Summary

- Numerous ASX listed retailers such as JBH, HVN and NCK have swept the market with their respective robust business performances during FY20, albeit with a few hiccups.

- Furthermore, these retailers have stood their ground and have commenced FY21 on a positive note by observing an uptick in their sales during July and August.

- Despite the fact that Nick Scali noted a fall of 1% in its total sales revenue, it surpassed its recent guidance for FY20 NPAT, and further projects inflated profits in the range of 50% - 60% during 1H FY21, primarily due to visibility on sales orders and if there is not extension given to lockdown in Melbourne.

Lately, numerous ASX listed retailers have been outpacing the market and writing success stories. Furthermore, they have been leveraging several opportunities to stay competitive and have outperformed their competitors in the ever-changing business environment.

Did you read; ASX Surprises: Latest and Few on the Cards: AGG, NCK

Notably, ASX retailers such as JB Hi-Fi, Harvey Norman, and Nick Scali have commenced FY21 on a positive note and observed surged sales during July and August 2020.

Some of the observation on the same from the three companies under discussion are as follows:

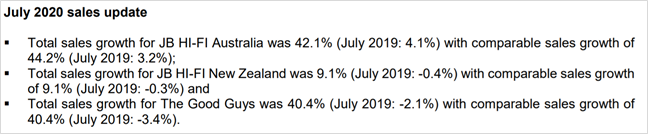

- JBH has commenced FY21 with an upbeat impetus and observed soared sales across JB Hi-Fi Australia, The Good Guys and JB Hi-Fi New Zealand in July.

Source: ASX announcement, dated 17 August 2020

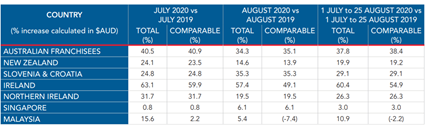

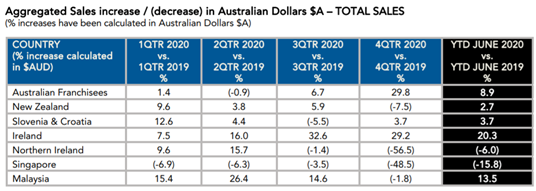

- Harvey Norman® management revealed that notwithstanding the metropolitan Melbourne Government authorised stage 4 lockdown period, the Company’s aggregated sales witnessed an uptick amid 1 July 2020 to 25 August 2020.

Source: ASX announcement, dated 28 August 2020

- Nick Scali saw an increase in written sales orders during the trading in July 2020 and experienced an uptick of 70% in comparison with the same period in 2019.

Must read; Retail Spending and Stocks That Have Become Dearer

Let us quickly skim through these ASX listed retailers:

JB Hi-Fi Limited (ASX:JBH)

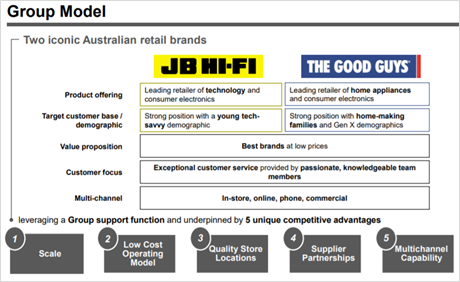

JBH brings together JB Hi-Fi and The Good Guys, Australia’s trusted and iconic retail brands.

Source: ASX announcement, dated 17 August 2020

As notified on 7 September, UBS Group AG and its related bodies corporate ceased to be a substantial holder of the Company, effective 02 September 2020.

On 20 August 2020, JBH unveiled its robust business performance with soared sales of 11.6% to AU$7.9 billion for the financial year ended 30 June 2020 as compared to FY19. Furthermore, JBH online sales experienced a boosted y-o-y growth of 48.8% to stand at AU$597.5 million.

Other highlights of the inflated financial performance of ASX listed JBH for FY20 are as follows:

- The Company witnessed an upsurge of 30.5% (y-o-y) in the underlying EBIT and stood at AU$5 million.

- JBH noted an increase of 2% in the underlying NPAT and was recorded at AU$332.7 million.

- The Company’s underlying earnings per share noted an increment of 33.2% and was recorded at 6 cents per share (cps).

- Furthermore, JBH had declared a fully franked final dividend of 90 cps to be paid by 11 September 2020 and was up by 76.5%. The total dividend for FY20 now stands at 189 cps, increasing by 33.1%.

