Summary

- As per ABS, Australian retail turnover increased 3.2% in July 2020 in seasonally adjusted terms, with sales in household goods being particularly strong.

- NAB Online Retail Sales Index jumped 6.7% (month-on month basis) in July due to surge in online sales activity in Victoria amid stage 3 restrictions.

- Myer Holdings is looking to strengthen its retail business by partnering with Amazon where customers will be able to collect their Amazon purchases from 21 Myer stores from 9 September.

- Coles Group net profit after tax grew 7.1% to $951 million in FY20 compared to FY19, and Group sales revenue rose to $37.4 billion in FY20 because of solid performance across its segments due to implementation of the refreshed strategy.

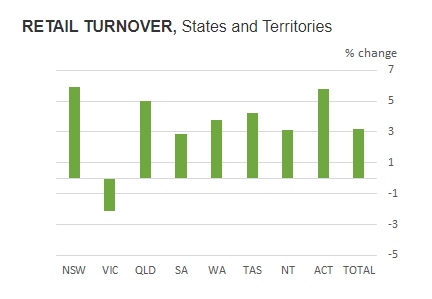

More and more Australians are enhancing their wardrobes, binging on food, and purchasing games and toys to incorporate some zeal amid dull lockdown life. Australian retailers recorded strong sales, surging 3.2% in seasonally adjusted terms to $30.7 billion in July from a month earlier as per the figures released by ABS on 4 September. The retailers in Australia gained in all regions except in the virus-struck Victoria.

Do read; Consumer Spending and Confidence dips due to COVID-19 outbreak in Victoria

Household goods drove the monthly sales as consumers were persistently buying large items for their homes. Revenue from clothing, footwear and personal accessory retailing rose 7.1% and 4.9% in cafes, restaurants, and takeaway food services with the exception of Victoria where Stage 3 lockdown in July partially offset these increases.

ALSO READ: Retail Confidence Crashes in August amid Level 3 restrictions

Online sales contributed 9.8% of the total retail turnover in July 2020 in original terms, up from 9.7% in June. Retail sales rose the most in New South Wales at 5.9% followed by Queensland and Western Australia at 5% and 3.8%, respectively.

Source: ABS

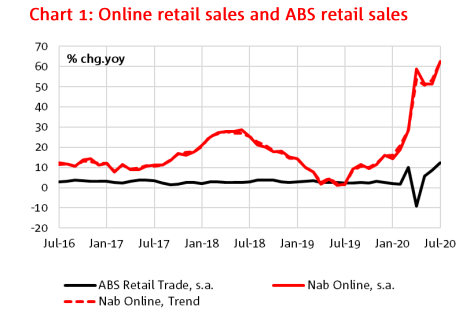

National Australia Bank Limited (ASX:NAB) Online Retail Sales Index speeded up quickly in July by 6.7%, month-on-month basis (seasonally adjusted).

While NAB Online Retail Sales increased 62.6% year-on-year with spending on takeaway food up by 11.2%, games and toys up by 15.2% and fashion up by 12.7% driving the rise in the sales figures.

The figures include the impact of Stage 3 restrictions in Greater Melbourne but do not include the effect of Stage 4 restrictions in Victoria.

Source: NAB Online Retail Sales Index, dated: 3 September 2020

Alan Oster, NAB Chief Economist, stated that online monthly sales growth almost doubled in Victoria amid Stage 3 restrictions, which added heavily to the July figures as shoppers had little choice but to buy online.

Tasmania recorded 3 successive months of reduction in online sales growth, which came on the back of a strong April result. All states recorded double-digit growth in year-on-year terms, with Victoria in the lead.

Let’s now have a look at the performance of a few ASX200 listed retail stocks.

Myer Holdings Limited

Myer Holdings Limited (ASX:MYR) share price gained 17.021% to $0.275 on 3 September. However, on 4 September Myer Holdings closed the day at $0.265, decreasing by 3.636% from its last close.

Myer runs departmental stores in Australia, and its merchandise includes men’s and women’s accessories, beauty and cosmetic products, electrical goods, and homewares.

Myer announced the launch of Amazon Hub on 3 September by partnering with Amazon Australia.

Myer would provide shoppers with a parcel pickup option from its 21 stores from 9 September 2020. The retailer would also witness Amazon hub parcel collection network combined with its own click & collect locations for its customers. The new partnership blends the advantages of both online and offline retail platforms and gives alternate parcel delivery option to Amazon customers.

Myer CEO, Geoff Ikin stated that the partnership had been done to bring greater convenience to time-poor customers who can gain access to the retailer’s great array of services and brands that can benefit Amazon consumers while picking up their parcel.

As per the S&P Dow Jones Quarterly Rebalance announced on 4 September, Myer has been removed from S&P/ASX 300 Index effective at the open on 21 September.

Coles Group Limited

The share price of Coles Group Limited (ASX:COL) gained 0.17%, closing at $17.71 on 3 September.

On 4 September 2020, Coles Group share price was at $17.11, down by 3.388% from its last close.

Coles Group is an Australian based company that owns and operates retail stores, serving customers in Australia and New Zealand. The retailer sells different products including groceries, household goods, liquor, apparels, and office supplies.

As per the S&P Dow Jones Quarterly Rebalance announced on 4 September, Coles Group will now be part of S&P/ASX 20 Index effective at the open on 21 September.

In the lately released results, Coles Group witnessed its net profit after tax (NPAT) to increase by 7.1% to $951 million in FY20 ended 28 June 2020, compared to FY19 amid unparalleled panic buying and implementation of the refreshed strategy.

Some of the highlights of the Group’s performance are as follows:

- Sales revenue rose by 6.9% to $37.4 billion in FY20 compared to last year, while EBIT increased 4.7% to $1.76 billion compared to the prior year, first EBIT growth in 4 years

- Coles reported comparable sales growth of 20.2% in liquor and 8.3% in Express convenience (c-store)

- Comparable sales growth in the supermarkets segment also increased by 7.1% in Q4 for 51st successive quarter

- Strong cash realisation of 111% and net debt of $0.4 billion showed a substantial capacity for future growth

- Fully franked final dividend of 27.5 cps was declared, up by 14.6% and EPS growth of 7.1% was recorded in FY20

The Group recently re-entered the Australian debt capital markets with long-dated multi-tranche $450 million transaction.

NOTE: $ used in the article refers to Australian dollar unless stated otherwise.

.jpg)