemic had significant impact on the business of Qantas Airways.

Qantas Airways Limited (ASX:QAN) shares ended sharply higher on the ASX today (21 April 2022) as the travel industry has started showing signs of pickup. International travel, which was severely impacted due to the pandemic, is gradually getting back to normalcy as countries have removed travel restrictions for international passengers.

Shares of the flagship Australian carrier ended 3.87% higher at AU$5.64 apiece today, in-line with its industry benchmark ASX 200 Industrial (XNJ), which gained 2.23% to end at 6,573.60 today.

Suggested reading: ASX 200 opens in green; Megaport falls 10% despite positive Q3 numbers

Why is Qanta's share price gaining momentum?

Shares of Qantas dropped when the first wave of Covid-19 hit the world, and now with ease in the global travel restrictions, investors are probably grabbing shares of the flagship carrier.

Now Aussies are no longer required to undergo the Covid-19 test before travelling. In addition to this, Aussies with or without vaccination can travel abroad.

Qantas' share price gain can also be linked with the global airline's stocks rally. Shares of Delta Air Lines, Inc. (NYSE:DAL) closed 1.16% up, and United Airlines Holdings Inc (NASDAQ:UAL) closed 1.24% higher overnight. These shares gained after the mask mandates were eased on planes by the Florida court.

Share price of Qantas has increased by over 9% year till date. In the last five trading sessions alone, Qantas shares by gained over 11%.

Image source: © Caymia | Megapixl.com

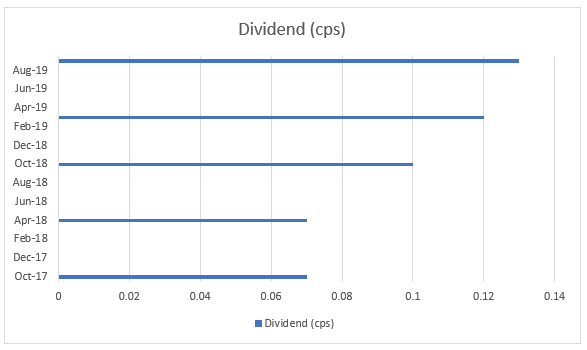

Dividend history of Qantas

Qantas, which has a market capitalisation of AU$10.24 billion has not declared any dividend since September 2019 as its business was severely impacted after the outbreak of Covid-19. In June 2020, it reported a net loss of AU$1.96 billion, and in June 2021, it recorded a net loss of AU$1.73 billion. Earlier, Qantas used to be one of the strongest dividends paying companies, and now it has tightened its belt.

Must read: Inflation jumps to 30-year high in NZ, what to expect from Australia?

From October 2017 till September 2019, Qantas showed significant growth in the dividend amount. In two years, the dividend amount surged from 0.07 to 0.13 cents per share.