Stay tuned for the updates from JBH’s 2020 Annual General Meeting scheduled on 29 October 2020.

On 9 September 2020, JBH’s share price noted a fall of 1.374% and was trading at AU$46.65 (at AEST 1:29 PM).

Must read; Resilient Retail Space in the Wake of Coronavirus? Lens on HVN, JBH

Harvey Norman® Holdings Limited (ASX:HVN)

An Australia-based retailer, Harvey Norman® is into activities related to integrated retail, property, franchise, and digital enterprise.

On 28 August 2020, HVN unveiled its robust financial performance during FY20 ended 30 June.

- Harvey Norman® noted a whopping increase of 2% (y-o-y) in its reported EBITDA and was recorded at AU$944.67 million.

- The Company’s PAT and non-controlling interests were recorded at AU$54 million, up 19.4 % from the previous year.

- Harvey Norman® reported PBT was noted at AU$29 million, indicating a surge of 15.1% (y-o-y) at the end of FY20.

- Harvey Norman® witnessed an upsurge of 7.6% (y-o-y) in total aggregated Company-Operated and Franchisee Sales Revenue and stood at AU$23 billion.

Source: ASX announcement, dated 28 August 2020

- HVN noted net cash position of AU$35 million at the end of 30 June 2020 versus net debt position of AU$626.47 million at the end of FY19.

- The Company declared a fully franked final dividend of AU$0.18 for 2H FY20, to be paid by 2 November.

On the property front, HVN possesses a robust property portfolio worth AU$3 billion.

Notably, the Company had 194 franchised complexes across Australia and 96 company-operated stores abroad, as on 30 June 2020.

Do Read; Harvey Norman® FY20 Results: A “Testament To The Strength Of Its Model”?

The Company intends to open up to 12 new stores abroad in FY21, comprising of 3 each in Malaysia, Singapore, and New Zealand; 2 in Ireland; and 1 in Croatia.

It is worth noting that a new store has already opened at Galway City in Ireland and is trading well.

On 9 September 2020, HVN’s share price decreased by 2.214% and was trading at AU$4.195 (at AEST 1:43 PM).

Nick Scali Limited (ASX:NCK)

A furniture retailer, Nick Scali has scheduled its 2020 Annual General Meeting virtually on 27 October 2020.

Notably, recently Nick Scali notified that Eley Griffiths Group ceased to be a substantial holder of the Company, effective 25 August 2020.

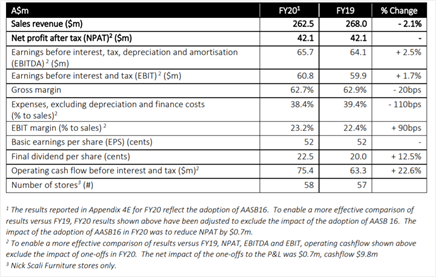

Furthermore, on 6 August 2020, NCK unveiled its business performance with plunged total sales revenue by 2.1% to stand at AU$262.5 million for the financial year ended 30 June 2020 as compared to FY19.

The fall in the revenue was ascribed largely to temporary store closures that occurred in April 2020 and a subdued trading environment in March.

Noteworthy, amid temporary closure of NCK’s stores in April, the Company launched online store across all its product categories and attained sales order of more than AU$3 million for the quarter ended 30 June 2020. Additionally, the online store contributed positively to EBIT in the June quarter of operation.

NCK’s EBITDA was noted at AU$65.7 million, representing a surge of 2.5% (y-o-y) and underlying net profit after tax (NPAT) was reported at AU$42.1 million, exceeding the guidance of AU$39 - AU$40 million provided during June.

Furthermore, NCK noted an increment of 12.5% in its fully franked final dividend to 22.5 cps in FY20 from 20 cps in FY19. The fully franked final dividend of 22.5 cps is due for payment on 27 October 2020.

Source: ASX announcement, dated 6 August 2020

On the outlook front, NCK expects to record profits to increase by ~50-60% during the half-year ending 31 December 2020, primarily due to visibility on sales orders, are contingent no extension given to the lockdown in Melbourne region.

On 9 September 2020, Nick Scali share price was trading at AU$8.3, indicating an increase of 0.851% (at AEST 2:05 PM).

Do Read; COVID Diary: Strategies that helped these 100 Companies create History