Highlights

- Zenith has secured the Yalgoo potash brine project via three 100%-owned exploration licences.

- Electromagnetic data modelling has defined a series of conductive layers (50km long by 15km wide) extending from the surface to over 95m depth beneath the surface.

- Shares of ZNC have surged by over 66% since the beginning of 2022.

Amid skyrocketing fertiliser prices, Zenith Minerals Limited (ASX:ZNC) has made a strategic move. By securing a new potash brine project in Western Australia. As per its latest announcement, the company has secured the Yalgoo potash brine project via three 100%-owned exploration licences.

Must Read: Lithium and Tantalum intersected at Zenith Minerals’ (ASX:ZNC) Waratah Well

On the back of continued growth efforts, shares of ZNC have surged by over 66% (as of 26 April 2022) since the beginning of 2022.

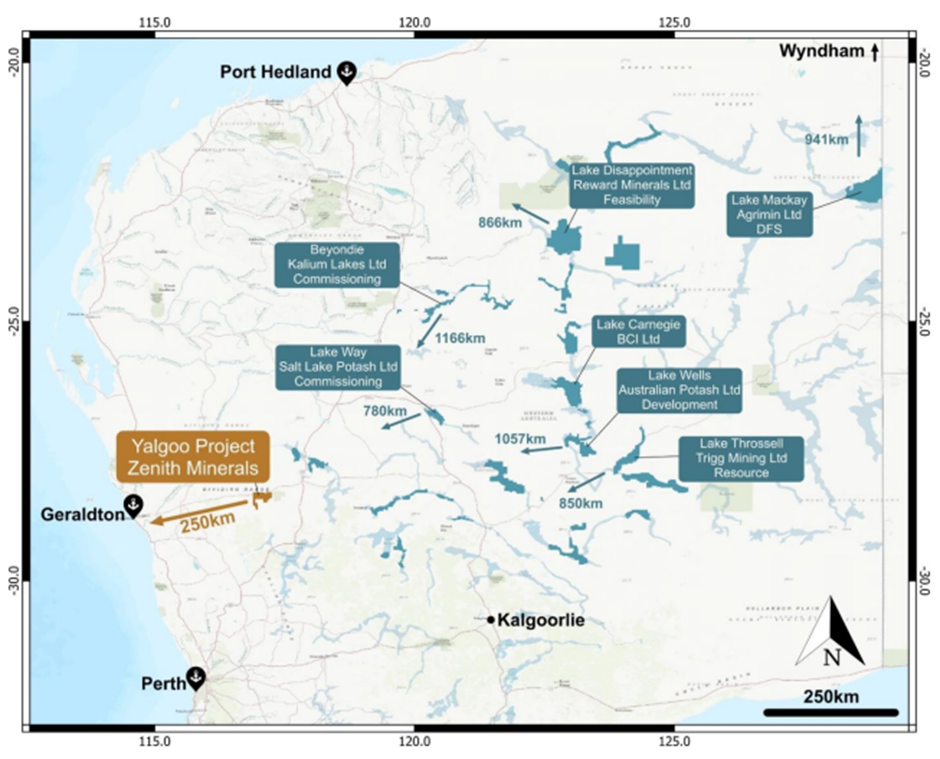

Yalgoo Potash Brine Project Source: Zenith Minerals Announcement 26 April 2022

The Yalgoo potash brine project is located immediately south of the Geraldton-Mt Magnet Road and is just 250km east of the Geraldton port. The project enjoys excellent logistical advantage against other Western Australian potash brine projects that are farther from ports.

Also Read: Zenith Minerals (ASX:ZNC) widens mineralised footprint at Earaheedy

Commenting on the Yalgoo potash project, Managing Director Mick Clifford said: “Whilst assessing regional government geophysical data on our Waratah Well lithium project, the technical team identified a very large potash brine target located southeast of Yalgoo, adjacent to the main Mt Magnet Geraldton Road.

If drill testing is successful in confirming the presence of sub-surface potash rich brines, then this project has a potential major logistical advantage over competitor projects being located only 250km from the port of Geraldton. Most competitor Western Australian potash brine projects are located hundreds of kilometres from port facilities, with the transport of potash product to coastal port being a significant component of the total operating costs of these projects.”

Zenith has already delineated potash brine targets from the assessment of regional government airborne electromagnetic (AEM) geophysical data under the company’s wider ongoing exploration program at the proximal Waratah Well lithium project.

Must Read: Zenith Minerals (ASX:ZNC) announces high-grade results at Earaheedy Project

Electromagnetic data modelling has defined a series of conductive layers (50km long by 15km wide) extending from the surface to over 95m depth beneath the surface and is interpreted to be a brine rich paleochannel.

The Yalgoo AEM anomaly is like that owned by competitor potash brine companies to the east and northeast. So far, no drill testing of potash brine target has been reported.

Significantly, Zenith’s team is planning to demerge the non-battery minerals projects including the Yalgoo potash project into one or multiple companies to be listed on ASX. Any potential merger will be contingent on ZNC’s Board approval, tax advice favourable to ZNC, shareholders, ASX, ASIC and other regulatory approvals.

Read Here: Zenith Minerals (ASX:ZNC) commences a dual-purpose drill program at Split Rocks

Shareholders of ZNC will also benefit from in-specie distribution of shares of the newly listed companies.

ZNC traded at AU$$0.40 a share on 27 April 2022.